Title: Unbelievable Comeback: This Struggling Stock Soars an Impressive 180% by 2024

Life can toss you some lemons, but sometimes, these situations can be turned around for the better. That's why insurance disruptor Lemonade, with the ticker symbol LMND (-4.70%), chose its whimsical name.

Lemonade investors have been feeling a bit sweeter lately. After a rocky start with ups and downs, the stock is now up an impressive 180% for the year as we approach the end of 2024. However, it's still 74% below its all-time highs. Let's dive into Lemonade's recent performance and future prospects.

Turning Sour Lemons into Sweet Deals

Lemonade made waves when it went public in July 2020, but like many tech stocks during that period, valuations skyrocketed. Lemonade's value soared along with the excitement, only to be humbled during 2022's tech slump. The stock plummeted by over 90% from its peak. Since then, it's been mostly treading water, moving sideways. However, recent business performance has ignited fresh enthusiasm and extraordinary share price gains.

The market's renewed interest stems from Lemonade's improving loss ratio and profitability. For years, the company touted the advantages of its AI and machine learning algorithms, claiming they gave it an edge over legacy insurers. But results were less than stellar, and mounting losses raised doubts. Now, promises are becoming reality.

Lemonade still reported impressive growth, with in-force premiums up 24% year-over-year in Q3 2024 and a customer count increase of 17%. But its loss ratio fell by a significant 10 percentage points to 73%, within its targeted long-term range. The company also earned $16 million in cash from operations and $48 million in net cash flow.

Share price movements often respond to quarterly reports, but what's truly noteworthy is that Lemonade's trailing-12-month loss ratio dropped 11 percentage points to 77%. This trajectory signals consistent improvement, not a one-time fluke.

However, loss ratios have decreased across the industry as inflation eases. Keeping a watchful eye on this trend is crucial.

Greater Delights Ahead

Lemonade recently hosted its first investor meeting in two years, and the event showcased many exciting developments. The most thrilling part was management's prediction of growing the in-force premiums by a staggering 10x – reaching $10 billion – in the same time it took to reach $1 billion (around 10 years).

The case for this ambitious growth was strong. Insurance is a vast market, and new entrants with fresh digital solutions could spearhead disruption. Being powered by advanced technology gives Lemonade a structural advantage over centuries-old players. Initially, the company emphasized that it would take time for its platform to develop superior results. Now it's entering that phase. As revenue growth surpasses expenses, expectations of becoming not just profitable but massively so are high.

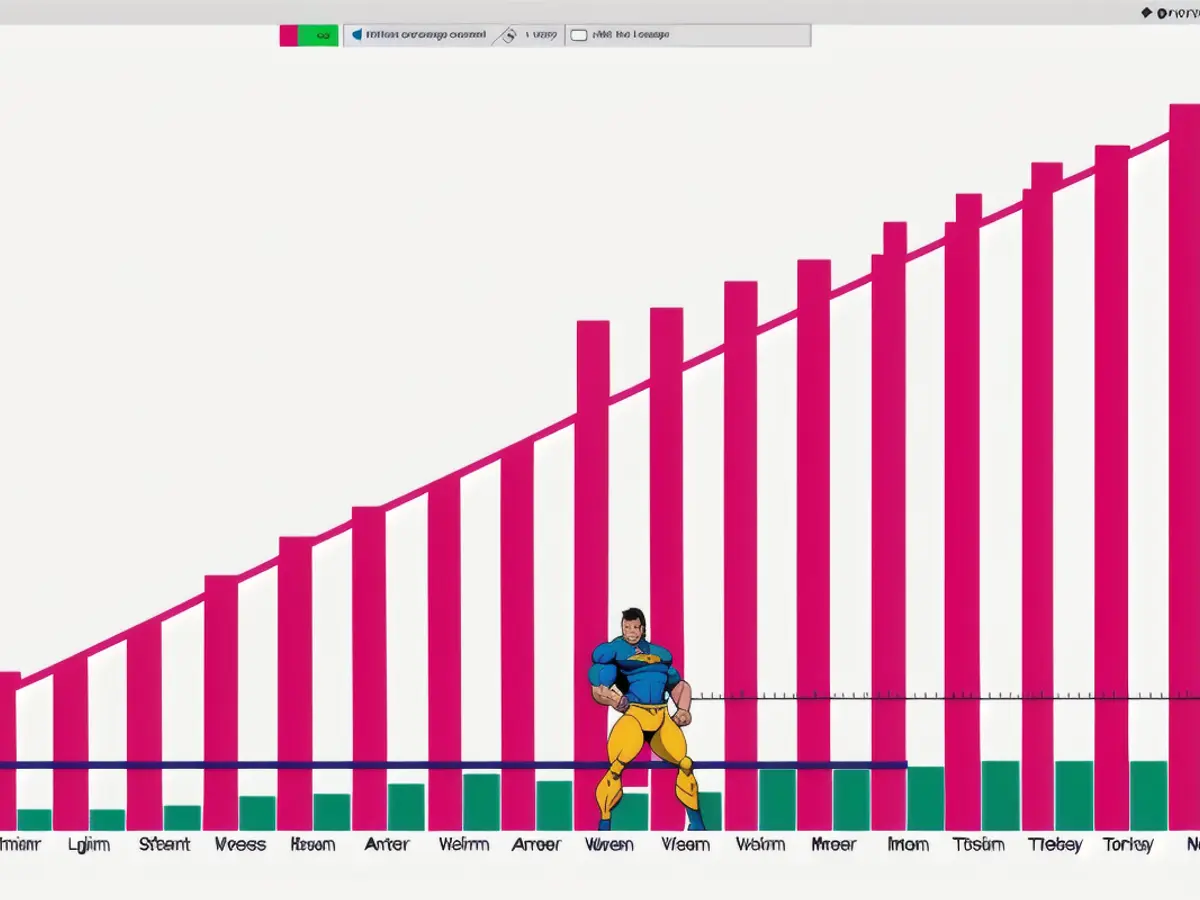

A chart illustrating this growth trend provides a glimpse of how this evolution is unfolding. In-force premiums (IFP) represent the total value of active policies, while operating expenses (Opex) and customer-acquisition costs (CAC) tell different stories.

Lemonade has successfully maintained flat headcount while achieving steady growth. Technology powers much of the work, allowing the company to excel despite ongoing expansion. However, this chart only covers fixed expenses, as Lemonade's biggest expense, CAC, is yet to be factored in. Lemonade will reach profitability once sales surpass expenses, including CAC.

Management anticipates accelerated growth in the next two years, with Lemonade reporting positive net income in 2027. This optimism is reflected in the stock's recent surge. However, it's crucial to ponder the distant future – could Lemonade's platform outperform legacy insurers' models by an enormous margin in 20 years?

More to Savor?

Following such a share price surge, investors might be questioning whether there's more upside potential. Predicting the near term is impossible, but the long-term opportunity appears appetizing.

Lemonade's valuation might still be considered reasonable. It trades at 5.5 book value, in line with other insurance companies. Despite the elevated price-to-book value increase, the share price has not yet reached its 2021 peak levels.

Lemonade is currently trading at 6 times trailing-12-month sales, which, while not precisely cheap, is far from the breathtaking ratios surpassing 50 that it experienced earlier.

Investors with an appetite for risk and a long-term horizon should consider Lemonade. This digital insurer represents an engaging opportunity to navigate growth and innovation in the insurance industry.

The improved financial performance of Lemonade, including a significant decrease in its loss ratio and profitable quarters, has ignited excitement among investors, leading to significant shares price gains. With the company's ambitious plans to grow in-force premiums by 10 times in the same time it took to reach $1 billion, many see potential for further financial gains in investing in Lemonade.