Tariffs pose a threat to economic growth, according to central bank records

Taiwan's Economic Growth Slows Down in Second Half of 2025

Taiwan's economic growth is expected to decelerate significantly in the second half of 2025, according to the Chung-Hua Institution for Economic Research (CIER) and the Taiwan Institute of Economic Research (TIER). This slowdown is primarily due to the effects of US tariffs and a high base from strong early-year growth.

The CIER projects Taiwan's GDP growth to decelerate to about 1.08% in the second half of 2025, much lower than the 5.17% growth seen in the first half. This slowdown is attributed to the lingering impact of Trump-era tariffs, which initially spurred accelerated export orders early in the year but are now moderating demand. Taiwan's export growth is similarly expected to decline steeply, with forecasts dropping from over 20% growth in the first quarter to just 6.71% in Q3 and 2.55% in Q4.

The TIER also supports this outlook, revising Taiwan's overall 2025 GDP growth forecast slightly upward to about 3.02%, based on strong first half export data. However, they caution about ongoing tariff-related uncertainties. They highlighted the boost in AI-related technology exports and private investment in the first half but warned about the potential risks to inflation and broader economic activity due to higher US tariffs.

In a board meeting, directors expressed concern over potential easing of inflationary pressures due to the appreciation of the New Taiwan dollar against the US dollar. They emphasized the need to closely monitor price trends. The central bank views potential US tariffs as a downside risk to economic growth in the second half of the year. Inflation in May was partly due to a high base from the previous year, according to board members.

The effect of a weaker currency boosting exports has diminished due to structural changes in trade. Some directors noted a cooling in the housing market following the central bank's selective controls introduced in September last year. Persistent year-on-year increases in housing rent and prices of frequently purchased goods were a concern for board members.

The ratio of real-estate lending to total bank lending has declined but remains relatively high. Some banks have been more cautious in meeting their disciplinary lending targets, reflecting varied levels of prudence in credit allocation. The deeper integration of Taiwan into global value chains has reduced the export sector's sensitivity to exchange rate fluctuations, according to one board member.

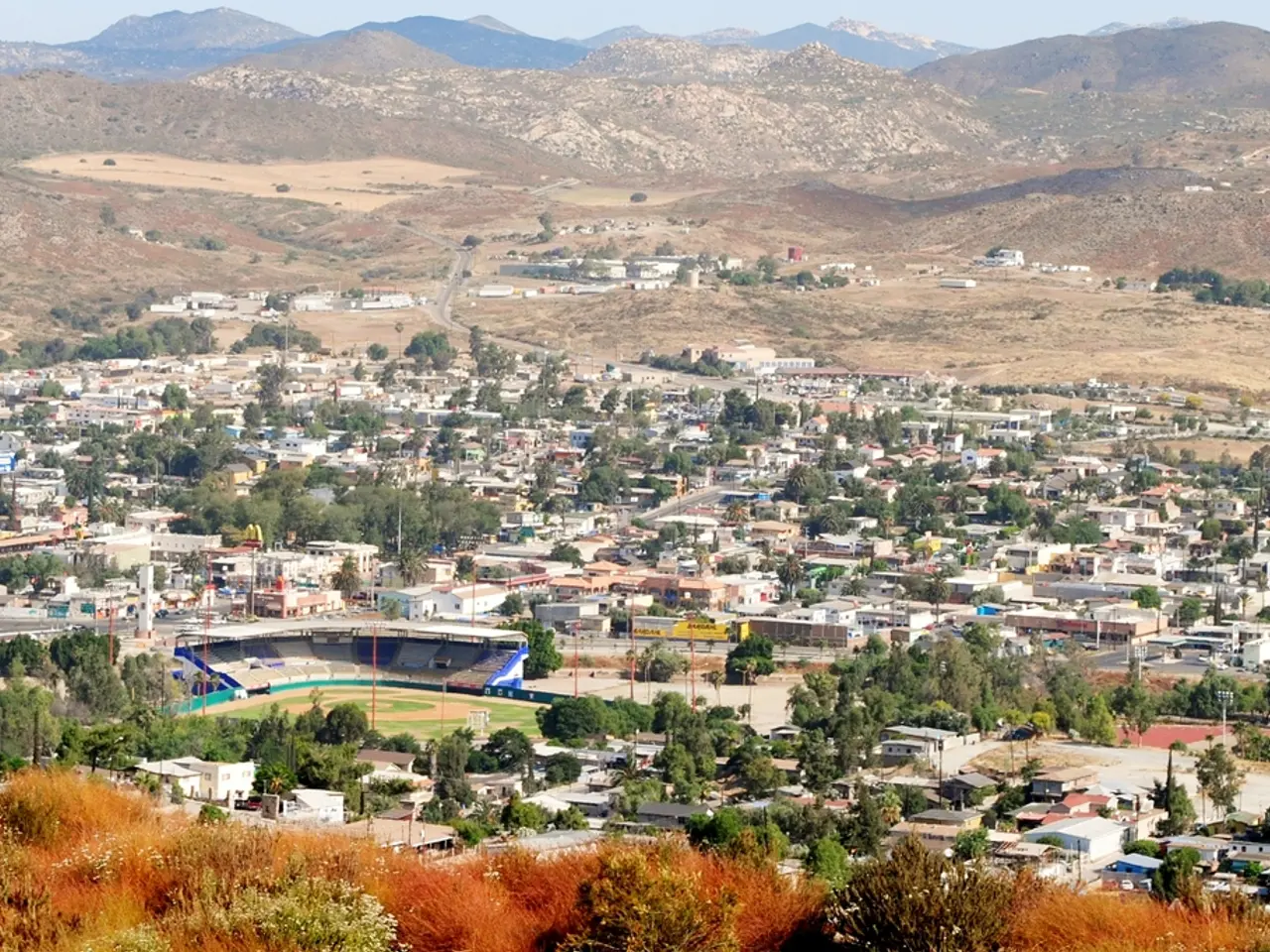

Washington has set a 15 percent tariff on Japan and South Korea, Taiwan's major trade competitors. The minutes of the board meeting showed concern over potential risks to inflation and broader economic activity due to these tariffs. The photo in the article is by Ann Wang from Reuters.

This staff report is by Crystal Hsu.

[1] Chung-Hua Institution for Economic Research (CIER) report on Taiwan's economic growth outlook for the second half of 2025. [2] Taiwan Institute of Economic Research (TIER) report on Taiwan's 2025 GDP growth forecast. [3] Minutes of the board meeting discussing Taiwan's economic outlook and potential risks.

- In light of the CIER and TIER reports, it appears that the slowdown in Taiwan's economic growth in the second half of 2025 could be partly attributed to the effects of ongoing business uncertainty, particularly US tariffs, on the finance sector and exports.

- As Taiwan's major trade competitors face additional tariffs from Washington, there is a growing concern within the financial industry about potential risks to inflation and broader economic activity, which could further impact the overall business environment.