A Peek into Bid Bonds: Guaranteeing Contractors' Commitment

Sure thing! Here's a paraphrased version of your text:

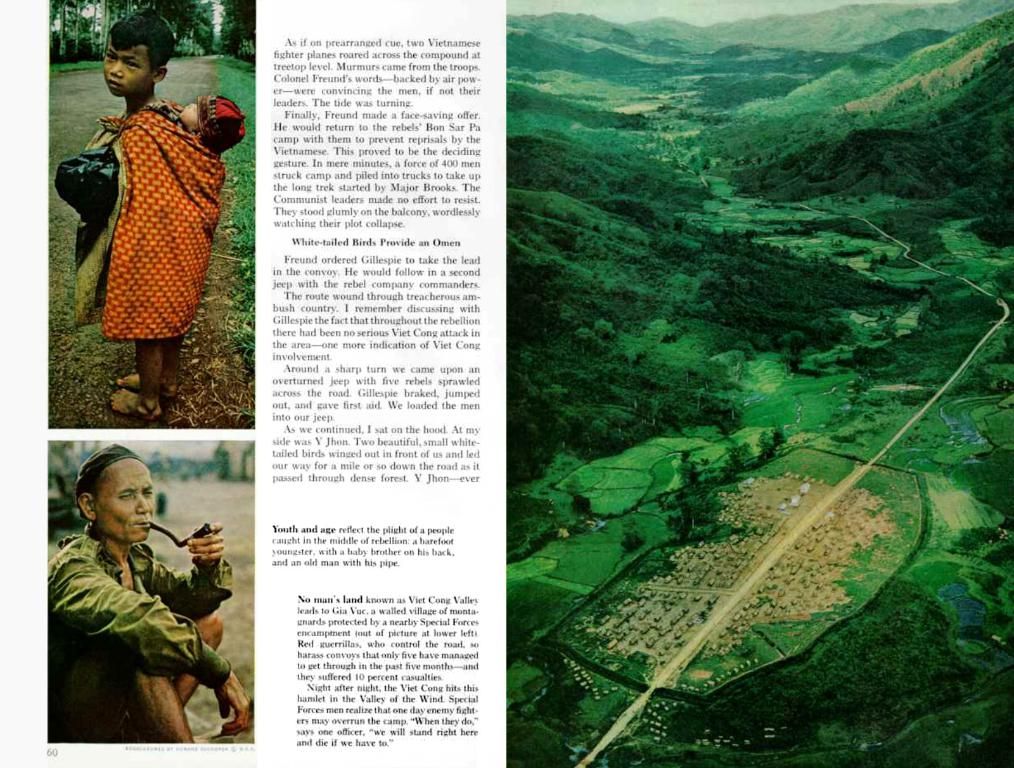

In a nutshell, a bid bond secures a project owner from financial loss if a bidder fails to live up to their end of the deal. This bond often comes into play during construction jobs or similar projects that rely on a bidding system for selection.

Breaking Down Bid Bonds

Simply put, bid bonds ensure that the winning bidder sticks to their commitment to the project. Missing out on bid bonds may lead to project owners being stuck with no way of ensuring that the bidder can complete the work adequately.

For instance, a bidder with insufficient funds could run into financial troubles mid-project. Bid bonds also help project owners avoid wasteful bids, streamlining the process when choosing contractors.

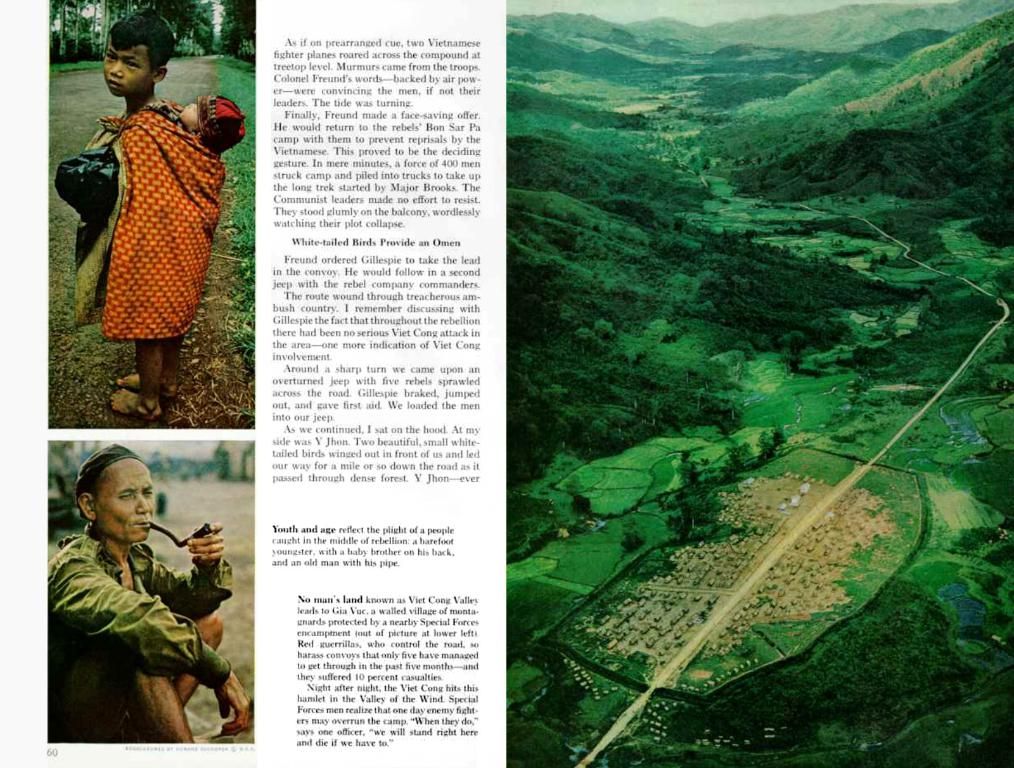

The Nitty-Gritty of Bid Bond Requirements

Typically, project owners expect anywhere between 5% to 10% of the tender price upfront as a penalty sum. For federal projects, the requirement rises to 20% of the bid[1]. The cost of the bond depends on factors such as the project's location, bid amount, and contractual terms[1].

Crafting a Bid Bond

A bid bond can often serve as a written guarantee supplied by a third party and submitted to a client or project owner. The bond certifies the contractor has the necessary finances to carry out the project.

Traditionally, contractors purchase a bid bond from a surety, which carries out intensive financial and background checks on the contractor prior to approving the bond[3]. Factors impacting a contractor's approval include their credit history, years of experience in the field, and financial statements[3].

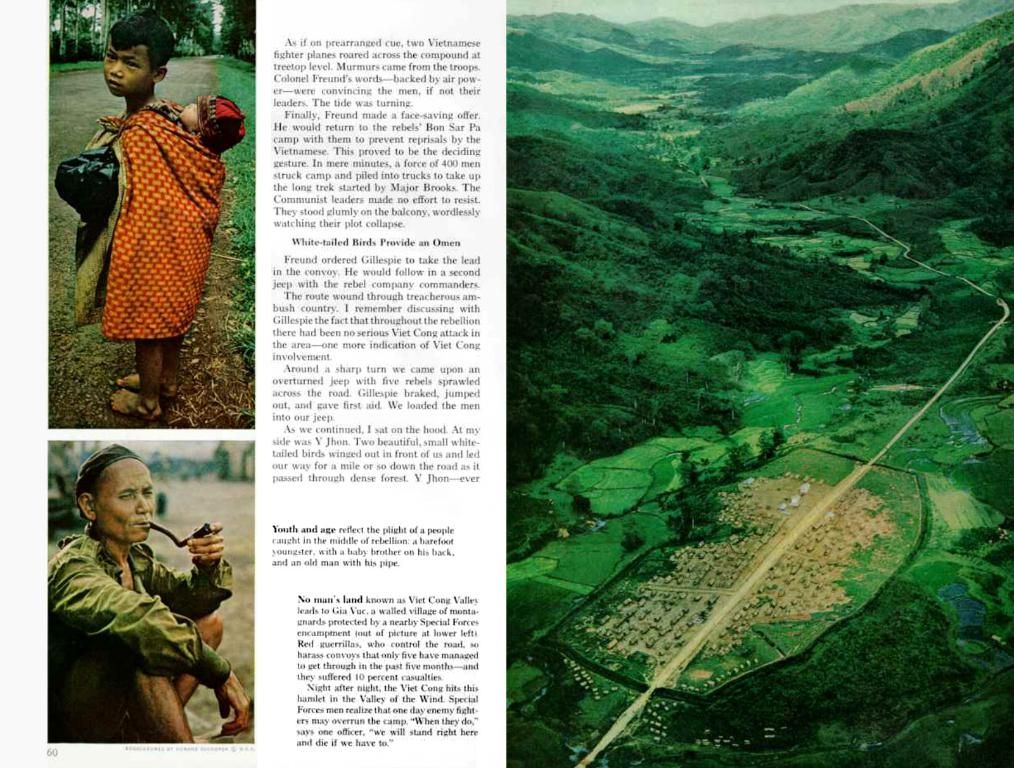

Players in the Bid Bond Game

A surety bond involves three main residents: the financial guarantor or surety of a construction bond, the project owner (the obligee) who hires the contractor, and the contractor (the principal) purchasing the bond[3].

- The obligee is the client in charge of setting the terms and conditions of the bond and making a claim if the contractor fails to perform or breaches the contract[3].

- The principal is the contractor buying the bond[3]. If the contractor fails to deliver, they'll be held liable based on the bond's terms and conditions[3].

- Surety companies evaluate the financial strength of the principal contractor and charge a premium according to their calculated likelihood of a negative event occurring[3].

Bid Bonds vs. Performance Bonds

In essence, bid bonds are replaced by performance bonds once a bid is accepted and the contractor commences work on the project[3]. Performance bonds protect clients from contractors failing to meet the contractual terms[3]. If a contractor delivers subpar work, the project owner can make a claim against the performance bond, receiving compensation for the cost of redoing or fixing the work[3].

The Consequences of Skipping Obligations

If the contractor neglects their responsibilities as per the bid bond, both the contractor and the surety are held liable for the bond[3]. In this situation, the project owner often awards the second-lowest bidder the contract and the higher associated costs[3].

In such instances, the project owner can claim the full or partial amount of the bid bond—an indemnity bond that safeguards the client if the winning bidder bails on the contract or fails to supply the necessary performance bonds[3]. The amount claimed against a bid bond usually equates to the difference between the lowest bid and the next lowest bid[3]. The bonding company or surety may sue the contractor to recover these costs, contingent on the terms of the bid bond[3].

Bid Bonds: Verifying Contractor Capabilities

Bid bonds are an essential component of the pre-bidding process. By ensuring that only reliable contractors participate in projects, they allow project owners to filter out untrustworthy bidders and secure the services of qualified contractors[6]. Surety companies may also consider other factors such as the contractor's management team, current workload, and bonding capacity for other contracts[6].

Pro-Tip for Improving Retirement Income

Take advantage of personal financial advice and kickstart your conversation. Paid non-client promotion.

- In the finance industry, defi tokens have recently emerged as alternatives to traditional investment instruments, offering decentralized and borderless financial services.

- To secure funding for a new business venture, a company might consider launching an ICO, a digital token sale that allows them to raise capital from investors in the cryptocurrency space.

- As the business world becomes increasingly reliant on digital assets, understanding the role of tokens, such as bid tokens in bid bond transactions, can provide a competitive edge in the construction industry.