Stashed в Euros: The Surge of Cash Holdings Persists

- *

Cash hidden in household savings: Accumulation persists - Secret stashes of cash: Unabated increase in hidden monetary reserves

Despite the recurring speculation about cash becoming obsolete, the continuous decrease in the significance of banknotes and coins in daily transactions fails to halt the influx of cash in the eurozone. Central banks and experts suspect the accumulation of banknotes reaching hundreds of billions is not spent but tucked away.

Estimated: Approximately 400 billion euros in cash concealed in household vaults

As per data from the German Central Bank, the share of banknotes stored for "preservation of value" in Germany is approximately 42 percent, nearly doubly the number recorded in 2013. In absolute terms: By the end of 2024, the German Central Bank assumes 395 billion euros were safely ensconced in German household safes—a distribution that surveys suggest is gravely uneven, as several households own little or no cash reserves.

"Cash Paradox"

By March, as suggested by figures from the European Central Bank, a staggering sum of 1.564 trillion euros was circulating in the euro area. This figure represented a 30 billion euro increase compared to the spring of 2022 and a massive 300 billion euros more than at the start of the Corona pandemic five years ago. Although the growth rate has seen a significant slowdown since 2022, the volume of cash in circulation persistently surges and does not recede. The predicament is labeled the "banknote paradox" at the German Central Bank. "It has been noticed for decades, and not just in this region," says a spokeswoman for the German Central Bank in Frankfurt.

"Until 2021, the growth rate of banknotes in circulation was consistently many times the annual rate of inflation," claims Johannes Gärtner, a payment expert at the consulting firm Strategy&.

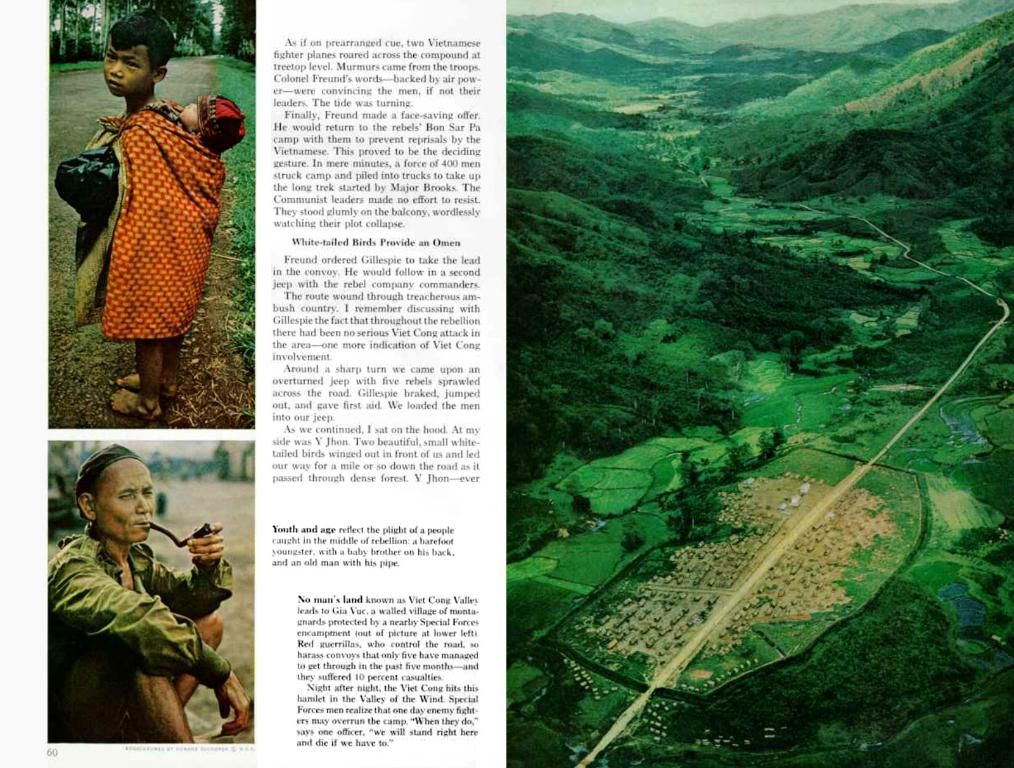

The paradox lies in the fact that cash transactions are continuously decreasing in number. In 2023, according to the German Central Bank, half of all payment transactions at Germany's cash registers were still cash-based, but they accounted for only a quarter of the total volume.

Electronic payment increasingly popular

Recent research by Strategy& involving 5,500 respondents from nine European countries and Turkey indicates that the debit card has overtaken cash as the most commonly used payment method, with just 23 percent opting for cash payments. Numerous retailers also endorse electronic payment, particularly contactless payment, which is claimed to be seven times quicker than traditional cash transactions. "This substantially speeds up the process," says Bernd Ohlmann, a spokesperson for the Bavarian Retail Association.

"Uncertainty fuels demand"

But why is a greater volume of cash in circulation when its usage in everyday life is declining? "The euro is being hoarded intensely," states Ralf Wintergerst, CEO of the Munich banknote and security technology manufacturer Giesecke+Devrient, which caters to around 150 central banks. "Not only does the production volume of euros serve the purpose of payment, but it is also saved for later." The company has been conversing with central banks for about 20-30 years about the mystery of the cash cycle, "Why, how, and for what purposes do people use cash?" Wintergerst attributes the apparent trend of cash hoarding to one underlying factor: "Uncertainty is the driving force behind this phenomenon."

According to the Bundesbank, the share of cash held for preservation purposes reached an unprecedented high of 43 percent during the Corona pandemic, mainly in response to the prolonged lockdowns at the pandemic's onset. "The increase in the circulation of banknotes during crises, not just during the Corona pandemic, is a frequently observed phenomenon," says the Bundesbank spokeswoman.

Cash rules for criminals

Financial consultant Gaertner proposes two additional factors contributing to the surge in cash circulation. "In essence, the growth in the amount of cash is not tied to traditional payment transactions," says Gärtner. "Reasons involve a blend of 'hoarding', illicit economy, and currency usage abroad." The shadow economy pertains to economic activities outside the legal realm, whether involving traditional under-the-counter work or criminal activities. In November, customs officers seized one million euros from the vehicle of a 34-year-old man in Bavaria — suspected proceeds from alleged criminal activities and stored in plastic bags.

Old-fashioned, but dependable

Even though the relevance of cash to everyday lives of law-abiding citizens dwindles, it is not anticipated that lawbreakers will be the only ones carrying notes and coins in the future. The Bundesbank has prioritized preserving the cash infrastructure. After all, cash offers undeniable advantages: It does not require electricity or electronic infrastructure. "The central bank must ensure a sustainable, resilient payment infrastructure," asserts G+D CEO Wintergerst. "In war, during crises, or during floods, it must still be possible to pay. Cash argues for that."

- German Federal Bank

- Doomsday prediction

- Mattress

- Germany

- Frankfurt

- Coronavirus

- Ralf Wintergerst

- Munich

- Bavaria

- ECB

- Spring

- Inflation

Enrichment Data:

The persistently rising volume of cash in circulation in the Euro area is attributed to various key economic and behavioral trends:

- Store of Value and Precautionary Demand:

- Safe Haven During Uncertainty: The prevalence of economic uncertainty, geopolitical instability, or financial market fluctuations can compel people to hold cash as a precautionary measure. Factors like heightened global trade uncertainty, changes in US trade policy, higher energy costs, or the COVID-19 pandemic can boost demand for cash as a store of value.

- Low Interest Rates: Keeping cash (in the form of physical banknotes) is less penalized when interest rates are low compared to high-rate environments, as forgone interest income is reduced.

- Demand from Outside the Euro Area:

- Cross-Border Demand: Euro banknotes are extensively used and hoarded in regions outside the Euro area, such as Eastern Europe, the Middle East, and North Africa, where they function as an unofficial or secondary currency for savings and international transactions.

- Informal Economy: In countries with less stable or controlled currencies, euros are often used for transactions and savings, elevating the demand for physical banknotes even if they are not spent inside the Eurozone.

- Financial and Technological Factors:

- Countercyclical Reserve Holdings: During economic downturns, businesses and households may increase their cash holdings as a buffer against potential liquidity shortages.

- Digital Payment Growth Offset: Although digital payments and card transactions are on the rise, this does not directly impact the amount of cash printed or held, as some cash may shift from retail circulation to hoarding or storage outside the formal financial system.

- Central Bank Policy and Banking Sector Trends:

- Banking Sector Behavior: Banks themselves may hold more cash to meet regulatory requirements or serve as operational liquidity buffers, particularly during periods of financial stress.

- Inflation and Reserve Management: With inflation expectations moderating and the ECB’s inflation target being attained by mid-2025, the depreciation of the real value of cash decreases, making it more appealing to hold.

Summary Table

| Factor | Impact on Cash in Circulation ||--------------------------------------|------------------------------------|| Precautionary demand (uncertainty) | Increases cash holdings || Cross-border/euro demand | Increases cash usage outside EU || Informal economy | Raises demand for physical euro || Low interest rates | Reduces cost of holding cash || Digital payment growth | Reduces transaction use, not stock || Banking sector behavior | Increases operational cash buffers |

Conclusion

The continuation of the surge in the volume of cash in circulation, despite its diminishing use in daily shopping, is driven by precautionary demand during uncertain circumstances, cross-border use outside the euro area, and informal use beyond the Eurozone. The decline in traditional, cash-based transactions does not directly affect the stock of cash, but rather transforms its role from transaction to storage or reserve. Economic uncertainty, geopolitical risks, and demand from regions outside the eurozone serve as the primary drivers of this trend.

- Despite the decreasing significance of cash in daily transactions, the accumulation of banknotes in the eurozone continues to increase, with approximately 400 billion euros estimated to be concealed in household vaults, a significant portion of which is stored for "preservation of value."

- The persistently rising volume of cash in circulation is attributed to various factors, including precautionary demand during uncertain circumstances, cross-border use outside the euro area, and informal use beyond the Eurozone. The decline in traditional, cash-based transactions does not directly affect the stock of cash, but rather transforms its role from transaction to storage or reserve.