Prudential Financial's Stock Performance Compared to Nasdaq: A Assessment

Prudential Financial, Inc., known by its ticker PRU, is a New Jersey-based behemoth in the world of insurance, investment management, and financial services. With a market cap of $37.5 billion, it proudly falls into the category of "large-cap stocks." This heavyweight player offers a wide range of products and services, from life insurance to mutual funds, annuities, and more.

The insurance-life sector is fiercely competitive, and PRU holds its own fairly well. Despite its size and influence, the past few months have seen a dip: PRU shares slipped 18.7% from its $130.55 52-week high, achieved on Nov. 27, 2024. That's about $24 billion in market value vanishing into thin air.

Let's delve deeper into this bear market. Over the last three months, PRU shares only saw marginal declines, underperforming the Nasdaq Composite's massive 12.9% gains during the same period. It's important to note that on a year-to-date basis, shares of PRU dipped 10.5%, while falling 9.6% over the past 52 weeks. Ouch!

To better understand the trend, let's take a look at its moving averages. Since mid-December 2024, the stock has been trading below its 200-day moving average—a technical indicator often pointing towards a bearish trend. However, there's a silver lining: PRU has recently started trading above its 50-day moving average. Could this be a sign of recovering momentum?

On Apr. 30, the stock took a 1% hit when PRU reported its Q1 results. While the adjusted EPS of $3.29 topped Wall Street expectations of $3.21, the company's revenue of $13.4 billion fell short of the prediction of $14.5 billion.

Despite its notable strength and brand equity built on trust and reliability, PRU still faces tough competition from industry titans like MetLife, Inc. (MET). MetLife has outperformed PRU, with only a 3% year-to-date loss and a 13% upward trend over the past 52 weeks.

Analysts on Wall Street have adopted a cautious stance towards PRU's prospects. The consensus "Hold" rating from the 17 analysts covering it suggests they're not overly optimistic about its future. Furthermore, the mean price target of $115.20 implies a possible 8.6% upside from the current levels.

In conclusion, Prudential Financial is grappling with a bearish trend due to its lackluster financial performance, challenging revenue trends, and a cautious outlook from analysts. While it remains a large-cap firm with brand equity, it faces stiff competition and market volatility, making it a tricky bet for investors. Before diving into PRU, keep these aspects in mind and remember to do thorough research and consider your risk tolerance.

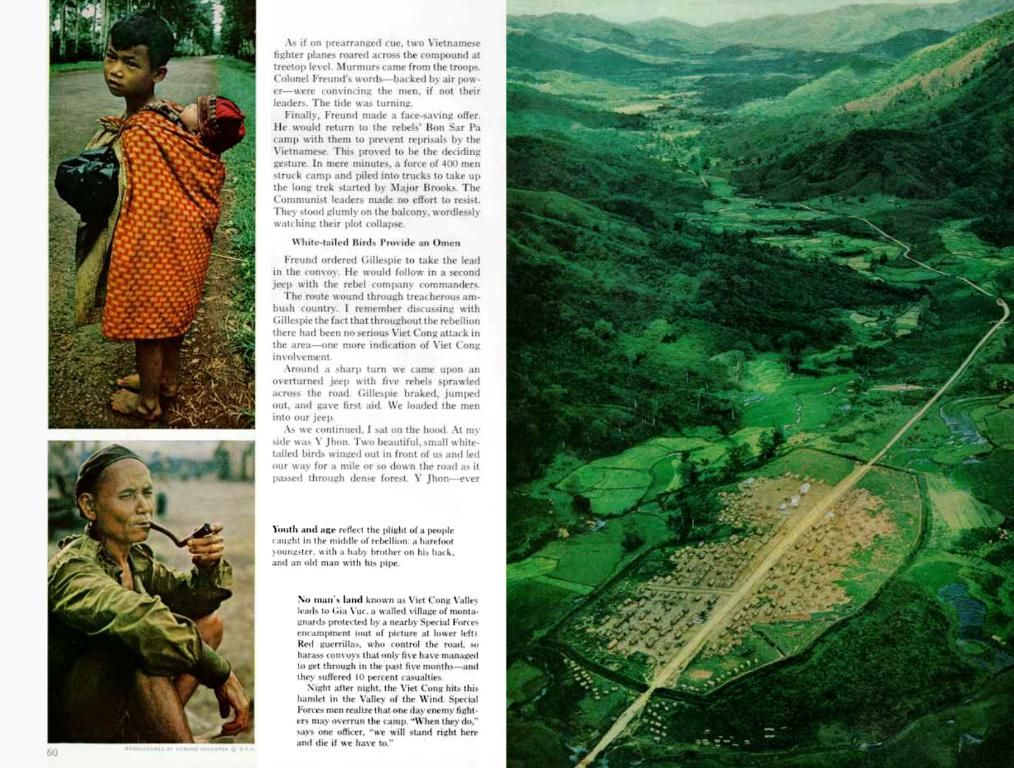

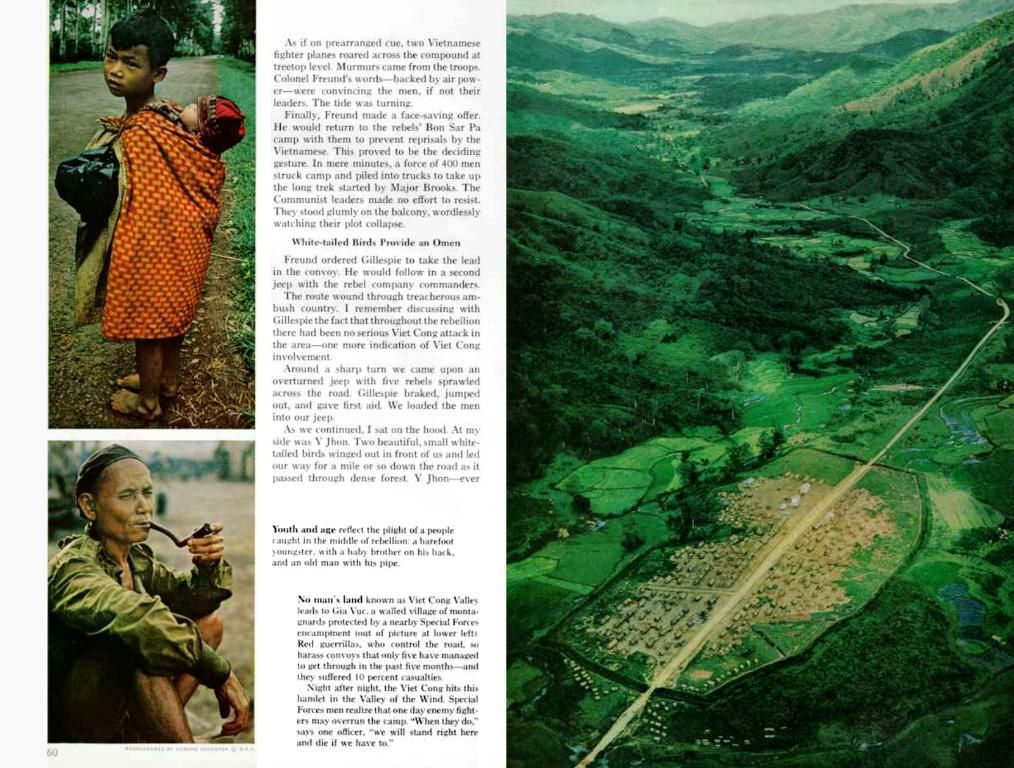

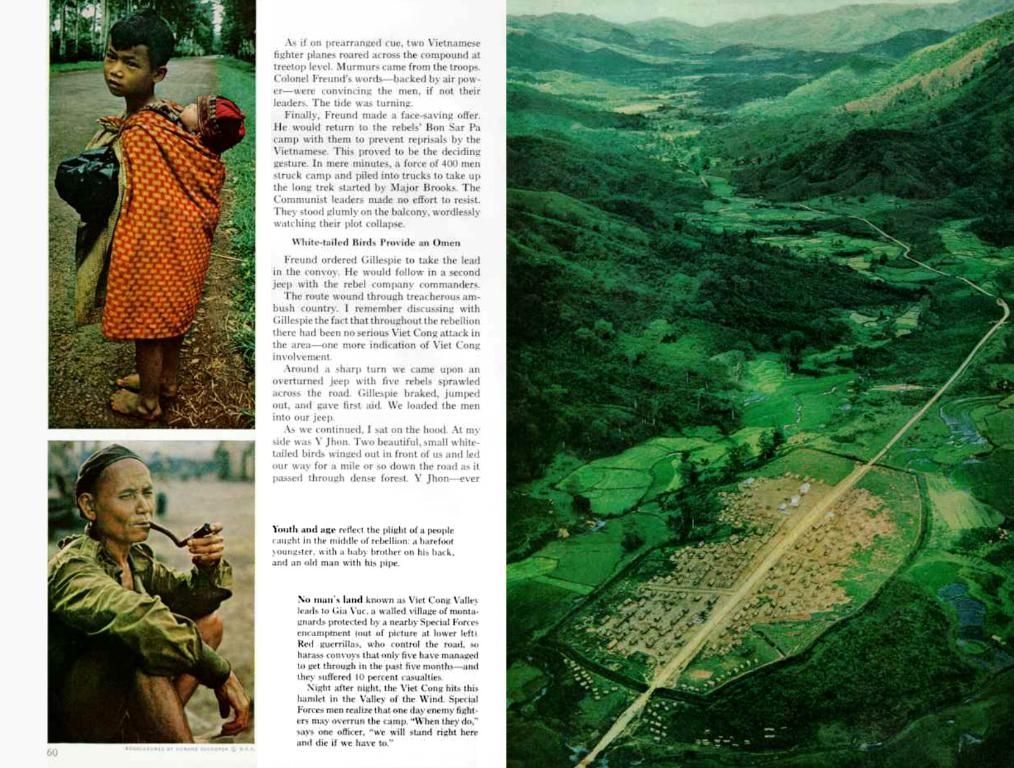

Investors considering Prudential Financial, Inc. (PRU) for their business ventures should be aware of its recent struggles with a bearish trend in the finance sector. Despite its size and influence as a large-cap stock in the insurance, investment management, and financial services industry, PRU's revenue and earnings have performed poorer compared to market expectations, causing a dip in its share price. Analysts have adopted a cautious stance towards PRU's prospects, urging a 'Hold' rating and predicting a possible 8.6% upside from the current levels, indicating potential challenges in the short term for those engaging in investing in PRU.