Preparations Underway: Bitcoin and Cryptocurrencies Face Potential $80 Trillion U.S. Valuation Explosion

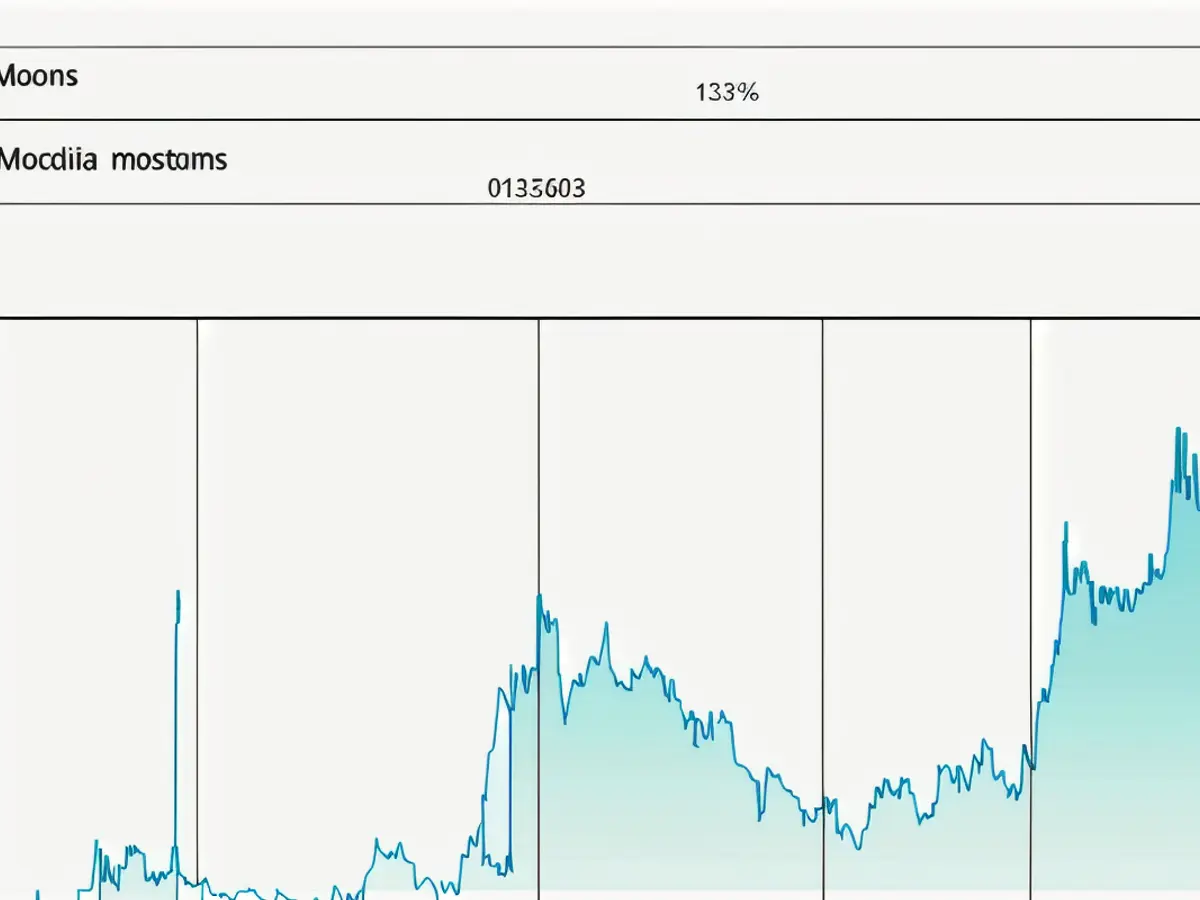

Bitcoin and cryptocurrencies have seen significant growth since Donald Trump's election into the U.S. presidency. Currently, the bitcoin price is hovering around $100,000, with a staggering jump from under $50,000 earlier in 2024. JPMorgan recently issued a warning on Wall Street, adding to concerns about the market's health.

Now, a sovereign wealth fund has kickstarted a global Bitcoin adoption race. This has sparked interest, with U.S. Senator Cynthia Lummis priming the market for a major legislation update. Congressman Michael Saylor, on the other hand, has been promoting his vision for digital economy dominance with an $80 trillion plan.

Meanwhile, the FBI has issued an advisory, warning of dangerous ransomware attacks. Other headlines include Pentagon cuts and lawsuits against Trump and Musk.

"And so it begins," Lummis wrote, referencing an upcoming subcommittee hearing on Bitcoin and crypto legislation. The hearing, set for February 26th, will explore bipartisan legislative frameworks for digital assets. Lummis, a strong advocate for Bitcoin, is pushing for the U.S. to create a Bitcoin reserve, similar to its gold reserve.

In early February, Donald Trump's crypto czar David Sacks held a press conference, announcing plans to develop crypto regulation focused on stablecoins and market structure. During a CPAC appearance later that month, Saylor suggested the U.S. government should buy 20% of the Bitcoin supply to secure its position in the digital economy.

Trump himself has confirmed intentions to establish a U.S. Bitcoin strategic reserve, aiming to stay one step ahead of competitors like China. With volatility and regulatory uncertainty being major concerns, the working group has 180 days to present its findings, shaping the future of Bitcoin regulation and potential reserve creation in the U.S.

The announcement by Trump's crypto czar, David Sacks, to develop crypto regulation focused on stablecoins and market structure, is gaining momentum. This comes as Cynthia Lummis, a strong advocate for Bitcoin, campaigns for the U.S. to create a Bitcoin reserve, similar to its gold reserve. Michael Saylor, meanwhile, has suggested that the U.S. government should buy 20% of the Bitcoin supply to secure its position in the digital economy, echoing Trump's intentions to establish a U.S. Bitcoin strategic reserve. Amidst the volatility and regulatory uncertainty, the working group has 500 days to present its findings, potentially leading to significant changes in Bitcoin regulation and potential reserve creation in the U.S. Despite the regulatory talk, the Bitcoin price is still hovering around $100,000, with Michael Saylor's MicroStrategy holding over 125,000 Bitcoins.

This text contains the words: 'bitcoin', 'donald trump', 'cynthia lummis', 'michael saylor', 'crypto', 'bitcoin price', '500', 'campaigned', 'hovering', 'layoffs'. It discusses the significant growth of Bitcoin since Trump's presidency, his intentions to establish a Bitcoin strategic reserve, Lummis' campaign for a Bitcoin reserve, Saylor's suggestion for the government to buy 20% of Bitcoin, and the potential regulation changes for Bitcoin.