Preference for SRLN, Economic Climate Elicits Less Favor

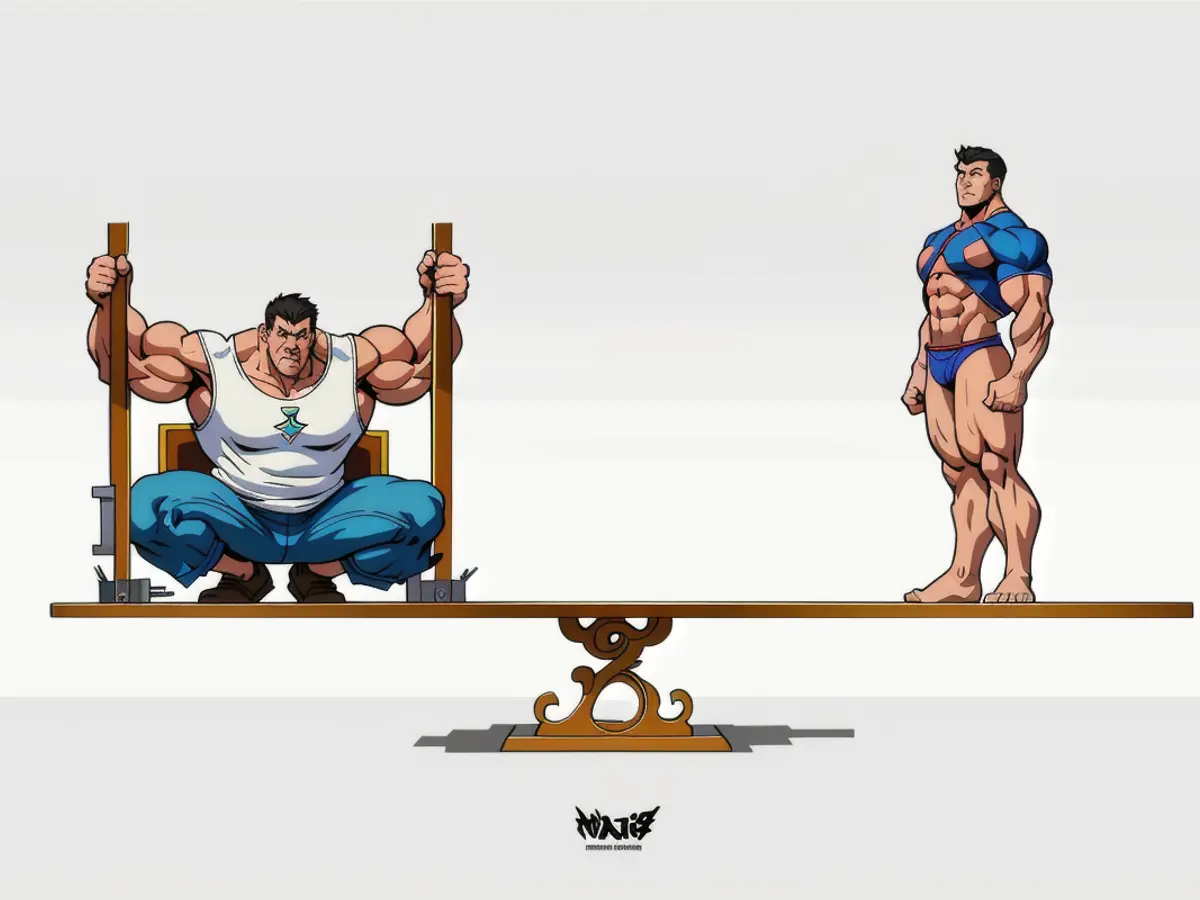

Let's talk about senior secured floating rate loans, a fascinating alternative to high-yield bonds - despite the fact they're quite different under the hood.

In truth, they're just two distinct financing tools for companies, each with its own perks and pitfalls.

Tracing the essential differences shed light on the advantages and potential drawbacks of each option. Here's the lowdown:

```Security and Priorities- Senior secured loans: These bad boys are secured by the borrower's assets as collateral, giving them precedence over unsecured debt in the event of default.- High-yield bonds: These share no such comfort, being unsecured and relying solely on the company's creditworthiness.

Interest Rates- Senior secured loans: Sporting floating interest rates, these puppies climb or fall with market conditions.- High-yield bonds: They keep it fixed and steady, regardless of the economic tides.

Credit Risks- Senior secured loans: Given their security and seniority, these loans carry a lower credit risk compared to unsecured high-yield bonds.- High-yield bonds: Being unsecured and often associated with companies boasting low credit ratings, they pack a punch of risk.

Default and Recovery- Senior secured loans: If the winds change and default occurs, lenders can recoup easily by selling the secured assets, usually fetching higher recovery rates than unsecured debt.- High-yield bonds: As unsecured, they don't have the cushion of collateral, meaning lower recovery rates if things sour.

Market and Liquidity- Senior secured loans: These bundles of joy are less liquid since trades typically happen over-the-counter and not on public exchanges.- High-yield bonds: Floating freely on the stock market, these exchange-listed wonders can be bought and sold with ease.

Credit Ratings- Senior secured loans: Even though they're often issued by companies below the investment grade threshold, their senior secured status keeps them less risky in the eyes of lenders.- High-yield bonds: On the other hand, they're unsecured and often issued by the same under-the-radar companies, escalating their apparent risk.

In essence, senior secured floating rate loans bring more safety and a tad less risk, but they come with floating rates and lower liquidity. High-yield bonds, however, offer fixed returns and higher liquidity but carry a greater risk due to their lack of security.```

At the end of the day, both options serve a purpose, and choosing between them depends on each investor's financial goals, tolerance for risk, and overall investment strategy.

When considering finance and investing, understanding the distinctions between senior secured floating rate loans and high-yield bonds is crucial. While senior secured loans are secured by the borrower's assets and offer lower credit risk with floating interest rates, high-yield bonds are unsecured and have fixed returns, but carry a greater risk due to their association with lower credit rated companies. In the end, the decision to invest in either depends on an investor's financial goals, risk tolerance, and investment strategy.