Predicted currency fluctuation: insights from financial experts and advisors on the anticipated exchange rate

Let's Talk Dollars:

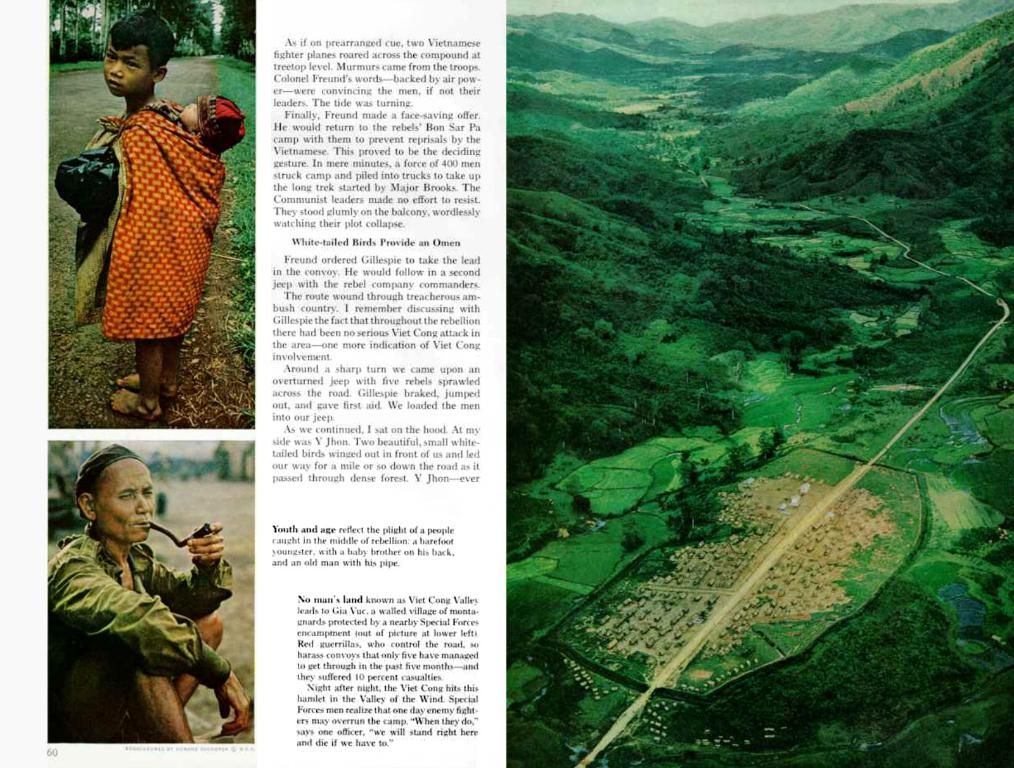

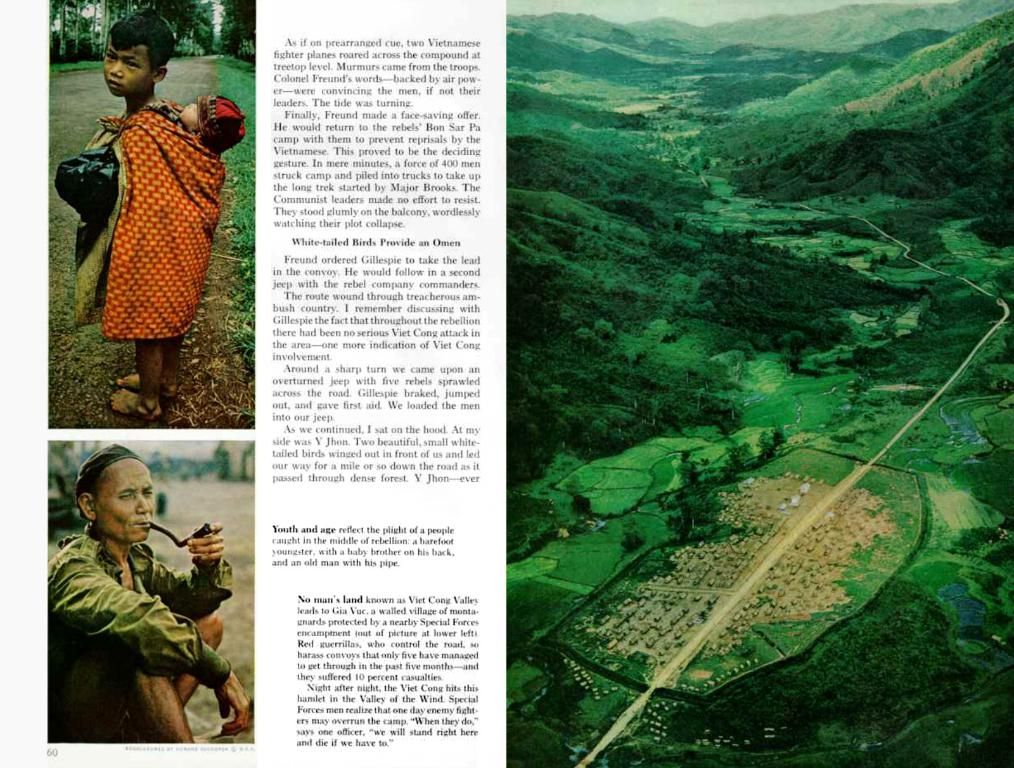

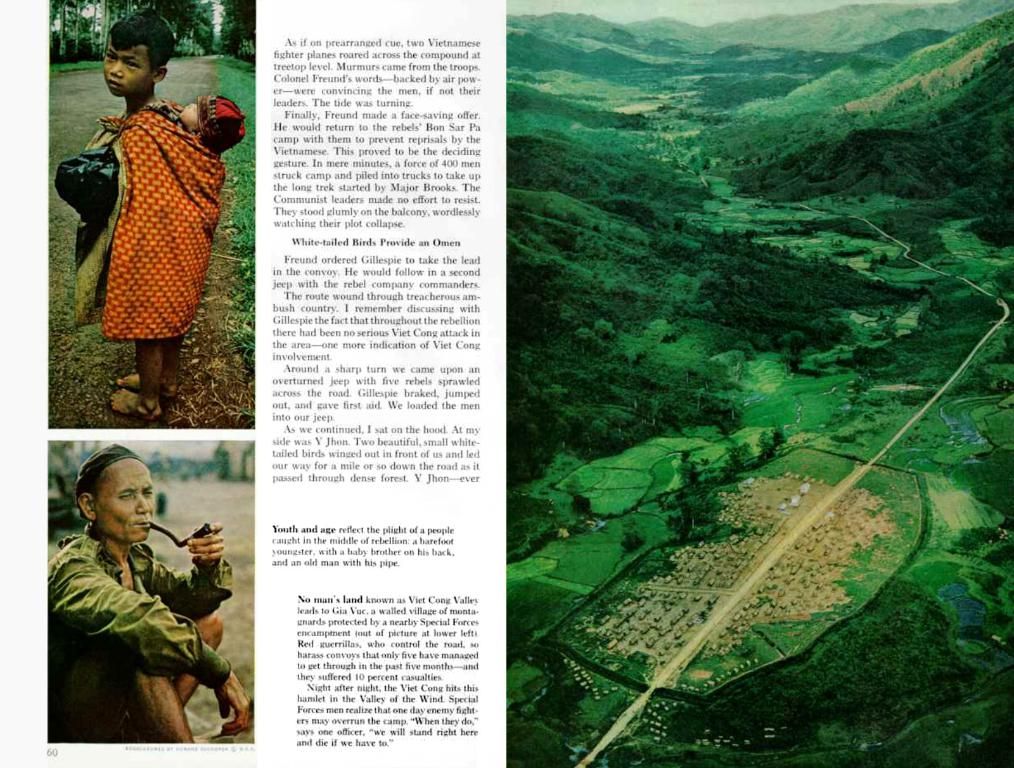

The Greenback's exchange rate took an upward turn since Javier Milei's government eased restrictions and introduced a fresh exchange rate system. The official exchange rate, operating within a fluctuation range of $1,000 to $1,400, witnessed a bullish trend in recent sessions, all without any Central Bank intervention, while the difference with the black market remains at record lows.

Wanna know more? The economic experts, analysts, banks, and consultancies, all polled by our site, expect continued stability in the immediate future, albeit with a dash of volatility. In government circles, they anticipate the greenback's worth to stick closer to the band's bottom than its top.

You may find this interesting: For Salvador Di Stefano, the dollar's value will tilt towards the Lower Limit of the Exchange Rate Band. He believes it could even dip below 1,000 pesos, with a monthly fluctuation of 1%. His advice? "Shed your dollars and buy pesos. Lecaps, stocks, and sovereign bonds are the instruments offering the best prospects, in that order," the financial expert said.

More Insights: According to FocusEconomics, their survey conducted by over 50 international consulting firms and banks, anticipates the official dollar will hit $1,306 per dollar by December 2025. This figure shows a controlled depreciation compared to the current rate, but with a significant slowdown in the pace of peso's depreciation, which has modestly decreased since the floating exchange rate strategy was initiated in April 2025.

Goldman Sachs analysts participating in the FocusEconomics survey expressed a positive outlook regarding the announcements from the Central Bank and the IMF, particularly the new floating exchange rate regime launched by the BCRA. They believe this new policy may lend a hand in the short-term sustainability of Argentina's macroeconomic adjustment plan being implemented over the medium term.

You may also find this interesting: Maximiliano Ramírez, partner of Lambda Consultores, pointed out that the shift from a crawling peg system to a floating one is rough on individuals and businesses. Before, there was a predictability about how much the exchange rate would climb, and now there is complete market discretion. This transition will take some time for economic agents to adapt to, he warned.

Christian Buteler, a financial analyst, advises keeping patience to observe the market's behavior in the coming days. "The question is what will be the value of the dollar that reflects the average productivity of the local economy. The recent close resembles the price registered during the summer, when tourism generated an exit of USD 1.6 billion. This suggests that the exchange rate should readjust upwards. In this scenario, a gap of 10% or less would be reasonable. As long as there is some exchange regulation, the disparity between the official and the black market will persist," he explained.

JP Morgan advised investors to hold short positions in peso bonds and capitalize on the carry trade until elections, according to a report shared with clients last week. "The possibility of private investors arbitraging between official and black market rates implies that the spread will remain minimal," the bank noted.

Currently, the official dollar trades at $1.195 at the National Bank and is the benchmark for the rest of the market. The "Rebel Dollar," or the black market rate, increased by five pesos this day, now at $1.215 for sale. With a wholesale dollar at $1.171, the exchange difference readsjusted to just 3.8%.

Noteworthy: Although the dollar price increased, Milei maintained that it should decrease. With Milei embarking on a trip to attend Pope Francis' funeral, he has rekindled his political agenda at the last minute before departing for the Vatican.

- "What could be the implications of the dollar's value dipping below 1,000 pesos, as suggested by Salvador Di Stefano?"

- "How does the current stability in the exchange rate impact our USD investments?"

- "Does the expectation of continuity in stability, as expressed by economic experts, influence Maximiliano Ramírez's warnings about the transition from a crawling peg system to a floating one?"

- "Given JP Morgan's advice to hold short positions in peso bonds and capitalize on the carry trade until elections, what should we expect regarding the exchange rate difference between the official and black market rates?"