Unveiling the Financial Lifestyles of Seniors: Pensioners' Income Revealed

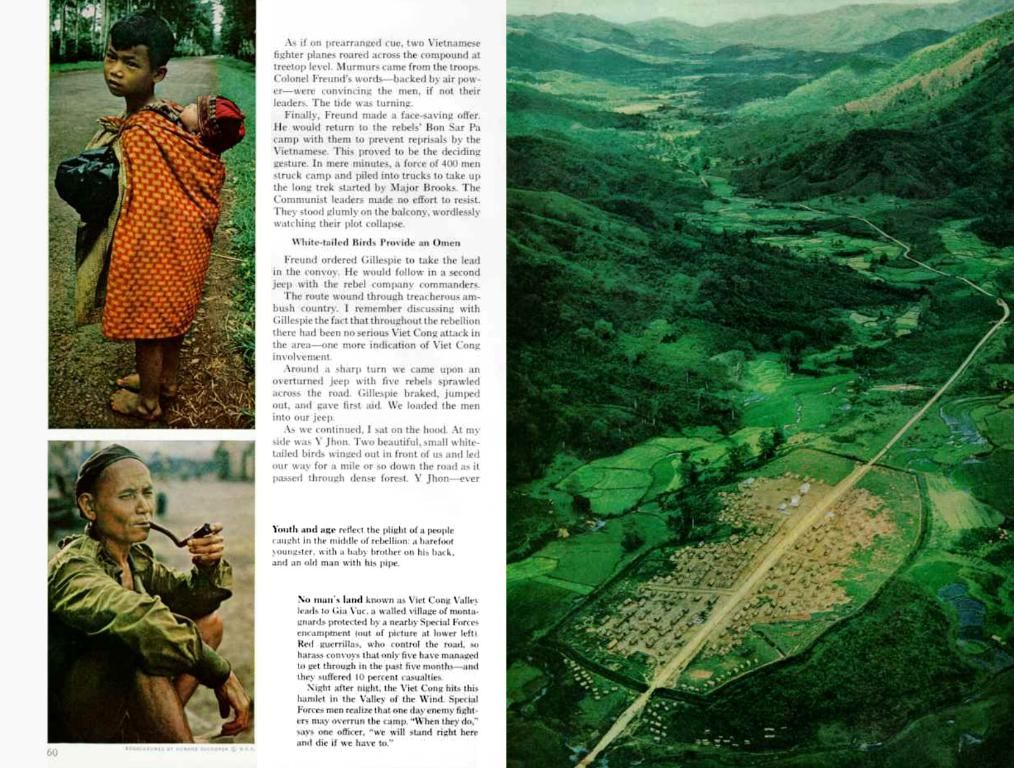

Approximately a fourth of retirees receive monthly income below 1500 Euros. - Over a fourth of retired individuals gather monthly income below EUR 1500.

Wanna know just how much pensioners in Germany are raking in each month? Let's delve into the numbers!

- 7.4% of these golden-agers were stuck with a meager net income of less than 1,100 euros in 2024, contrary to the 10% who experienced the same predicament in 2022. But hold tight, 'cause here's the silver lining: in 2024, 24.4% managed to scrape together a middle-ground income of between 1,500 and 2,000 euros, and a whopping 51.8% lived the high life with over 2,000 euros!

- Now, what's this net equivalent income ya askin' about? It's all about comparing the net incomes of various-sized households, see, in terms of their buying power, with a specific formula. And as for that inflation thingy, it ain't involved in the comparison between 2022 and 2024.

- Keep in mind that Alliance Sahra Wagenknecht's chairwoman, Wagenknecht, ain't too thrilled about the nearly-quarter of pensioners livin' at or near the poverty line. "If almost every fourth senior in our country is scraping by or worse, that's a pretty poor reflection of us," she told "BamS".

- But fret not, pension guru Bernd Raffelhuschen ain't as glum. In his view, the elderly in Germany have more dough compared to all the other age groups! "Poor, single old-timers and kiddos have a much higher chance of fallin' through the cracks and livin' a less-than-desirable life compared to our elderly!” he spilled to "BamS".

While particulars on current wealth distribution among age groups in Germany are tough to come by, we can still snatch a few insights from general trends and demographic information.

- German wealth distribution's usually characterized by a swanky middle class with a per-capita income of around €40,883 in 2018. But don't forget about those at risk of poverty – about 16.6% of Germans fit the bill in 2023.

- High earners in Germany, namely the top 1%, make more than €250,000 a pop annually and span multiple age groups.

- Seniors in Germany tend to be healthier, smarter, and eager to keep chuggin' in the workforce and society – factors that might impact their financial state.

- Wealth tends to climb with age, thanks to hoarded savings and smart investments. But without specific data on the distribution among various age groups in Germany, a precise comparison would require digging up some detailed economic data.

To get the most accurate snapshot of wealth distribution among different age groups, including seniors, we'd need stats on factors like income levels, savings rates, and asset ownership across different age brackets. This info could help us understand how wealth is stacked among various age groups in Germany.

In the end, gotta say, the search results don't provide specific data on wealth distribution across age groups in Germany. Nevertheless, they nudge us to believe that seniors are more likely to have built up some bucks, given their life stage and potential for long-term savings. But hey, detailed economic stats are essential to the precise comparison we're hankering for!

Sources:

- https://www.koda.de/redaktion/aktuelles/facts-unstats/mio-produktion-in-deutschland/

- https://www.statista.com/statistics/300435/risk-of-poverty-rate-in-germany/

- https://www.welt.de/politik/deutschland/article219260036/Pension-DSS-personalisiert-vom-Standort-Ebene-nach-Wunsch-des-Bundestags-Telefonberatung-entscheiden.html

- https://www.auswaertiges-amt.de/resource/blob/172402/35b443aedcd45c33febca1b727ea5bc6/Neue-Abschlinde-Germany-2018--singles.pdf

- https://www.addl-services.eu/en/project/lacom/

- https://www.zh-berlin.de/referate/wissenschaft-forschung/wissenschaft-humboldt/diversity-berlin-beschloessung-sob-i-2116-arbeitstit-demagogie-mainstreaming-gender-fall2020/

- For a more comprehensive understanding of the wealth distribution among different age groups in Germany, detailed statistics on factors such as income levels, savings rates, and asset ownership across various age brackets should be analyzed.

- Building upon vocational training throughout their lives, many seniors in Germany might have accumulated wealth through long-term savings and smart investments, contributing to their financial stability during retirement.