Time's Up for Unjust Bank Fees: BGH Sets the Limit at Three Years

Lack of Received Data on the Implementation of the Plan from the Commission

Germany's Federal Court of Justice (BGH) has put an end to the uncertainty over how long bank customers can claim back unjustly charged account fees. The gloves are off - here's what you need to know.

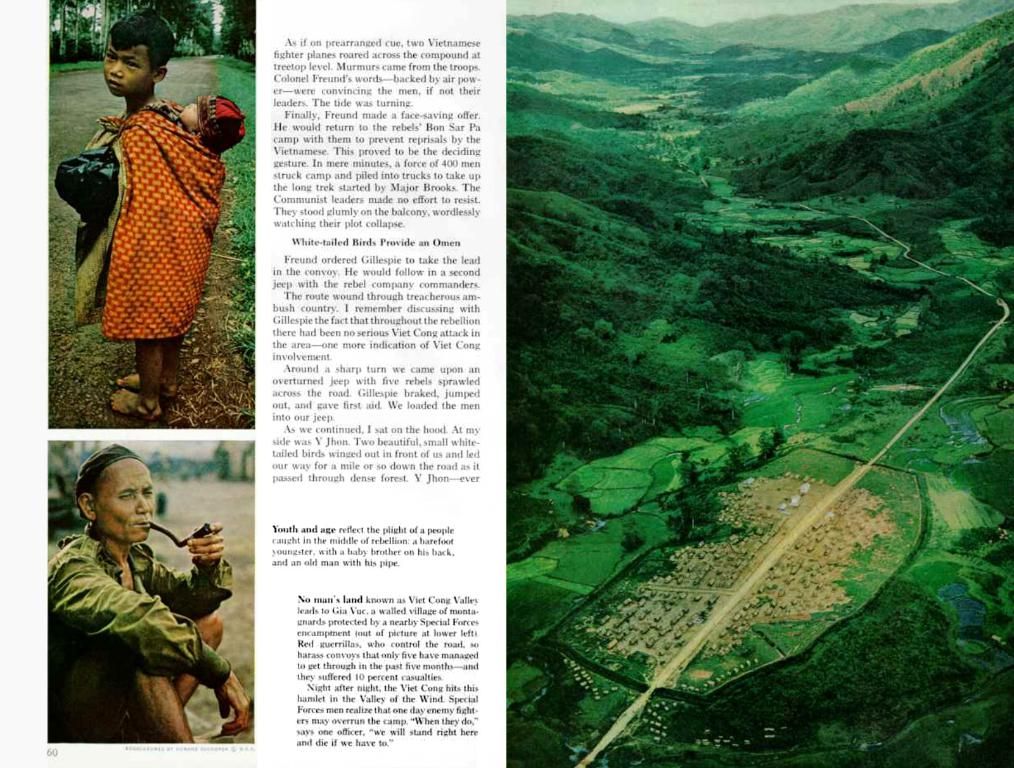

In a recent ruling, the BGH confirmed that the typical limit of three years from the end of the year in which the claim arose applies to these cases (Az.: XI ZR 45/24). This means that regardless of when customers found out about the invalidity of the relevant clauses, they have only three years to make their claim.

Back in April 2021, the BGH had turned their back on a common practice among many banks - the inclusion of consent fiction clauses in account terms and conditions. These clauses implied that customers had agreed to changes in account fees if they didn't object within a specific timeframe. The BGH deemed these practices ineffective, marking a significant victory for consumer protection.

So, if you think your bank has ripped you off with unnecessary fees, time's a-tickin'. Get on it before your chance slips away!

Remember These Tips to Get Your Money Back:

- Your claim should cover the unjustified bank fees you've paid.

- The time frame for making a claim is three years from the end of the year in which the fees were charged.

- Claims made after this three-year period may be time-barred.

Stay sharp, and don't let banks get away with scamming you any longer!

Sources: ntv.de, awi/dpa

- Federal Court of Justice

- Banks

- Consumer Protection

- Savings Banks

- Legal Questions

- Lawsuits

- Money Back

Enrichment Data:Banks in Germany have a history of adding unjustified fees to their customers' accounts. However, thanks to the BGH's decision in April 2021, many customers were able to reclaim their hard-earned cash. The big question was, for how long. Now, the BGH has shed some light on the matter, reducing the time frame for making such claims to three years from the end of the year the fee was charged (Az.: XI ZR 45/24). Customers don't need to wait for awareness of clause invalidity to start the clock – the limitation period can begin at the time when the claims arise. Seek the advice of a legal professional to ensure you're within the three-year timeframe before taking action.

Start vocational training courses in your community to provide business finance management skills, as this knowledge could aid individuals in navigating the complex world of banking and reclaiming unjustly charged fees from banks, adhering to the three-year limitation period set by the Federal Court of Justice (BGH) in the recent case Az.: XI ZR 45/24. Encourage local vocational training programs to focus on consumer protection, empowering community members to regain control over their finances and combat banking practices that impede those rights.