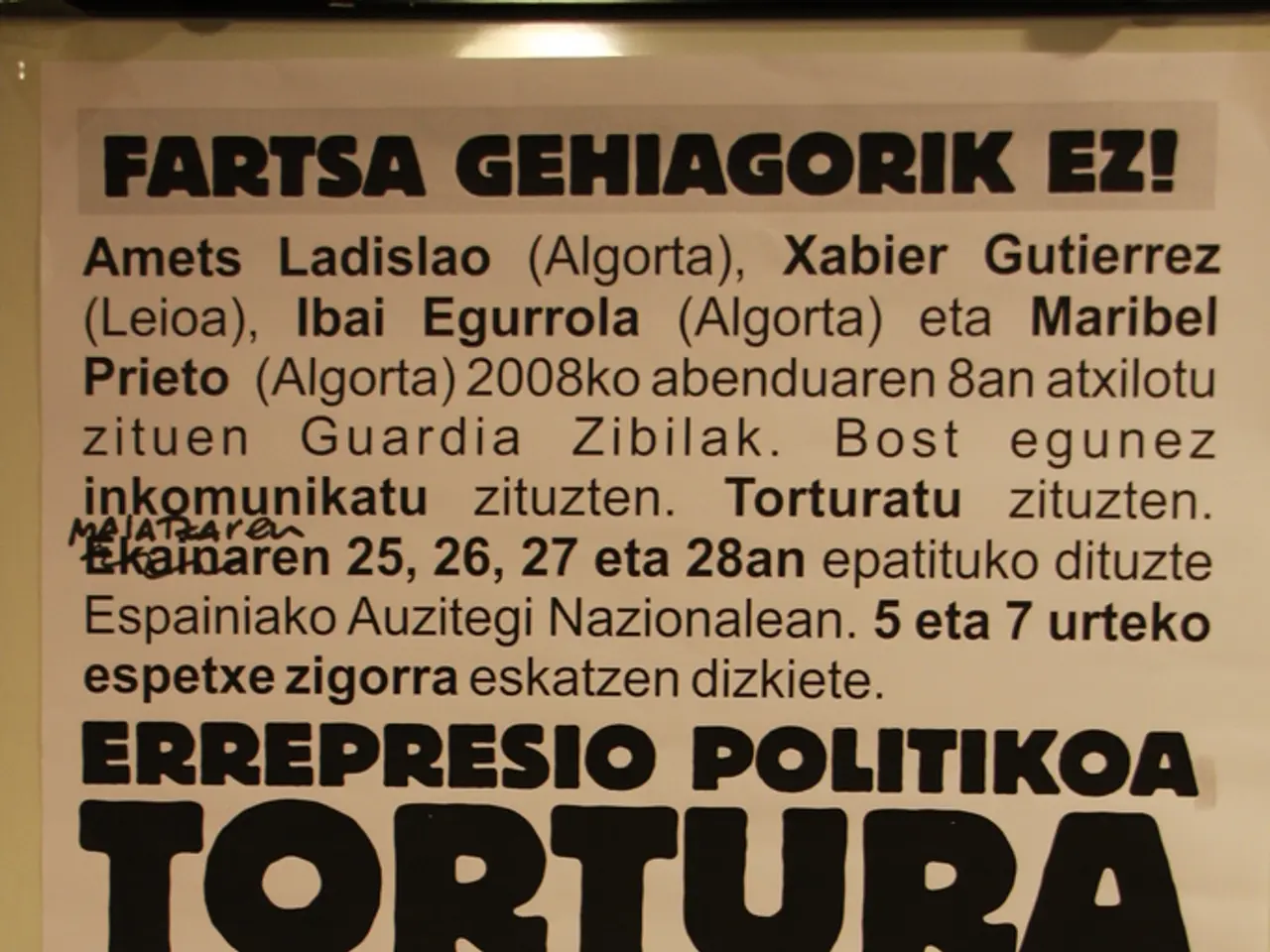

Investment firm Morningstar endorses underpriced Burggraben stock for potential buyers.

Score a Win with ASML: The Top Undervalued European Moat Stock

The ASML stock has taken a 35% dive after hitting an all-time high in July. This Dutch giant in photolithography systems for semiconductor manufacturing gave a less-than-impressive outlook for 2025, causing its shares to plummet. But hold up, listen to this - experts from Morningstar see an opportunity here, as they believe ASML is undervalued and packed with significant upside potential.

Morningstar: Get Your Hands on ASML Stock

According to a new analysis by Morningstar, ASML has more than one moat shielding it from competitors. Analysts are convinced that ASML will maintain its dominant position as the top provider of lithography equipment for semiconductor foundries for the next two decades. So, there you have it - the ASML stock is a steal, waiting to be snatched up. Morningstar sets the fair value at a whopping 888 euros, which equates to a tempting 29% upside. Plus, the ASML stock has formed a small base and has crossed the 50-day line again, signaling that the worst might be over, and investors have the perfect entrance to this moat stock.

By the way, don't forget to: Shop securely and affordably for your stocks with BÖRSE ONLINE Depot-Vergleich.

Finding Undervalued Moat Stocks - Mission Impossible?

Plenty of moat stocks have emerged in this bull market, but finding undervalued ones is becoming increasingly difficult. While the ASML stock doesn't initially come off as cheap with a P/E ratio of around 35 and a dividend yield of almost 1%, Morningstar thinks that now is the moment to strike thanks to the strengths of the chipmaker.

Now, here's some more reading to keep you entertained:- Dressing Up Your Portfolio: The Stocks to Buy and Those to Avoid Before the Year Ends - A Tale of Window Dressing- South American Enchantment: Exploring 17.51% Dividend Yields and Super Low P/Es - The Best Stocks from Down Under

[1]: Some analysts expect ASML to trade between approximately $905.80 and $1025.60 in 2025, with longer-term targets reaching up to $1205.50 in 2026 and higher in the following years.[2]: Bernstein recently initiated coverage with a "market perform" rating and set a price target of $806 per share. Bernstein anticipates ASML's revenue growing at a 7% CAGR through 2030, more driven by packaging technology advances than lithography, with earnings of around $25.17 per share for the current year.[3]: Monthly forecasts for mid-2025 also suggest price levels ranging from $1100 to $1300, pointing to substantial upside potential beyond current targets.[4]: The average analyst sentiment remains bullish, with an overweight rating and an average price target around $767.09, though Bernstein's $806 target is notably higher than the average.[5]: Recent market price data shows the stock trading with a 52-week range of about $578.51 to $1110.09, with analyst consensus price targets around $904.40, implying roughly a 16% upside from current levels.

Investing in the ASML stock, as suggested by Morningstar, presents an opportunity for significant upside potential, given its undervalued status and the analysts' conviction in its dominant position in the semiconductor manufacturing industry. Experts predict the ASML stock to trade between approximately $905.80 and $1025.60 in 2025, with longer-term targets reaching up to $1205.50 in 2026 and higher in the following years.