Gold Rush Red Alert? ECB Sounds the Warning Bell on Precious Metal Surge

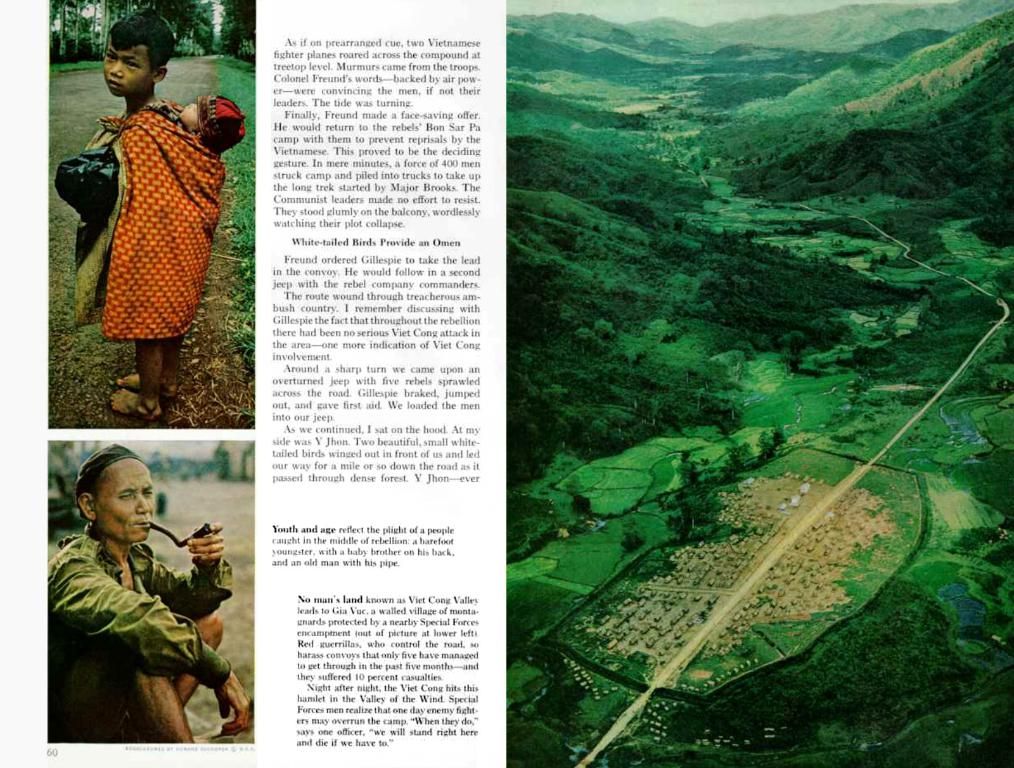

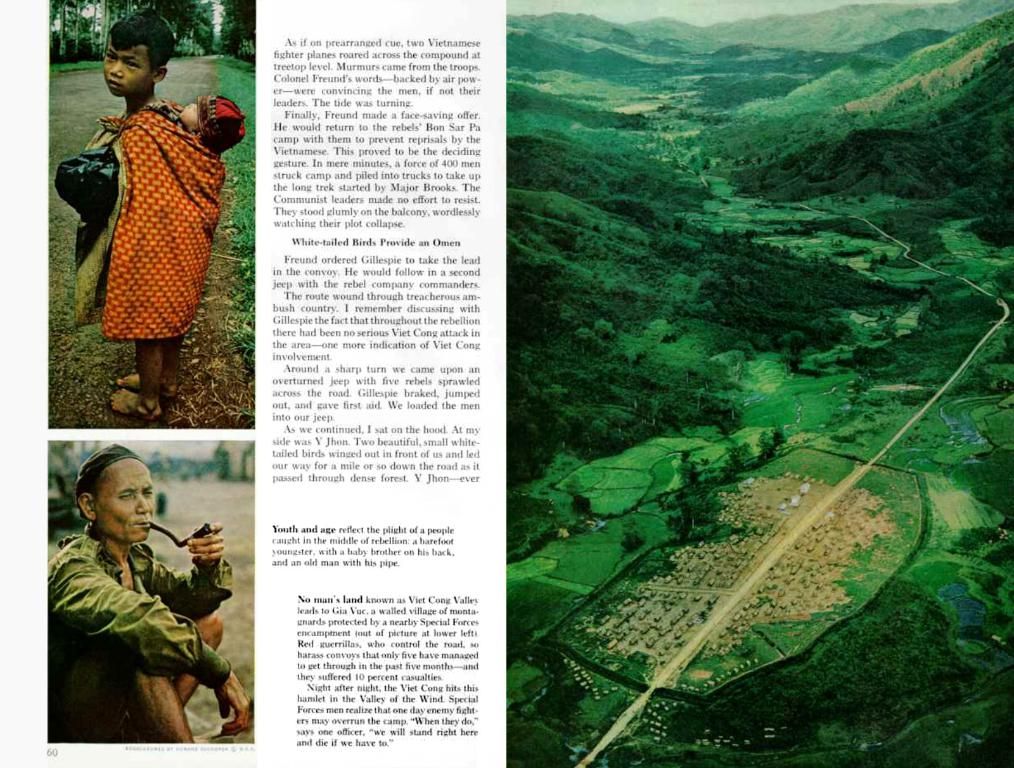

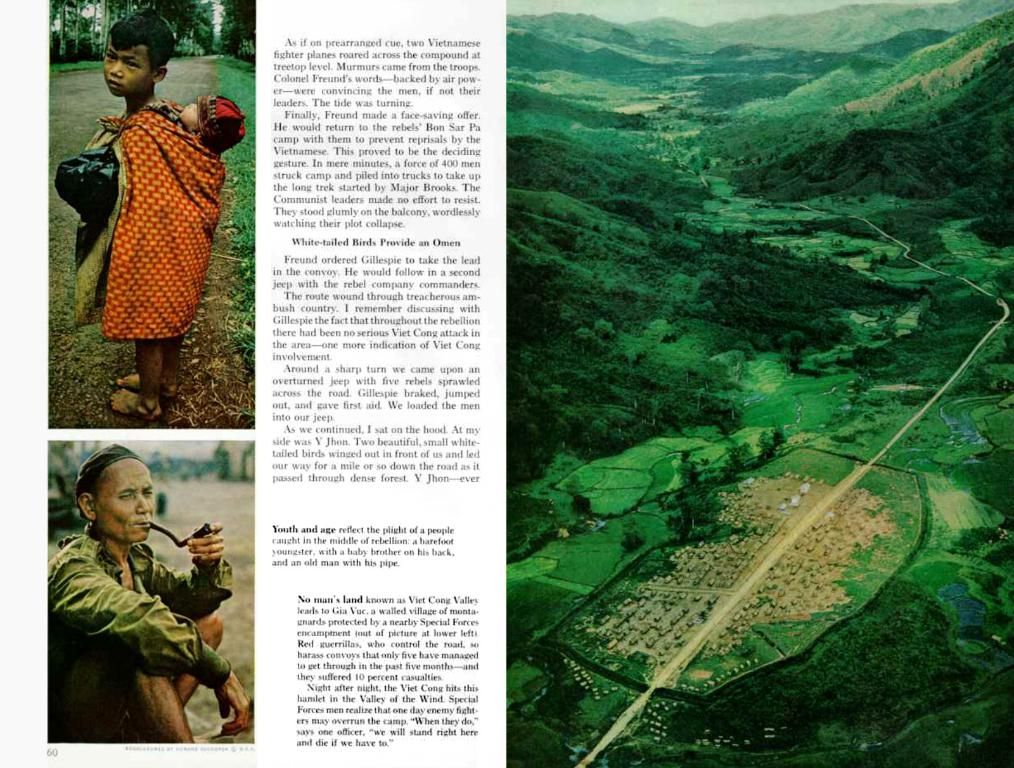

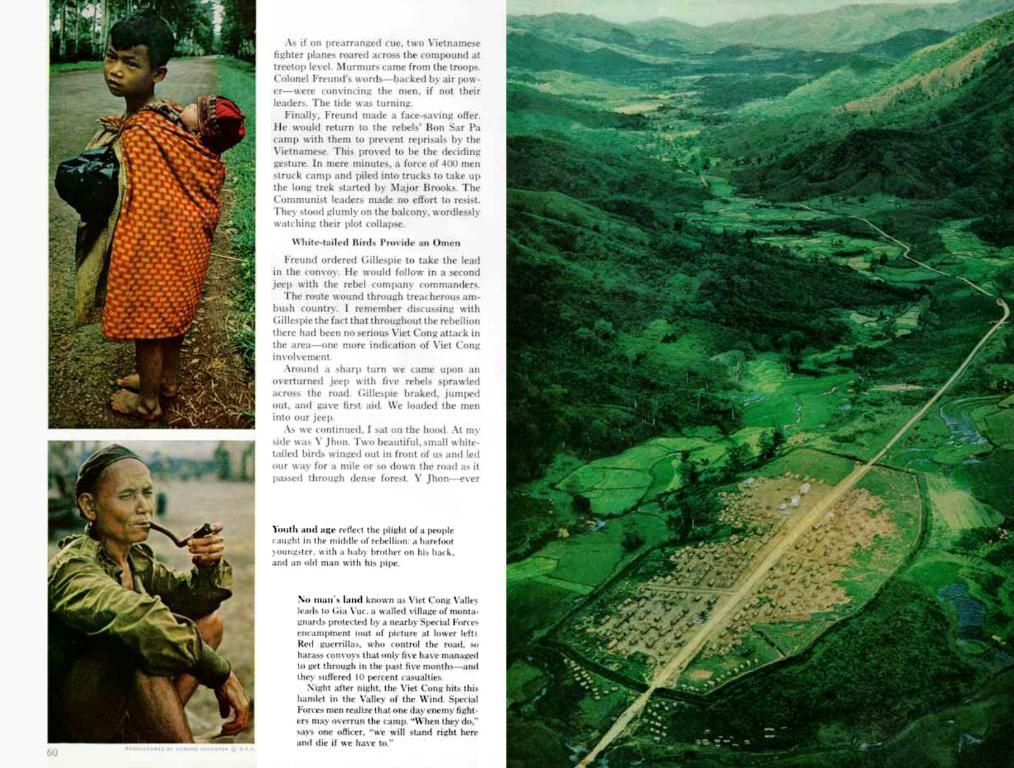

- Author: Daniel Huefner

- Estimated Reading Time: 3 minutes

Potential peril for safe gold investment: ECB raises concerns over impending collapse - Gold Market Alert Issued by European Central Bank: Potential Crash Warned

Is the relentless rally of gold prices casting a dark shadow over the global financial landscape? The European Central Bank (ECB) has thrown a stark warning: As per their latest analysis, the soaring gold price spells an escalating risk aversion among numerous investors. Gold, conventionally regarded as a "safe haven" during uncertain times, could thus be a ticking time bomb.

Gain insights

For centuries, turned to in times of turmoil, gold has played the role of a tried-and-true refuge for investors. Fast-forward to today, and this yellow metal is anything but predictable. According to the ECB, the current record prices hint at a growing sentiment of risk aversion among investors, potentially signaling trouble ahead for the global financial market.

Gold's Starring Role: From Inflation Hedge to Geopolitical Risk Shield

In recent years, gold has experienced a remarkable metamorphosis in its perceived value. No longer solely considered an inflation hedge, gold has morphed into a bulwark against geopolitical risks[5]. Investors have been flocking to it for safe haven, driven by uncertainties and sanction fears.

Central Banks' Gold Rush

Not just fanning the flames, central banks—especially those in emerging economies like Türkiye, India, and China—have been bulking up their gold reserves significantly, in response to geopolitical jitters and sanctions worries[2][5]. As a result, the presence of gold in central bank reserves has skyrocketed, standing tall as a core asset for monetary sovereignty and geopolitical insulation[1][5].

Gold's Prickly Price Patterns

Breaking free from traditional drivers such as real interest rates and inflation expectations, gold prices have developed a mind of their own[5]. This unusual behavior reflects a broader seismic shift in its role within the global financial system.

A Clash of Titans?

Despite its increased prominence in central bank reserves, gold's growing role isn't represented as a peril to the global financial market in the ECB's reports. Instead, it's viewed as a strategic readjustment by central banks to navigate risk and preserve stability in a complex geopolitical atmosphere.

[enrichment]

Insights:

- Gold's Renewed Role: Gold is garnering new recognition as a hedge against geopolitical risks instead of just an inflation hedge[5].

- Central Bank Act: Central banks, particularly those in emerging economies, have amplified their gold holdings significantly due to geopolitical concerns and sanctions[2][5].

- Price Dynamics: Gold prices have shaken free from traditional drivers such as real interest rates and inflation expectations, reflecting a broader evolution in its role within the financial system[5].

Overall, while gold has made a stride forward in central bank reserves, it's not framed as a danger to the global financial market in the ECB's reports. Central banks are seen to be adopting a strategic realignment to manage risk and maintain stability amidst a complex geopolitical environment.

- In the face of the ECB's warning, the escalating price of gold could indicate growing risk aversion among investors, raising concerns about potential troubles ahead for the global financial market.

- The surge in gold prices, paired with central banks' increased gold reserves, suggests a strategic shift in the financial world, as investing in gold is taken as a means to navigate risk and preserve stability amidst complex geopolitical conditions.