Financial Investment Firms, or Colloquially, Hedge Funds, Are Financial Intermediaries Specializing in Various Types of Investments.

Cryptocurrency Hedge Funds Bolster Teams Amid Market Gains

Wincent, a prominent cryptocurrency hedge fund, plans to bolster its staff by hiring 50 new employees, as the firm's assets under management have grown by 11%. The new hires are expected to fill roles as traders, quantitative experts, and engineers.

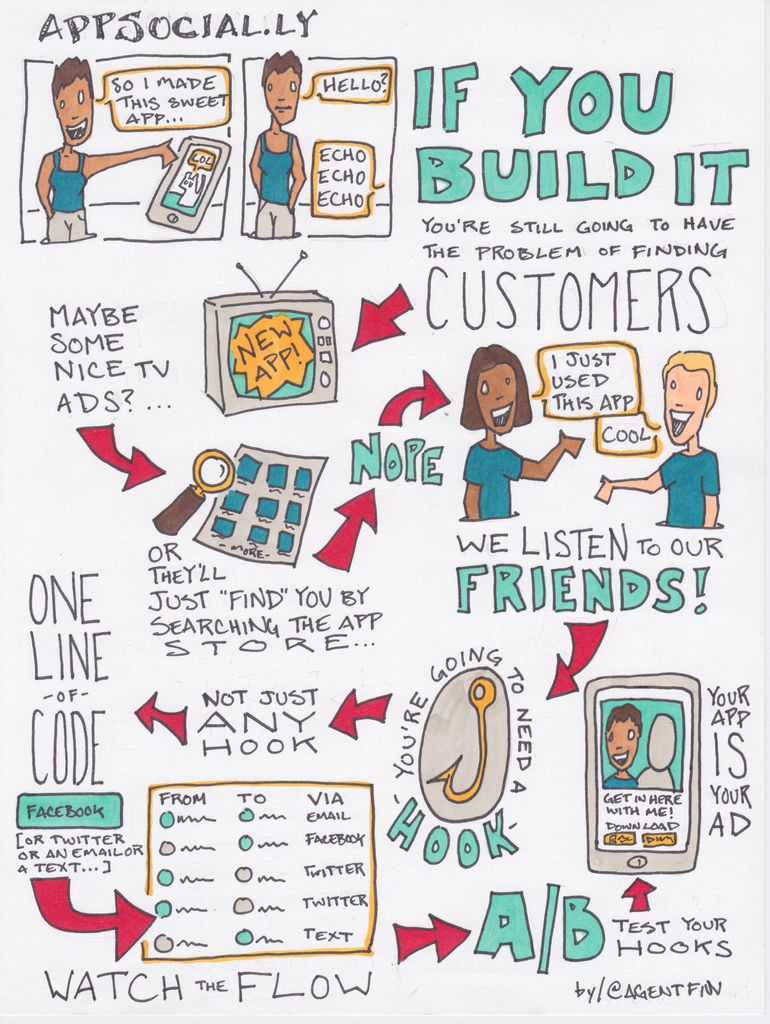

The cryptocurrency sector is currently experiencing rapid expansion, bolstered by increasing institutional adoption and regulatory clarity. This growth has created a high demand for specialized financial services, as reflected in the hiring landscape for cryptocurrency hedge funds.

- Traders

These skilled professionals are becoming increasingly essential as institutional investors enter the crypto space. To manage complex strategies and handle large volumes, traders require knowledge in algorithmic trading and risk management, as well as proficiency in advanced trading tools that are being increasingly adopted.

- Quantitative Experts

These experts are crucial for designing sophisticated trading strategies that can optimize returns while managing risk. With the growing integration of quantitative methods in cryptocurrency hedge funds, the ability to analyze large datasets and develop predictive models is highly sought after.

- Engineers

Engineers are essential for integrating Decentralized Finance (DeFi) solutions and bridging the gap between traditional finance and blockchain-based systems. Additionally, the trend towards tokenizing real-world assets necessitates innovative solutions for managing and trading these digital assets.

Fintech companies, including those in the cryptocurrency space, are competing to attract top talent by offering competitive compensation packages and flexible working cultures. Furthermore, the growing involvement of family offices and venture capital funds in crypto investments could lead to the creation of more specialized roles for traders and quantitative experts.

As the cryptocurrency industry continues to evolve, the need for skilled professionals in trading, quantitative analysis, and engineering will remain vital for the success of cryptocurrency hedge funds.

Investing in cryptocurrency has attracted the attention of numerous institutional finance players, leading to an increased demand for specialist traders who can manage complex strategies and handle large volumes. Given the rapid expansion of the crypto sector, it's essential for hedge funds to recruit quantitative experts capable of designing sophisticated trading strategies that balance profitability and risk. Meanwhile, engineers are indispensable for integrating Decentralized Finance (DeFi) solutions and tokenizing real-world assets amid the convergence of traditional finance and blockchain technology.