Ethereum's cost points towards an uptrend persisting, with the ongoing victorious streak of ETFs.

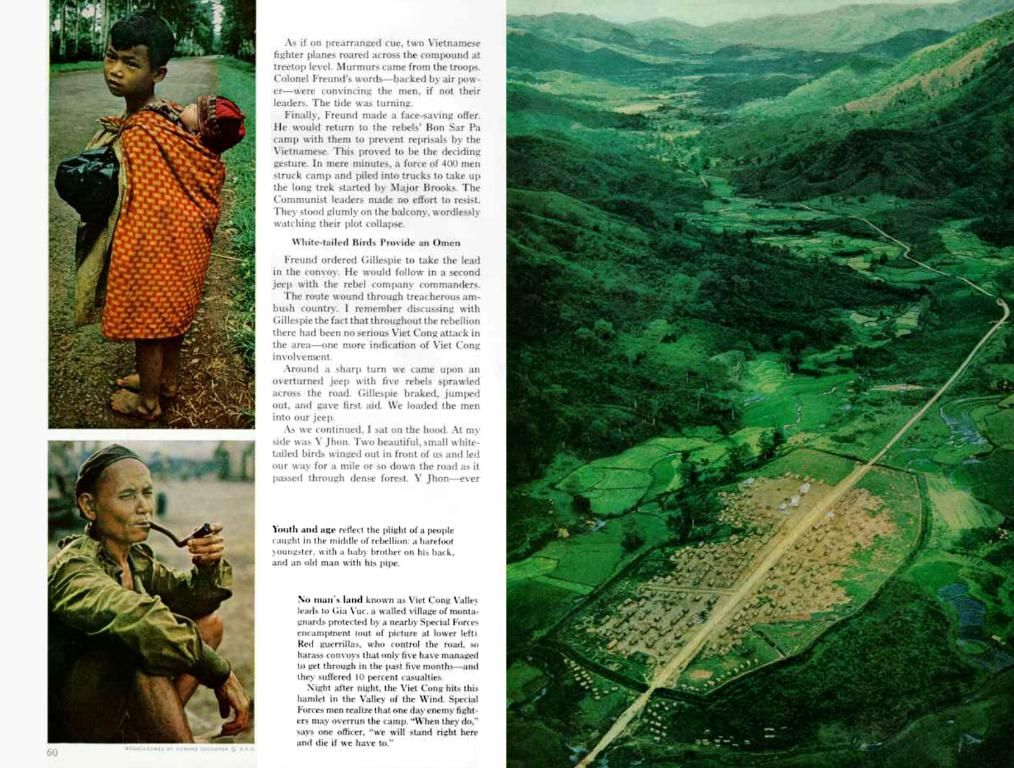

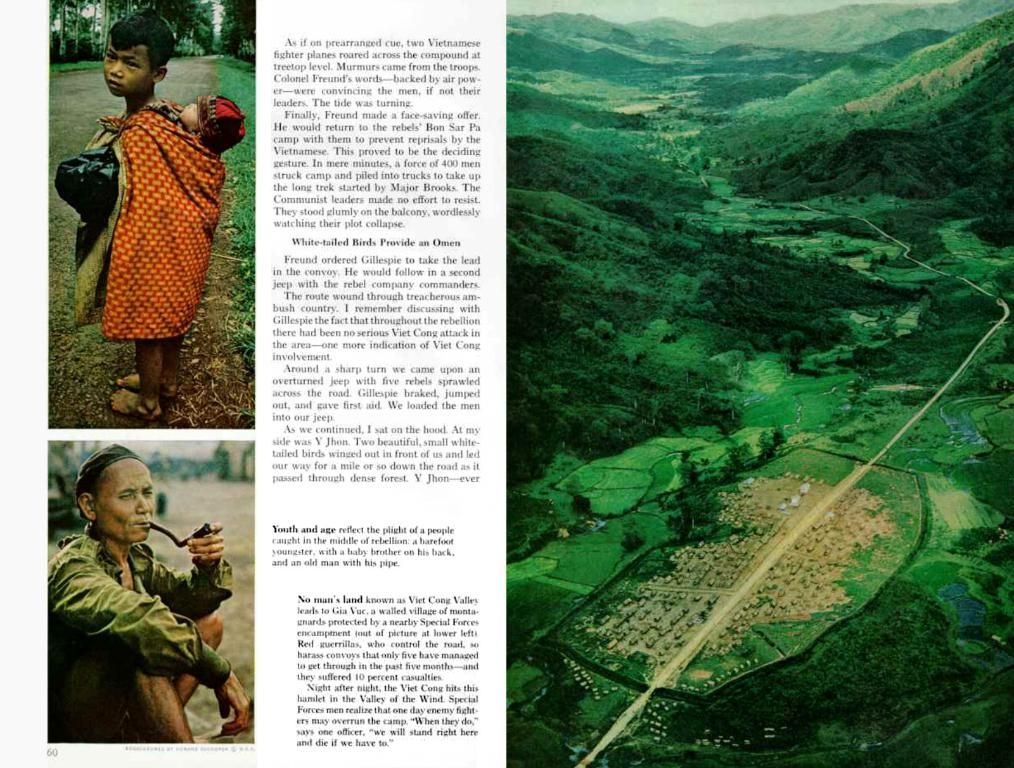

Ethereum's Resurgence with Bullish Flag and Golden Cross

Ethereum, currently trading at $2,530, is looking bullish with the formation of a bullish flag and a golden cross pattern. These technical indicators suggest an upturn in the cryptocurrency's price, as ETF inflows skyrocket.

American investors are eagerly piling up Ethereum as spot Ethereum ETFs have seen accumulation for five consecutive weeks. This week alone, these funds received a massive $528 million in influx, a significant jump from last week's $281 million. This influx brings the cumulative net inflow to a staggering $3.85 billion, with total assets under management surpassing $10 billion.

BlackRock's ETHA ETF leads the pack with $5.23 billion in inflows and $4.1 billion in assets under management. Grayscale's ETHE and ETH ETFs follow closely with $2.8 billion and $1.3 billion in assets, respectively, while Fidelity adds another $1.3 billion to the mix.

The gold rush for Ethereum might be due to its undervaluation in April when its price plunged. The MVRV (market value to realized value) indicator dropped to a disheartening -0.86 on April 9, suggesting that Ethereum was significantly undervalued.

Ethereum's dominance in key crypto industries is also a major factor for its resurgence. It boasts a total value locked of $134 billion and a market dominance of 62%. Moreover, Ethereum rules the stablecoin market with a 50% share, with its total holdings climbing to $125 billion.

Tech Analysis: Ethereum's Bright Future Ahead

The daily chart reveals Ethereum's bullish flag pattern, which comprises a vertical line (flag pole) and a horizontal or descending channel (flag). If Ethereum breaks above key resistance levels, this pattern indicates a continuation of the uptrend, potentially driving Ethereum's price to soar.

Ethereum has also formed a golden cross pattern, as the 50-day and 200-day Weighted Moving Averages have crossed each other. This pattern typically heralds a bullish trend, increasing the likelihood of Ethereum retesting $3,000 and, eventually, $4,000.

Meanwhile, Monero remains bullish as its price consolidates into a high-probability value zone.

Reference(s):1. Investopedia2. SoSoValue3. CoinMarketCap4. CoinShares5. Glassnode

- The boom in Ethereum's price might be attributed to its significant undervaluation in April, as indicated by the MVRV (Market Value to Realized Value) indicator, which dropped to a disheartening -0.86 on April 9.

- Ethereum's dominance in the crypto world is undeniable, with a total value locked of $134 billion and a market dominance of 62%, making it a key player in various crypto industries.

- In terms of stablecoins, Ethereum rules the market with a 50% share, and its total holdings are climbing, reaching $125 billion.

- American investors are actively investing in Ethereum, with spot Ethereum ETFs seeing accumulation for five consecutive weeks, with a massive $528 million influx this week alone.

- The bullish flag pattern and golden cross pattern on Ethereum's chart suggest a continuation of the uptrend, potentially driving Ethereum's price to soar, increasing the likelihood of Ethereum retesting $3,000 and, eventually, $4,000. Witnessing this resurgence, it appears Ethereum's future in the realm of finance and technology looks bright.