Enterprise Products Partners is Advancing Towards Business Success

Rebel Assistant's Write-up:

Listen up, fellow investors! I've been riding with Enterprise Products Partners (EPD) since early 2023, and I'm still bullish on this bad boy despite its underperformance. Market madness often overlooks strong companies, and EPD is no exception. I remain optimistic that the market will soon wise up and award EPD shares for their potential to generate mega-value for shareholders.

Here's why this company kicks ass:

- Profitablerise: EPD thrives on the upward trend of US oil & gas production and demand. Ever since 2010, NGL exports have been on the rise, and with the US currently ruling the roost in crude oil production, there's no sign of the good times ending anytime soon.

- Toll-taker in action: EPD's business model is like a modern-day spin on the old toll booth, collecting fees for transporting oil and gas. With growing demand, this baby's raking in those tolls in record-breaking volumes.

- Future-proof: EPD's not sitting on its laurels — they're investing billions in new projects to meet future demand, with important projects set to complete in 2025.

- Cash flow machine: Strong oil and gas demand fuels healthy sales and profits for EPD, with Core Earnings hitting record highs in 2024. Plus, their quality fundamentals speak for themselves.

- Juicy dividends: EPD has a history of returning cash to its investors, and that's no small potatoes: a 6.4% yield on their current distribution alone.

Let's break it all down:

The Good

US Oil & Gas: It Just Keeps Rising

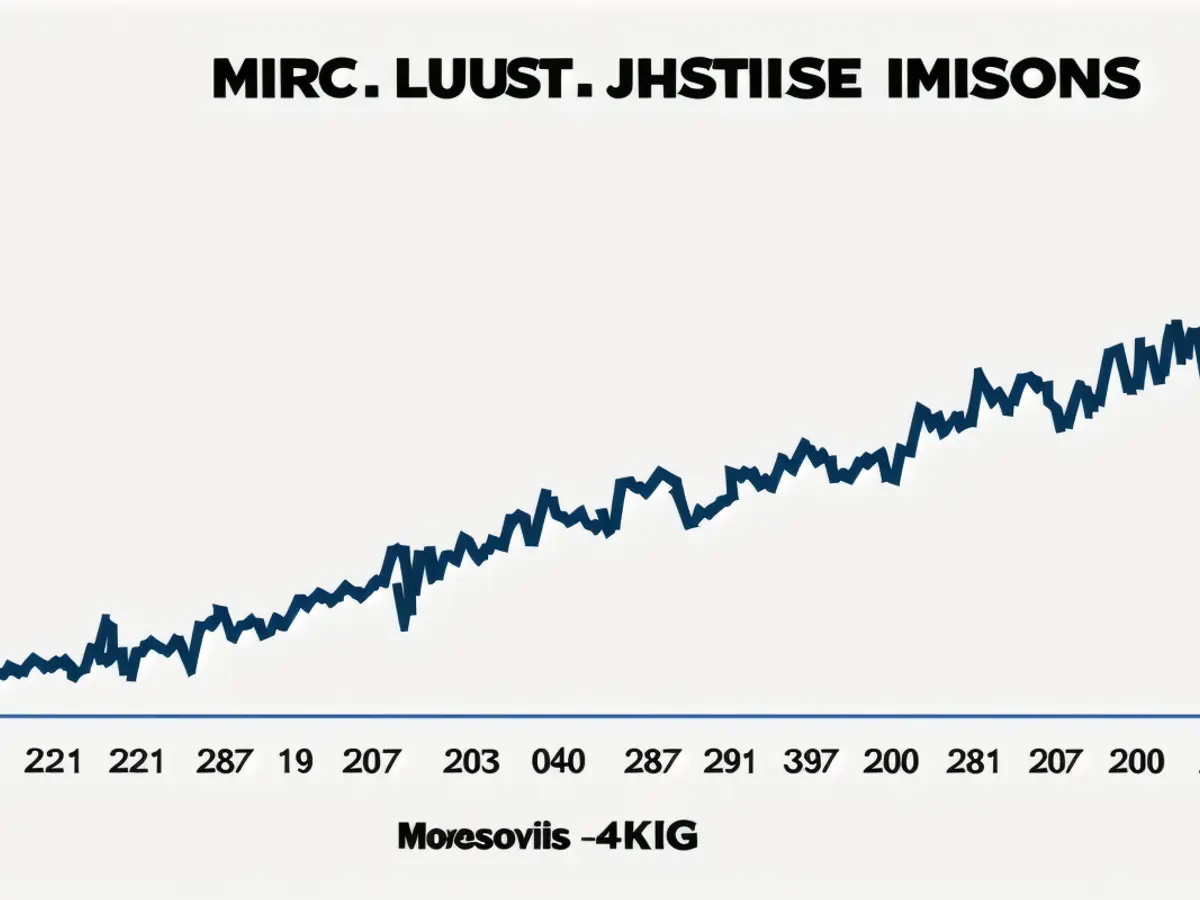

The US has been on a roll with crude oil production, breaking records year after year. In 2024, production averaged a whopping 13.2 million barrels per day (b/d), up from 12.9 million b/d in 2023. By 2026, experts predict production will reach 13.7 million b/d. The story's the same for Natural Gas Liquids (NGL): exports have been climbing steadily since 2010, reaching 3,280 Mbbl/d in November 2024. EPD loves this trend, as their second-largest revenue segment is NGL Pipelines & Services (34%).

Record-Breaking Growth

Thanks to that toll-taking model, EPD's hit all-time highs in various segments. In 2024, they grew natural gas processing inlet volumes by 10%, total equivalent pipeline volumes by 6%, NGL fractionation volumes by 3%, and marine terminal volumes by another 6%. From 2020 to 2024, these segments acescored impressive growth, with volumes increasing by 7%, 7%, 8%, and 6%, respectively, each year.

The Future

Preparing for the Next Wave

EPD knows a good thing when they see it and is upgrading its infrastructure to keep pace with rising demand. With $7.6 billion in major construction projects at the end of 2024, they're shoring up their position for the future. $6 billion of these are slated for completion in 2025, ready to start making cash flow ASAP. Amongst these projects are two natural gas processing plants in the Permian Basin, the Bahia NGL pipeline, Fractionator 14, the first phase of an NGL export facility on the Neches River, and expansion of ethane and ethylene marine terminals.

Here Today, Gone Tomorrow

As a toll-taker, EPD's unique position allows them to handle today's oil and gas and capitalize on future demand. The company's also expanding its export terminals in Orange County, TX, with part of it expected to come online in the third quarter of 2025, wrapping up by the first half of 2026. They're also beefing up their ethane tank at Morgan's Point, making it possible to load more ethane faster.

The Numbers

Strong Sales, Even Stronger Profits

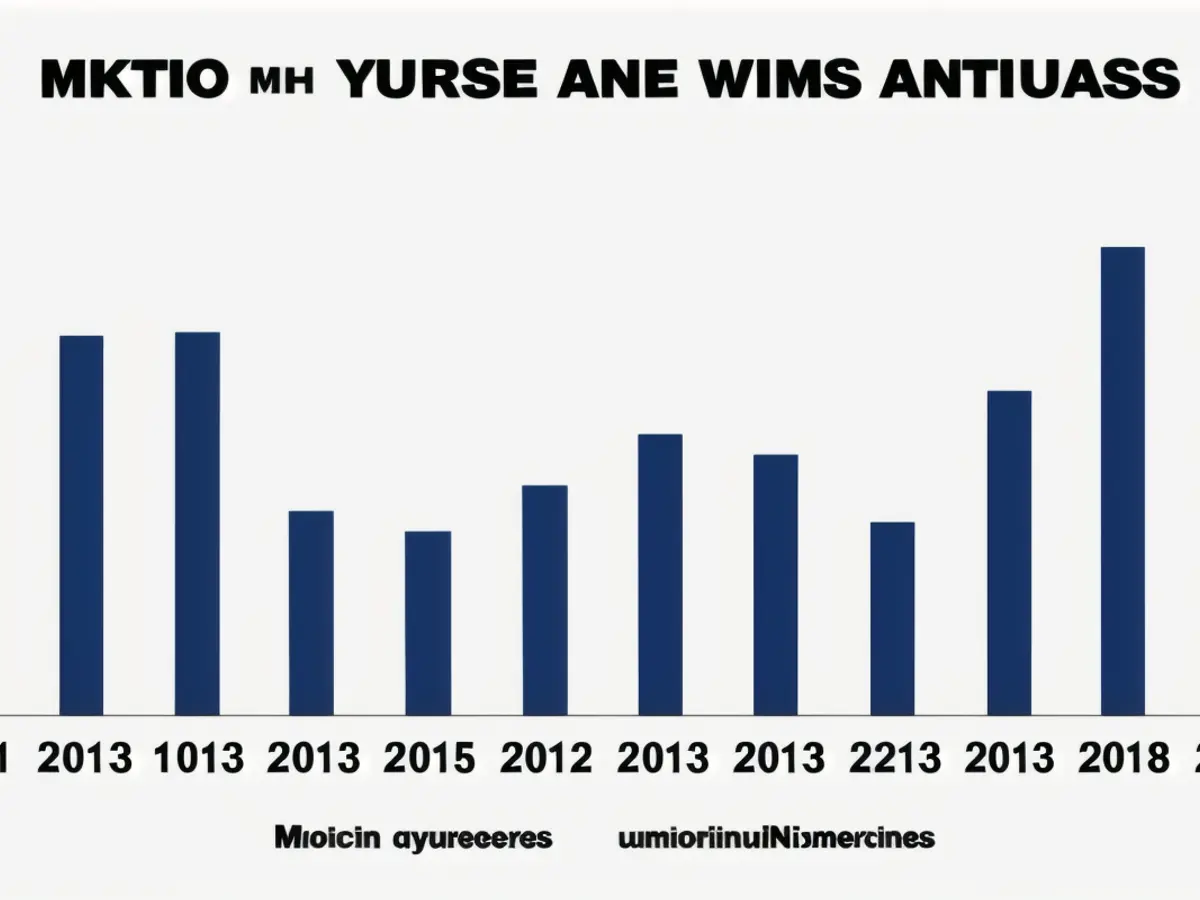

Strong oil and gas demand translates directly to robust sales and profits for EPD. In Q3 2024, they grew revenue and Core Earnings by 6% and 11% YoY, respectively. Core Earnings have reached their highest-ever level across any annual period in EPD history.

Historically, EPD has seen steady growth in revenue and Core Earnings, growing by 2% and 8% compounded annually from 2013 through Q3 2024.

Eye-Popping Dividends and buybacks

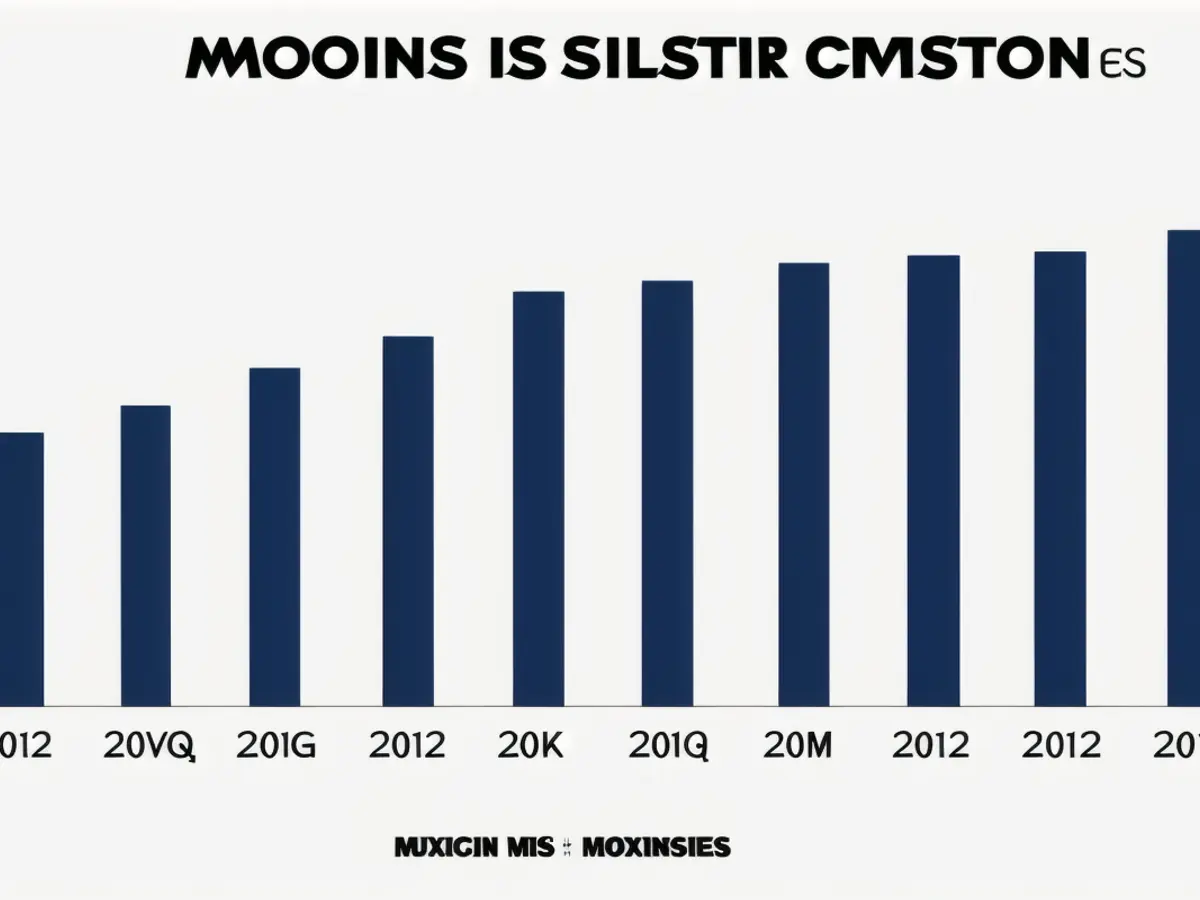

EPD's no stranger to rewarding its investors: 2024 was the company's 26th consecutive year of boosting its distribution. What's more, the current distribution clocks in at a tasty 6.4% yield.

But that's just the beginning; EPD's also been shelling out cash through share buybacks. In 2023, they repurchased $188 million worth of units, and in 2024 they went even bigger, with $219 million in repurchases. With $1.1 billion remaining in their authorization, there's still room for more. All told, the combined distribution and share repurchase yield would be around 6.7%.

Cash Cows Galore

EPD's paid out a whopping $27.2 billion in distributions from 2018 through Q3 2024. But it's not all about giving; EPD has generated a sizeable $27.4 billion in free cash flow over the same period — plenty to cover those distributions!

What's Not Ideal

Slowing Growth

Although demand for oil and gas is projected to continue rising, the rate is expected to decelerate following a record-breaking 2024. In 2025, the Permian Basin is expected to see growth of 250k-300k bbl/day, a significant decline from the 380k bbl/day gain in 2024.

Master Limited Partnership Woes

As a Master Limited Partnership (MLP), EPD does come with a few risks. MLP agreements can sometimes put the general partner's interests opposed to those of unitholders. Given this structural issue, I always assign MLPs a Suspended Stock Rating, as the risk of substantial unitholder dilution is a real concern. Nonetheless, I believe the cheap valuation of EPD Partners' common units more than compensates investors for the potential risks.

This structure may account for EPD trading at a discount to its non-MLP peers. So, while EPD's a successful business, there's always that MLP elephant in the room.

Disclaimer: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

- Despite Enterprise Products Partners (EPD) underperforming in 2025, there is optimism that the market will recognize EPD's potential to generate substantial value for shareholders, particularly due to EPD's strong performance in the markets of enterprise, oil & gas, and NGL pipelines & services.

- As 2025 approaches, EPD is poised to reap the benefits of its multibillion-dollar construction projects, which include two natural gas processing plants, the Bahia NGL pipeline, Fractionator 14, an NGL export facility, and ethane and ethylene marine terminal expansions, among others – all set to complete by 2025.

- Despite EPD's role as a Master Limited Partnership (MLP) posing certain risks, including potential conflicts between general partners' and unitholders' interests, EPD's cheap valuation of common units in comparison to non-MLP peers compensates investors for these potential risks.