Chatting with Economist Lucrezia Reichlin: A Frank Discussion on Italy's Banking Sector Interventions

Economist Reichlin advocates for the European Central Bank's involvement in Italy's financial affairs

In an open and candid conversation with the Financial Times, renowned economist Lucrezia Reichlin, hailing from the London Business School, expressed her concerns over the Italian government's growing influence in the banking sector. According to her, these interventions are standing in the way of essential consolidation, a move that should initiate European supervision.

By Gerhard Bläske, Milan

Economist Lucrezia Reichlin lays it all out in her interview with the Financial Times: "The happenings in the Italian banking sector are unjustifiable and directly conflict with a stronger unification of the sector," she states. The Italian government, as well as the German and French governments, have been expanding their control on the economy, but it's Rome's actions that have Lucrezia particularly riled up.

Breach of EU rules and problematic conditions

tackle issues concerning the takeover of Banco BPM by Unicredit by the Italian government, Reichlin points out that they contradict European rules. She particularly emphasizes the obligation dictated by Rome for the acquiring bank to hold a certain portion of Italian government bonds. "This aspect has been problematic in the past," she notes.

Problematic consolidation rhetoric

Reichlin also finds it troubling that Rome seems to link conditions to the planned joint venture between Generali and French Natixis. "The European Central Bank must step in here," the professor at LBS, with a renowned research and teaching career in the USA, Italy, Britain, France, and Belgium, advises.

Rome's lip service vs. nationalist approaches

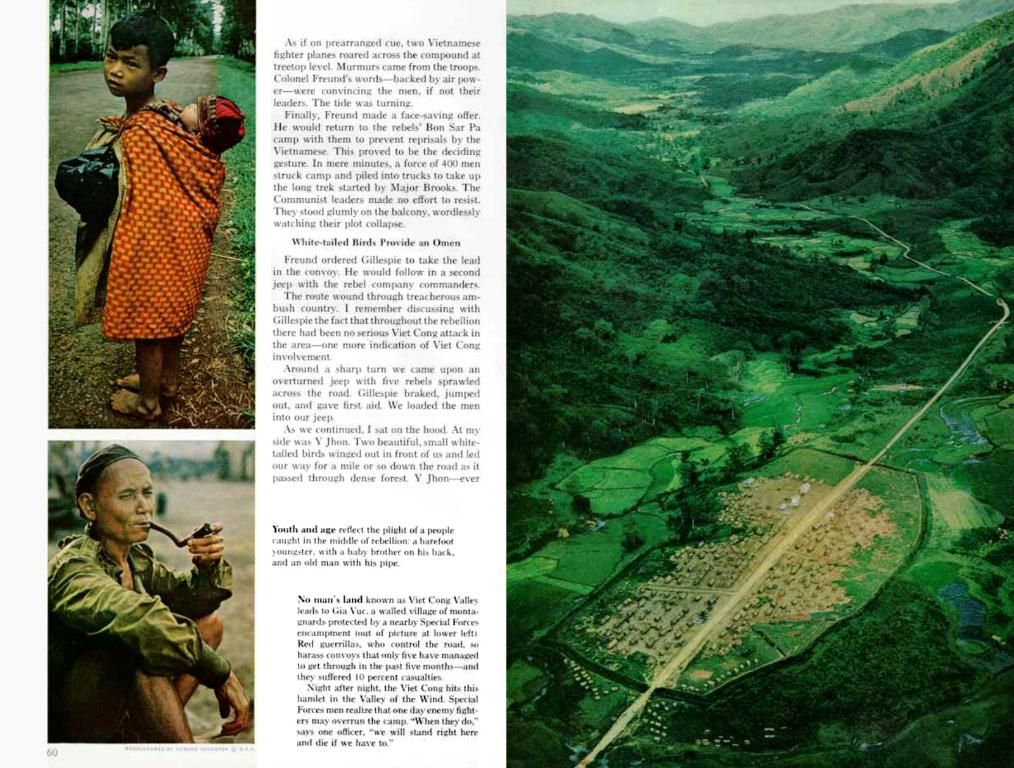

While the Italian government advocates for consolidation in the banking sector, Lucrezia Reichlin considers this as mere lip service. In her view, the government is following nationalist approaches, leading to stagnation or counterproductive development. "The alarm bells should be ringing," Reichlin warns.

Interference beyond strategic interests

One of Lucrezia's biggest concerns is Rome's interference in non-strategic matters, with their actions sometimes in sync with investors who are not even from the banking sector. She mentions construction and media entrepreneur Francesco Caltagirone and the Del Vecchio family's holding company Delfin, which owns shares in leading banks such as Mediobanca, Monte dei Paschi, and Generali. These investors play a significant role in Monte dei Paschi's takeover offer for Mediobanca and aim for a dominant position at Generali.

An Italian game of connections

Reichlin refers to the circumstances under which the state and private investors are meddling in consolidation as "very Italian." She notes, "It's a messy constellation of political, regional, and company-specific interests." The specialist in monetary policy and business cycles concludes, "It's absolute chaos with connections everywhere."

A plea for market-driven consolidation

Lucrezia Reichlin supports consolidation driven by market forces. However, she doesn't understand why market-driven consolidation, such as the merger between Unicredit and Banco BPM, faces resistance. She also questions "why the government backs Monte dei Paschi's takeover of Mediobanca but not Mediobanca's takeover of Generali, which would be much more sensible" because it would create a large asset manager, similar to the proposed alliance between Generali and Natixis.

Skepticism towards markets

Although Reichlin is not fundamentally against state interventions, she criticizes the current Italian government's actions as driven by a "purely political logic." The resistance against market-driven consolidation, in her view, arises from a general skepticism towards the markets.

- The Italian government's increasing control of the economy, particularly in the banking sector, is of concern to economist Lucrezia Reichlin, as it hinders essential consolidation and European supervision, which should be market-driven, following the rules set by the EU.

- Lucrezia Reichlin emphasizes the need for the European Central Bank to intervene in the banking sector, as problematic conditions set by the Italian government, such as the obligation for acquiring banks to hold a certain portion of Italian government bonds, have been problematic in the past and contradict the principles of a unified sector.