Economic globalization equates to economic bondage

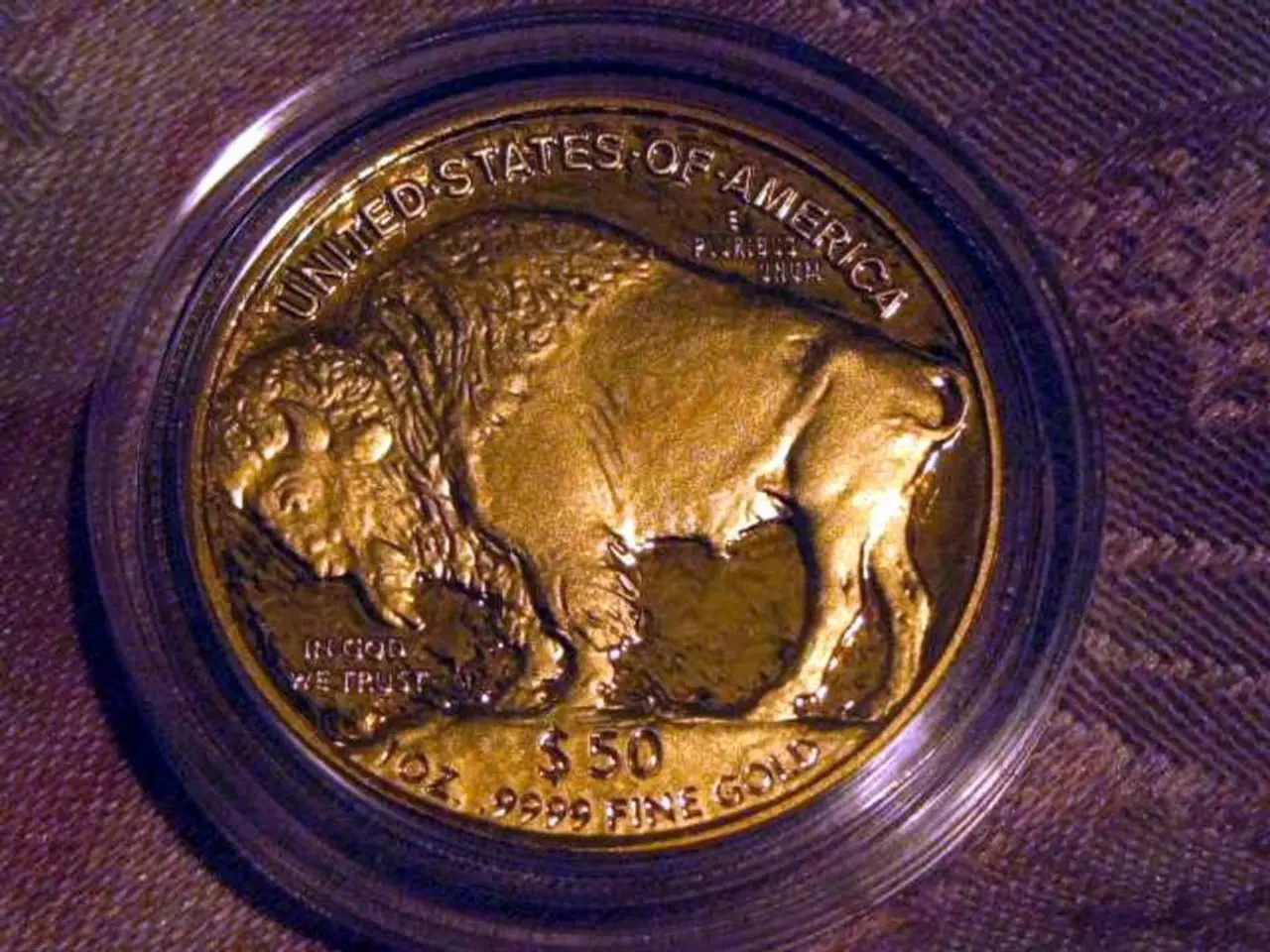

In a world where governments abandon sound money principles in favour of central bank digital currencies (CBDCs), one man finds himself grappling with the consequences.

John, a hardworking individual, lived under a system where his income was controlled by the government, with deductions for taxes, rent, utilities, and fees. His savings, meticulously built over time, vanished within 90 days, leaving him in a state of financial uncertainty.

This shift towards CBDCs, as government-issued digital currencies, offers greater control over monetary policy and the money supply. However, it also raises concerns. Like fiat currencies, CBDCs could be subject to inflationary expansion, destroying the real value of savings and increasing financial instability.

The erosion of savings is just one aspect of the problem. The economic incentives could change, potentially reducing incentives to invest in productive assets and favouring speculative or centrally steered financial activities. Furthermore, CBDCs enable governments to monitor transactions closely, potentially eroding individual financial privacy and increasing the reach of state control over citizens' financial lives.

The consequences of this shift are far-reaching. Inflation caused by unchecked money supply expansion harms those who save money, widens wealth inequality, and can undermine economic stability. On a broader social scale, abandoning sound money principles can contribute to widening inequality and loss of institutional trust, as monetary debasement disproportionately harms those least able to defend themselves financially, which may exacerbate social fragmentation and cynicism.

John's life is further complicated by a social credit score that can decrease if he does something the government deems contrary to his well-being. He is later drafted into military service, but is unsure about who he is fighting against. Upon his return, he finds breadlines and food shortages, a stark contrast to the rising prices of stock market shares that gave the illusion of economic growth.

The poorest people lose most in this artificial arrangement, as their cash savings lose value over time. The wealthiest end up owning everything, while everyone else tries to balance life precariously on a tightrope of debts and the prospect of insolvency. John, now on a government-controlled income, finds himself offered assistance to end his life peacefully due to his diminished financial prospects.

In a world created by financial and political elites, the system appears unsustainable and a form of economic slavery. The man is encouraged by the government to find personal meaning by fighting against global warming, a distraction from the real issues at hand. His A.I. supervisor informs him that he has been added to a list of potential domestic terrorists, further highlighting the erosion of individual freedoms.

John lives alone in a tiny apartment due to government policies, a stark reminder of the state's control over every aspect of his life. He wonders if there is a way out of this cycle, a return to sound money principles that can restore economic stability, trust, and individual financial autonomy.

Read also:

- Trade Disputes Escalate: Trump Imposes Tariffs, India Retaliates; threatened boycott ranges from McDonald's, Coca-Cola to iPhones

- Li Auto faces scrutiny after crash test involving i8 model and a truck manufacturer sparks controversy

- Celebrated Title: Cheesemakers Blessed Upon

- Construction and renovation projects in Cham county granted €24.8 million focus on energy efficiency