Disposable Income: The Crucial Factor in Exploring Consumer Expenditure [Implications, Equation, Factors]

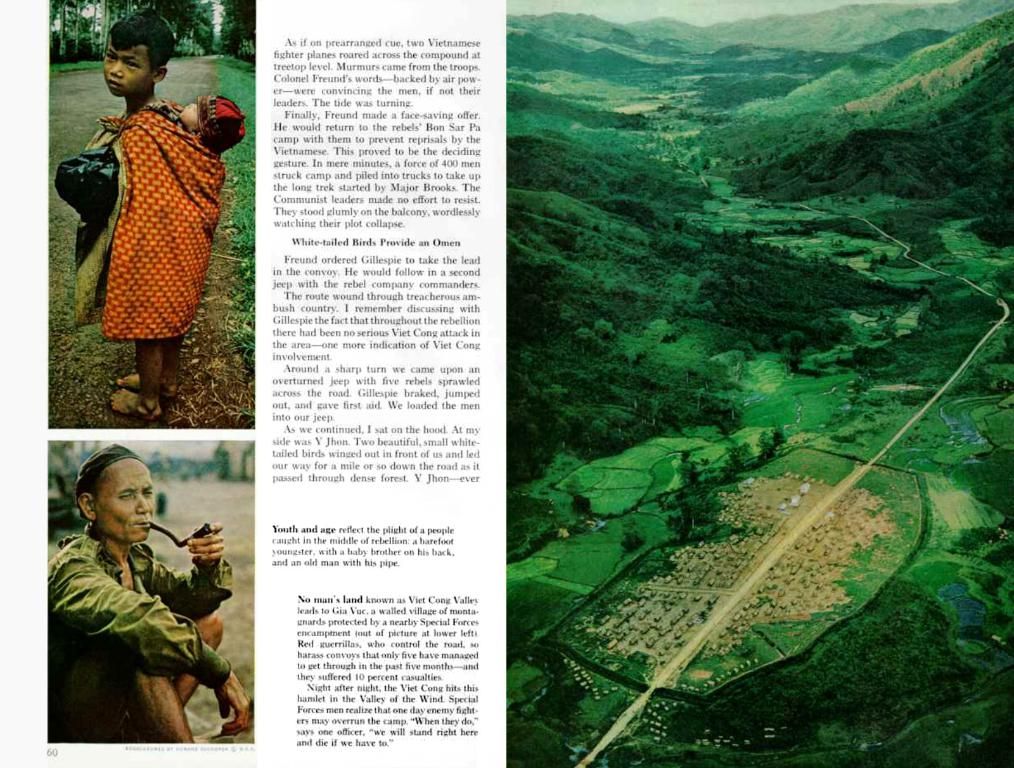

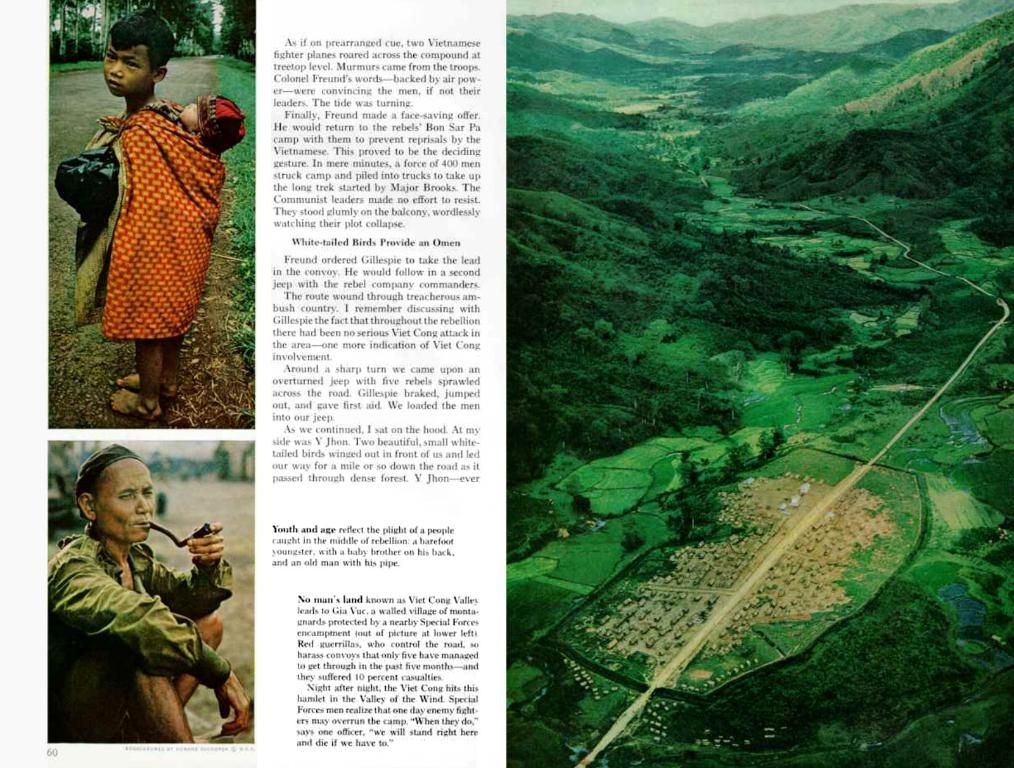

Let's Talk Disposable Income:

In simple terms, disposable income is what you've got left in your pocket after you've paid your taxes. It's nearly always on the agenda when discussing household finances because it influences how much you can save or spend.

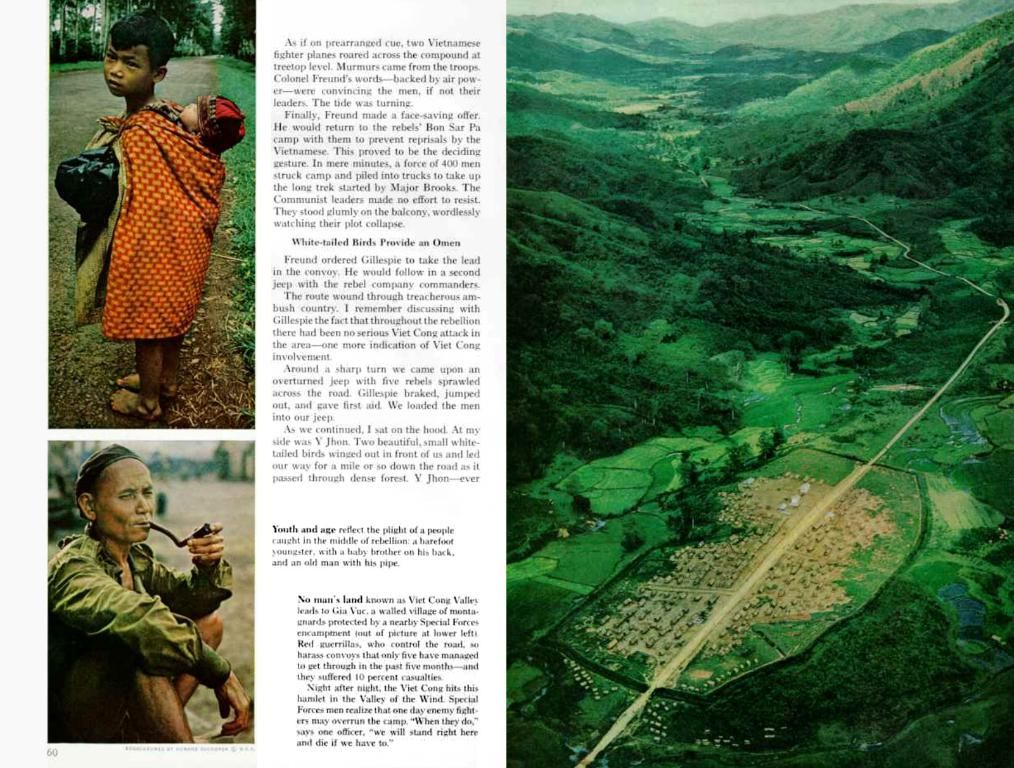

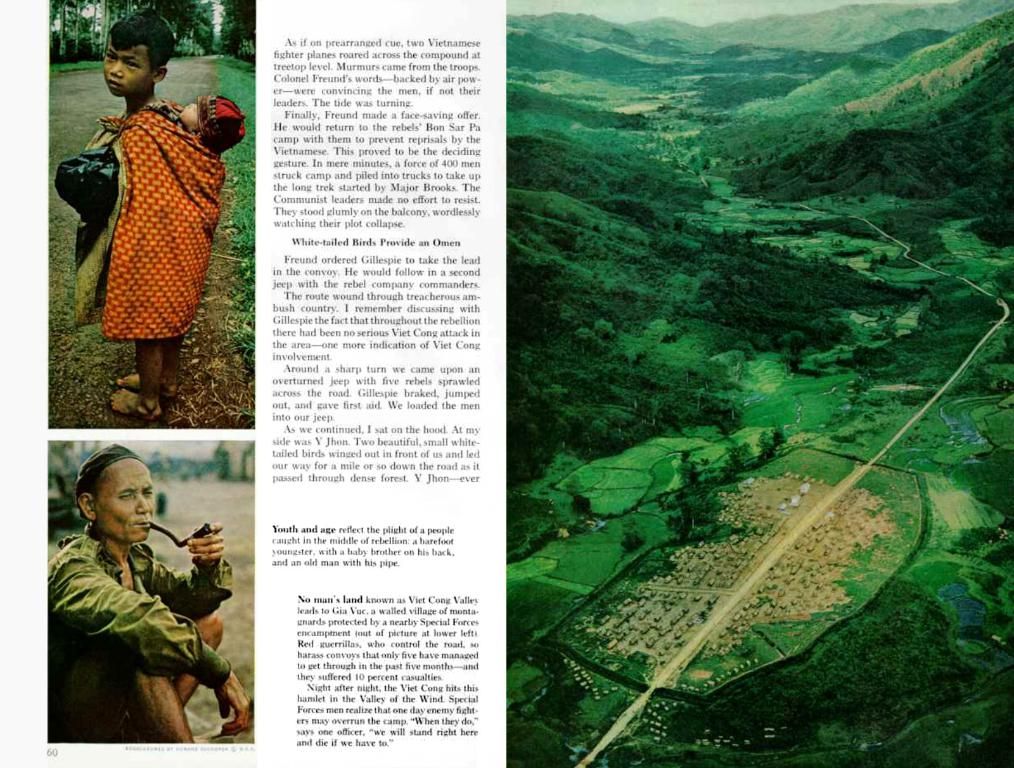

Disposable income gives us a fair idea about a family's purchasing power. If it goes up, we can expect them to ramp up their spending, which, in turn, stimulates businesses to up their production and recruit more workers. This cycle results in a growing economy, falling unemployment, and a positive outlook for income.

In 2018, the United States led the pack, boasting the highest disposable income per head, with a whopping $53,123, followed by Luxembourg ($47,139) and Switzerland ($41,561)[1].

How to calculate disposable income?

Calculating disposable income is as easy as pie. Just take your total income and subtract your personal taxes. Income can come from a variety of sources, including wages, earnings from stocks and bonds, and government aid. Taxes are the bite taken out before you can actually spend your dough.

The remaining amount is yours to splurge or save or stash away in financial instruments like stocks and mutual funds.

Mathematically, the equation for disposable income looks like this:

- Disposable income = Total income - Personal taxes

Assuming your income is $100, and the taxes you owe are around 20%, your disposable income will amount to $80. You can now decide whether to shop till you drop or spend it on something entirely different.

Disposable vs. Discretionary Income:

Disposable income focuses on taxes as a deduction because they're mandatory expenses. However, don't forget about your rent, utilities, and other basic necessities you've gotta pay — those expenses will push you down the ladder to discretionary income.

Discretionary income is the money left after you've covered all the bills. This is the coin you can use for travelling, dining out, or other plans to meet your secondary needs[2]. The formula for calculating discretionary income is:

- Discretionary income = Total income - Personal taxes - Fixed expenses = Disposable income - Fixed expenses

It's important to keep in mind that we only factor in personal taxes as a deduction when calculating disposable income. This excludes any indirect taxes like sales tax or value-added tax (VAT)[3].

Why disposable income matters?

Disposable income is the key indicator of a household's spending power and consumption. Changes in disposable income affect consumer demand and economic activity in various countries. Household expenditures contribute significantly to a country's GDP. In fact, some countries' household spending covers more than half of their GDP[4].

Economists track changes in disposable income to identify trends in household spending and saving. An increase in disposable income, for example, usually leads to a rise in demand for goods and services, which encourages businesses to ramp up their production and recruit more workers[4].

It's fascinating to see how much our spending habits can impact the economy. Economists call this the fiscal multiplier, and you can calculate it with this formula:

- Multiplier = 1 / [1-MPC (1-t)]

Where t is the tax rate.

A decrease in taxes increases disposable income, which amplifies the effect of household consumption on the economy[5].

Factors influencing disposable income:

The formula for disposable income, Disposable Income = Total Income - Personal Taxes, highlights the two primary factors impacting the cash in your pocket:

- Taxes: Personal income taxes directly knock a portion off your total income. When the government lowers tax rates, you keep more of your hard-earned dough. This puts money back into the economy, stimulating growth, particularly during a recession[5].

- Nominal Income: This refers to your overall earnings before adjusting for inflation. Factors like a competitive job market, increased dividends, and capital gains can contribute to a rise in nominal income. However, to truly understand the purchasing power of your disposable income, you'll need to factor in inflation[6].

By understanding disposable income, you'll have a better grasp of your financial past, present, and potential future. Happy spending (and saving)!

[1] Source: OECD, reporting the highest disposable income per capita in 2018.[2] Definition of discretionary income.[3] Disposable income vs. discretionary income.[4] Disposable income and household spending.[5] Expansionary fiscal policy.[6] Understanding inflation and its effects on disposable income.

In the context of businesses, an increase in disposable income among households can stimulate them to ramp up their spending, which in turn encourages businesses to up their production and recruit more workers, leading to a growing economy.

Furthermore, calculating discretionary income requires considering fixed expenses, such as rent and utilities, in addition to personal taxes when subtracting from total income.