Digital Currency Taking Over: Regardless of Preference, Traditional Money is Transitioning online

Cyber cash is taking over, and it's happening faster than you can say "pass the matcha." Your wallet's going digital, whether you're ready or not. Here's the scoop on what's happening, what it means, and what you should watch out for.

Kiss Your Cash Goodbye

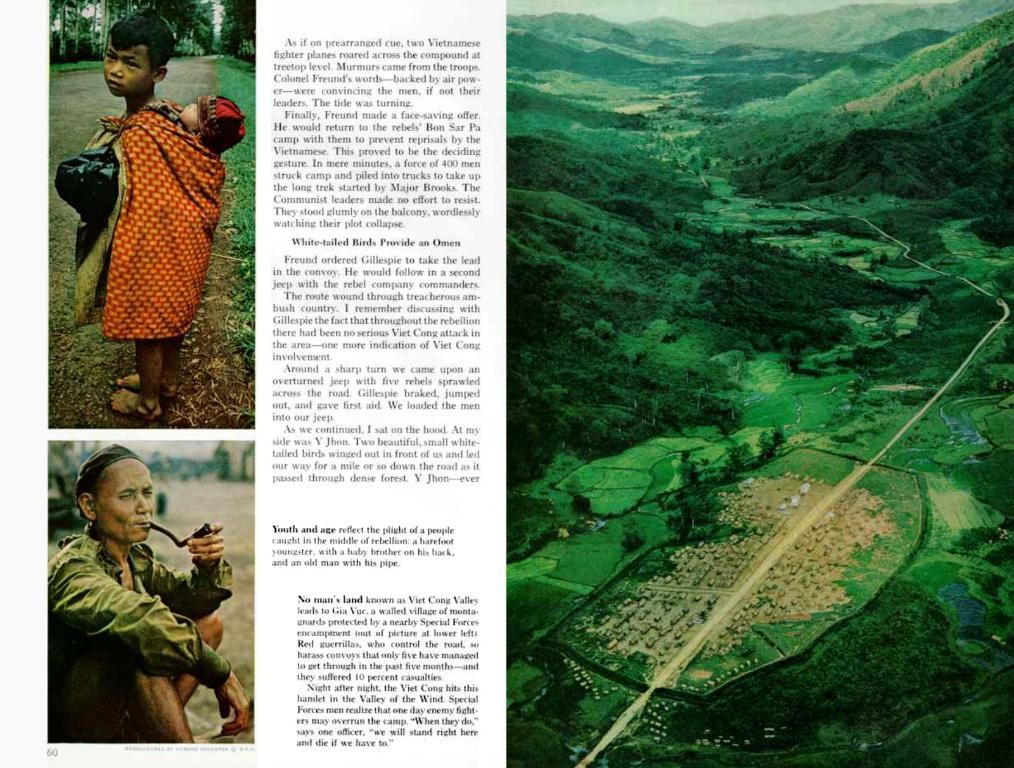

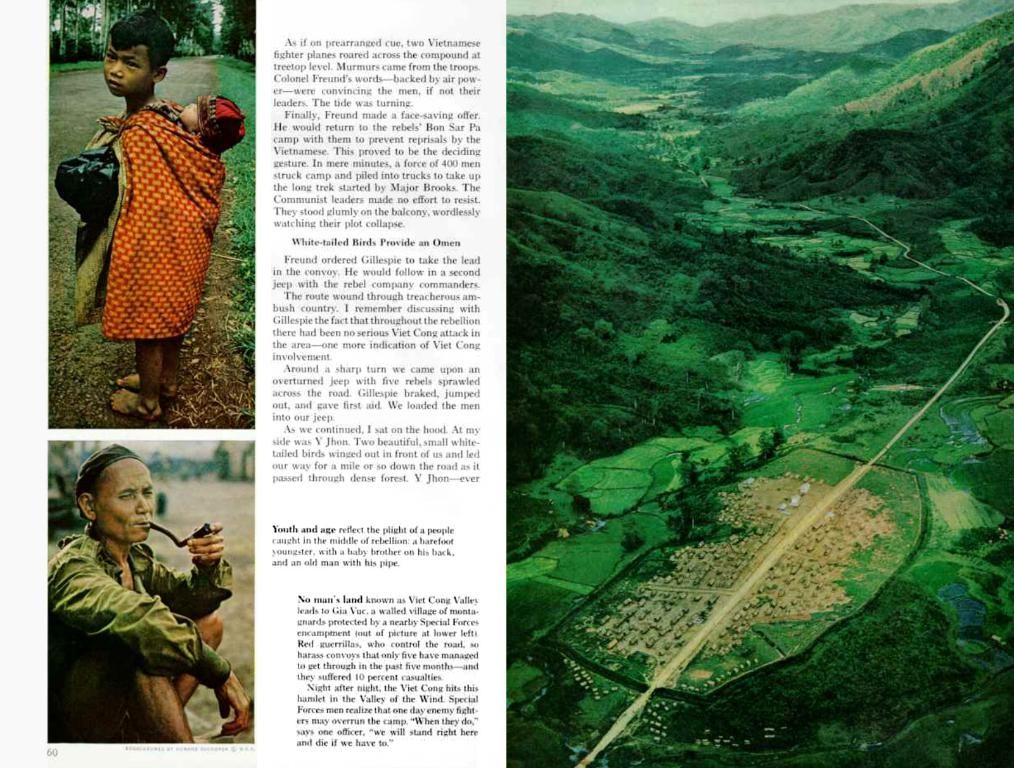

Money as we know it is disappearing, and it's not a gradual fade. It's a full-on vanish act, happening right before our eyes. Cash use worldwide is dropping like a rock, and countries like Sweden have all but phased it out. In the United States, ATMs are dwindling, with the number dropping from 470,000 in 2019 to 451,500 by the end of 2022. Governments love digital money because it's easier to track, harder to counterfeit, and perfect for surveillance. So, that crumpled $20 in your pocket? It won't be around forever.

Your New Banker is an App

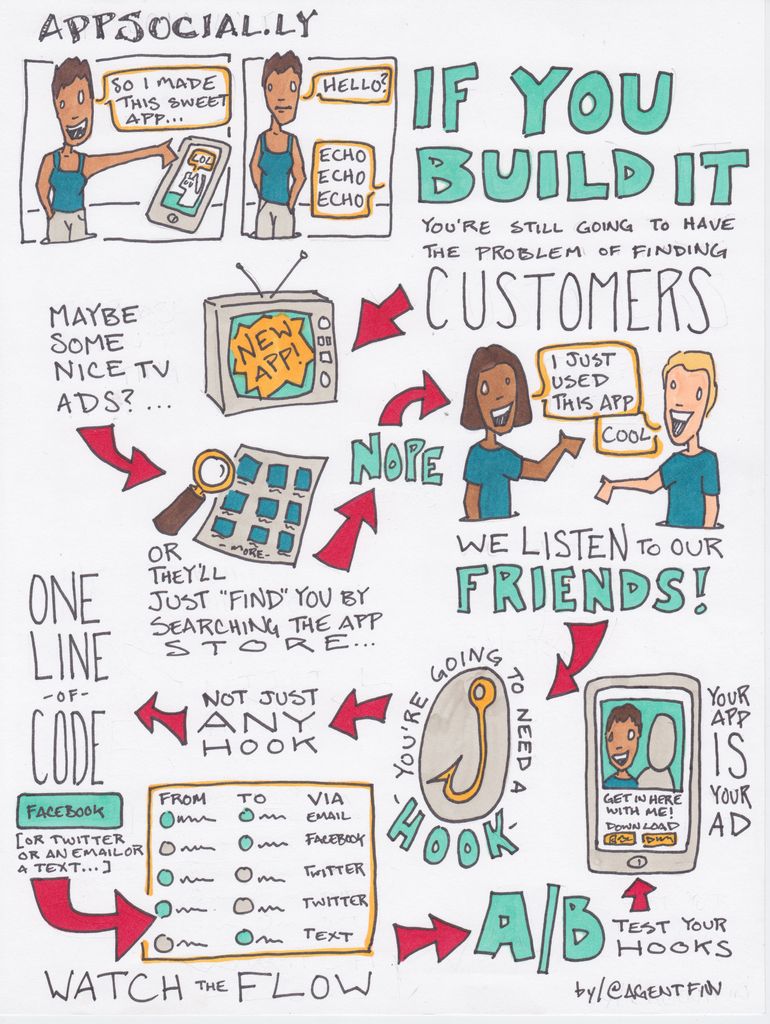

Remember the hassle of dealing with brick-and-mortar banks? Long lines, paperwork, judgmental tellers – it's a thing of the past. Welcome to the world of digital-only banks, where Neo-banks like Chime, Monzo, and N26 are shaking up the banking industry. No more branches, no more forms, and no more’why did you withdraw all your savings on a Wednesday?' From mobile apps, you can manage your bank account, and mobile banking is ranked the top choice by over half of U.S. consumers, according to a recent survey.

Algorithms are Your New Financial Advisors

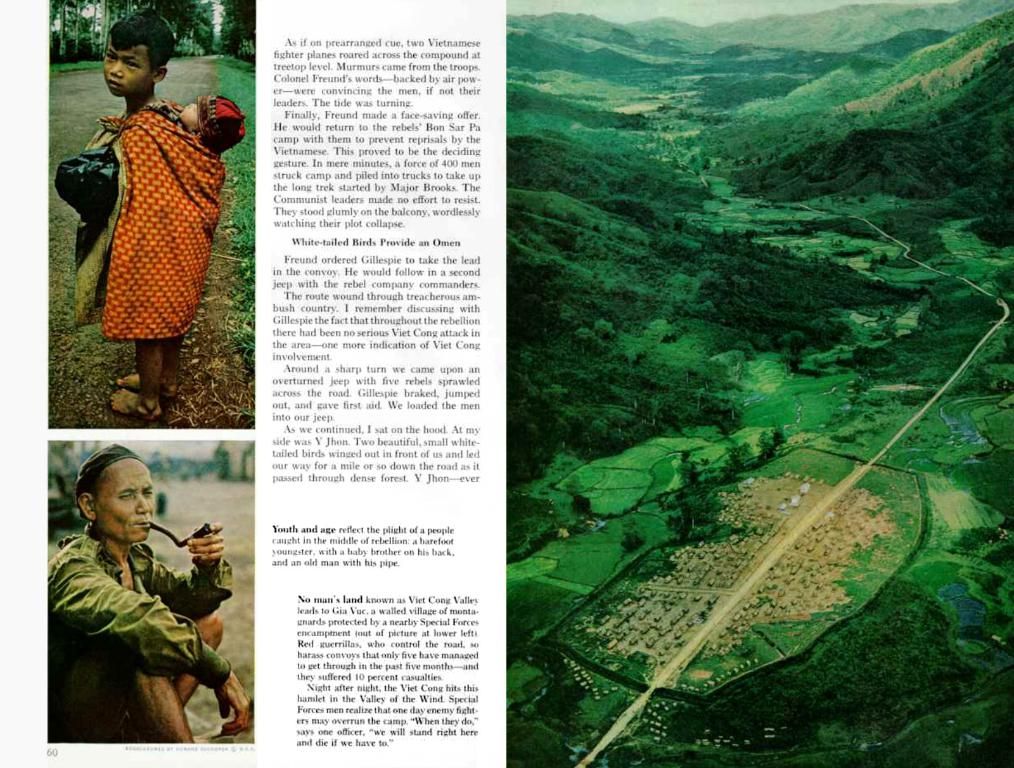

You thought algorithms were just recommending your next Netflix binge. Think again. They're budgeting, investing, even telling you when to stop ordering takeout. Apps like Cleo, YNAB, and Wealthfront use AI to analyze your spending habits and offer personalized financial advice on the fly. By 2025, robo-advisors could manage over $20 trillion in assets, reshaping the future of wealth management.

Is Convenience Worth the Cost?

Going digital means giving up control. Every transaction, every subscription, every impulse buy is recorded, analyzed, and sold to someone else's algorithm. It's addictive, but so is data. And fintech companies are thirsty. Even biometric payment systems collect facial recognition data and sometimes sell it. So, what are you willing to trade for convenience?

What's Next: CBDCs, Blockchain, and More

It's not just about Venmo and PayPal anymore. We're talking about CBDCs, the next wave of digital cash, and blockchain, the technology behind crypto that's still reshaping peer-to-peer payments and international transfers. About 134 countries, including China and Europe, are exploring or developing CBDCs. Blockchain's here to stay, even if you're not into Bitcoin.

Credit is Evolving

Remember the days of bank meetings, piles of paperwork, and potentially giving up your soul for a loan? Now, digital lenders offer fast, flexible credit through an online process. But beware – it's easy to borrow, hard to keep track of the fine print, and digital convenience can sometimes take a toll on your long-term financial health.

Big Tech is the New Financial Powerhouse

Apple, Google, Amazon, and Meta are entering the financial world, and they're not messing around. They've got your data, your trust, and your attention. Now, they want your banking business too. It's easy, it's convenient, but is it safe?

Are You Really Saving?

Digital money feels clean, but appearances can be deceiving. Under the surface, there are hidden costs like app fees, subscription-based budgeting tools, and higher interest rates for buy-now-pay-later platforms. It's easy to overspend when all it takes is a tap.

The Game Has Changed

Your money is digital now, and it's not going back. The best you can do is stay smart about it. Ask questions, read the fine print, and don't assume digital means better. Spend less than you earn, borrow wisely, protect your privacy – the core rules of money still apply. This isn't just about tech, it's about power and who controls it.

Like what you're reading? Subscribe now to get the latest news, exclusives, and videos on WhatsApp!

Disclaimer: Analytics Insight does not provide financial advice or guidance. If you invest in cryptocurrencies or digital assets, you do so at your own risk.

The digital transformation in finance implies that your money management lifestyle will heavily rely on technology, with algorithms becoming your new financial advisors and mobile apps your primary banking solution. As the game continues to evolve, big tech companies are positioning themselves as the new financial powerhouses, offering convenience at the cost of your data privacy. Stay vigilant and make informed decisions to protect your financial health in this increasingly digital world.

In the midst of transitioning to a cashless society, the question looms: is convenience worth the cost of sacrificing your data privacy? As CBDCs, blockchain, and other fintech innovations reshape the financial landscape, it's crucial to be mindful of the hidden costs associated with digital money and ensure that you're truly saving, rather than overspending due to the ease of digital transactions.