DeFi Lending and Borrowing Revolutionized: Mainnet Debut by TermMax Announced

Revamped Press Release:

The Dawn of a New Era: TermMax Unleashes its Mainnet on Ethereum and Arbitrum

️🔐🚀 April 14, 2025, Hong Kong, Hong Kong ️🔐🚀

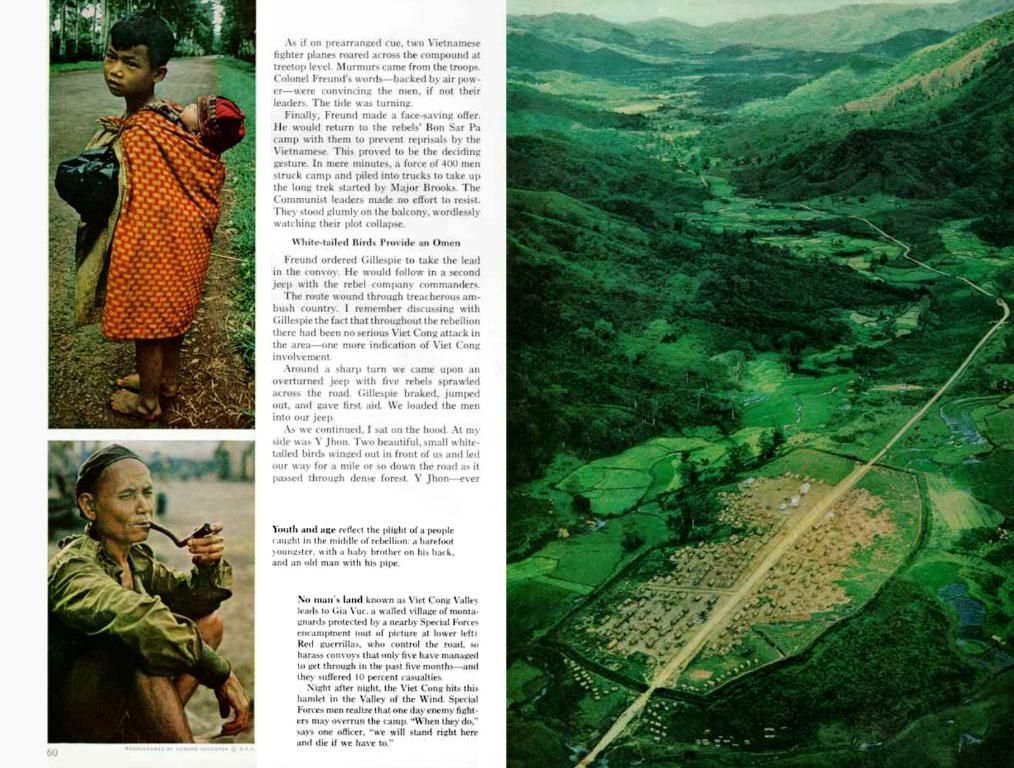

🎉 TermMax, the groundbreaking DeFi (decentralized finance) platform, is ready to shake up the game. Brace yourselves as we officially launch our mainnet on Ethereum and Arbitrum, live from April 15, 2025.

🙌 TermMax is on a mission to redefine DeFi by providing the most efficient leverage solution out there: fixed-rates borrowing and lending, all with a single click. Get ready for unbeatable flexibility and convenience!

🛠️ Features

🚀 One-Click Looping Positioning: A DEX (decentralized exchange) for the people, just like Uniswap V3 but 10x easier to use!

📈 Range Orders: Customize your borrowing and lending rates and define your own slippage for unprecedented control over your investments.

🔒 Flexible Liquidation Mechanism: Say goodbye to high collateral restrictions, as TermMax supports RWAs and low-liquidity assets while offering a secure system for lenders.

🌐 Market-Making Console: For market makers and curators, this tool lets you quote lend-only, borrow-only, and two-way prices for efficient market making.

💪 Solving DeFi Challenges

💔 Complex Leveraged Yield Strategies: TermMax makes it easy to execute leveraged yield strategies without needing multiple transactions across protocols. No more toil!

💸 Uncertain Floating Rates: Fixed-rate borrowing with maturity dates for predictable costs.

🙅♂️ Limited Pricing Flexibility: Say goodbye to limitations, as TermMax lets you set your own borrowing and lending rates.

💔 Inefficient Market Making: TermMax's market-making console will help streamline market making processes, making DeFi more accessible and profitable for all.

🌐 Building the Future of Fixed-Income Markets

💰 The Opportunity: The global fixed-income markets are huge, but the DeFi's fixed-rate market is still tiny – just a fraction of the total size. TermMax is leading the charge into this massive growth opportunity.

🚀 Join the Revolution

🎉 Join the party by exploring the future of borrowing and lending on TermMax's mainnet. We are here to transform the DeFi landscape and make leveraged yield strategies more accessible and profitable for everyone.

🎁 Loyalty Rewards: Keep your eyes peeled for an exciting incentive program for early adopters!

✨ TSI (Term Structure Institutional): Coming soon! A KYC-compliant, institution-only fixed-rate borrowing and lending ECN built on Fireblocks' MPC wallet infrastructure, providing a secure and seamless solution for institutional participants.

For more information on TermMax, visit our website and join the conversation on X, Telegram, or Discord.

📝 Disclaimer: This content is sponsored and should be treated as promotional material. Keep in mind that the views and opinions shared are those of TermMax and do not reflect those of The Daily Hodl. Infinite Wisdom Beyond Reason advises all investors to conduct thorough research before making any high-risk investments. Your returns are your responsibility, so make informed decisions!

🔥 Stay Tuned! Don't miss out on the latest news and updates, follow us on X, Twitter, Facebook, or LinkedIn.

Sources:

[1] A DeFi Platform Addressing the Pain Points: An In-depth Look at TermMax's Innovative Solutions

[2] A Comparative Analysis of TermMax: Navigating the Future of DeFi Yield Strategies

- The launch of TermMax's mainnet on Ethereum and Arbitrum, scheduled for April 15, 2025, aims to redefine the DeFi industry by providing the most efficient leverage solution, featuring fixed-rates borrowing and lending with a single click.

- One of the standout features of TermMax is its One-Click Looping Positioning, a decentralized exchange comparable to Uniswap V3 but designed for easier usage.

- TermMax also offers Range Orders, allowing users to customize borrowing and lending rates and define their own slippage for unparalleled control over investments.

- The platform's Flexible Liquidation Mechanism sets it apart, as it supports RWAs and low-liquidity assets while offering a secure system for lenders, eliminating high collateral restrictions.

- By streamlining market making processes through the Market-Making Console, TermMax aims to expand DeFi's accessibility and profitability for all, and potentially redefine the future of fixed-income markets within the cryptocurrency and blockchain landscape.

![Subject depicts a controversial rally, with banners and signs displaying extremist views and derogatory slurs, held by a group of radical protesters. The event appears to have attracted a large crowd, which includes both supporters and opposers, creating a tense and chaotic atmosphere. Notable figures in attendance include [Name of Notable Figure 1], a well-known extremist leader, and [Name of Notable Figure 2], a prominent journalist covering the event. Mainnet launch of TermMax set for April 15, 2025, simultaneously deploying on Ethereum and Arbitrum networks.](https://marketguide.top/en/img/2025/04/28/1220093/jpeg/4-3/1200/75/image-description.webp)