Crypto transaction used in house purchase, vendor receives Euros – a French first

Going Crypto for Your Dream Home: France Jumps on the Bandwagon

© Getty By Christine Lejoux, Head of Real Estate Service

Published on , updated on

- Copy link Link copied

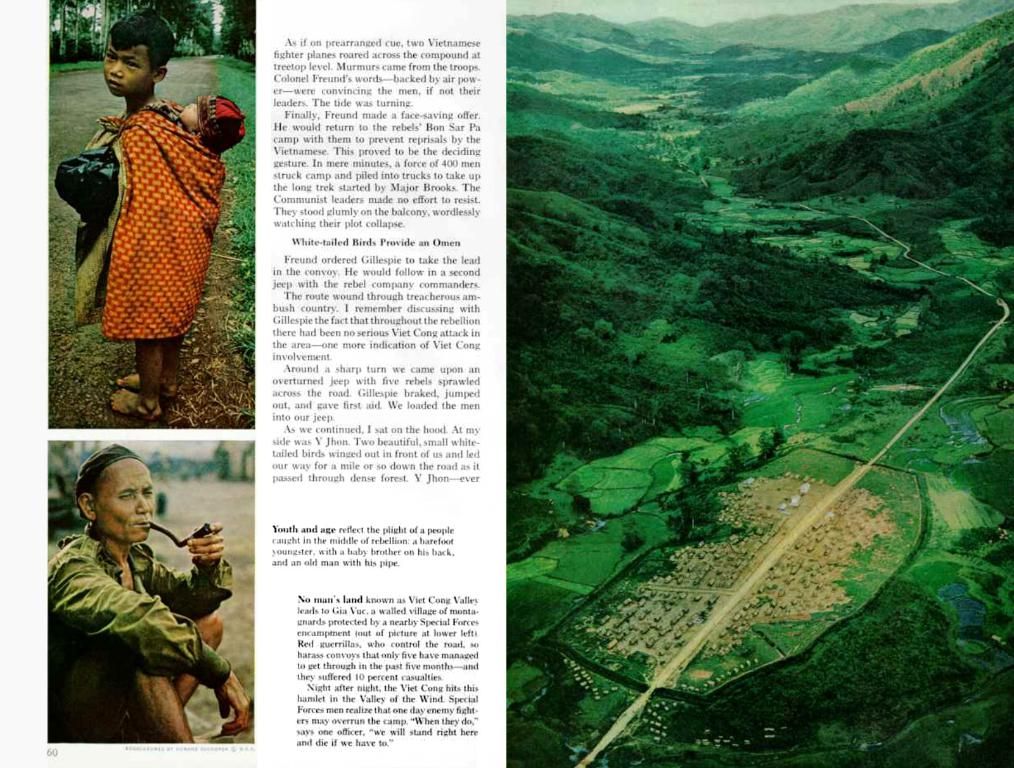

Dream house in sight? A 35-year-old family just scored one in the Lyon region, thanks to an innovative approach - financing it with... cryptocurrency. This extraordinary method, coordinated by startup JBDA, has marked its first France appearance. Curious? Here's a lowdown on how it works!

At 2 pm on June 19, this family will officially become homeowners. But what sets them apart from many is their unique payment method - cryptocurrency. Specifically, "stablecoins", shares Emeric Fillatre, co-founder of JBDA, a solution that lets the seller receive the sale proceeds in euros, setting a precedent in France. According to Fillatre, selling properties for cryptocurrency can be a tricky business given its infamous volatility.

Post finding their dream abode and securing the seller's agreement, the buyer reached out to JBDA. With verification of the stablecoins tapped to finance the property purchase, JBDA, in collaboration with its Legibloq solution, placed them in an escrow account before handing them off to one of its notary partners to draft the sales agreement.

Navigating Crypto Volatility

With the authentic deed of purchase due on June 19, there's a small catch - the stablecoins on JBDA's escrow account have already experienced a 7% dip. To counter this, JBDA asks buyers for a margin of safety of 30% beyond the value of the stablecoins equating to 370,000 euros. If the entire buffer isn't utilized, it will be refunded. By June 21, JBDA plans to convert the stablecoins into euros for transfer to the notary's account through the Caisse des dépôts et consignations. Fun fact: Notaries do not handle cryptocurrencies, so this process eliminates one major hurdle!

The crypto trend is gaining footing among French residents, with 5.5 million people said to possess over 20 billion euros in crypto-assets. Agencies are also receiving requests for cryptocurrency-funded transactions, making this solution an attractive offering.

Pro Tip: Lower Rates Ahead for Single-Parent Families - Find Out How

Levels and Layers

Cryptocurrency's real estate penetration extends to cities like Miami, where properties are being sold directly using cryptocurrencies. Similarly, in England and Dubai, crypto and tokenization are transforming the property game[1][4][5]. However, information on receiving sale proceeds in euros from cryptocurrency transactions is scant. Traditionally, converting crypto to traditional currencies like euros involves cryptocurrency exchanges or specialized conversion services.

While the precise workings of the Legibloq solution remain unclear, its function appears to revolve around blockchain or real estate.

The family is investing their stablecoins, a form of cryptocurrency, to finance their dream home in France, marking the first instance of a business arrangement using cryptocurrency in the country. JBDA, a startup facilitating the transaction, has placed the stablecoins in an escrow account and is planning to convert them into euros before transferring the sale proceeds through the Caisse des dépôts et consignations, bypassing the need for cryptocurrency exchanges or specialized services.