Crypto Analyst Identifies Three Factors Spurring Bullish Alterations in Digital Currencies After Enduring Lengthiest Bear Market

Title: Bitcoin and Altcoins Bull Run: Van de Poppe's Predictions and Factors Driving Bullishness

In the rapidly evolving world of cryptocurrencies, the ever-astute trader Michaël van de Poppe is predicting a booming bull run for altcoins, following an extended bear winter. Van de Poppe articulated this bullish sentiment to his 784,000 followers on social media platform X, highlighting three key factors fueling the impending surge in crypto prices.

- Global Financial Conditions: With financial conditions easing globally, liquidity is increasing, which Van de Poppe argues is highly favorable for risk-on assets such as altcoins and Bitcoin (BTC). Notably, China has moved forward with quantitative easing, Europe has lowered interest rates, and the United States may soon follow suit, priming the market for higher Bitcoin prices.

- Capital Shift from Gold: The markets might be on the brink of a gold top in the short term, according to Van de Poppe. Investors who have benefited from gold's strong rally over the past few months are expected to start transitioning their capital into crypto in the coming 12-18 months. As gold enters a correction phase, altcoins are poised to take advantage of this window of risk-on momentum and experience substantial growth.

- Historical Data Correlations: Van de Poppe posits that the offshore Chinese Yuan and US dollar ratio (CNH/USD) is tightly correlated with the value of the Ethereum versus Bitcoin (ETH/BTC) pair. By analyzing historical data, he found that CNH/USD printed major bottoms in 2016 and 2019, during which the ETH/BTC and broader altcoin markets recorded cycle bottoms before exploding in value. With the recent "tariff madness," Van de Poppe suggests the CNH/USD has bottomed out, indicating that Ethereum and altcoins are poised for a genuine bull run.

Currently, the ETH/BTC pair is trading at 0.01894 BTC, or around $1,798.

Stay up-to-date with the latest news and market developments by joining us on X, Facebook, and Telegram! Subscribe to get notifications delivered directly to your inbox, and explore Price Action and The Daily Hodl Mix for additional insights.

[!Disclaimer: The opinions expressed at The Daily Hodl are for informational purposes only and should not be construed as investment advice. Investing in cryptocurrencies carries significant risks, and users should conduct their research before investing any assets.]

Industry Announcements

- Bitcoin Seoul 2025: Asia's Largest Bitcoin Conference to Gather Global Leaders

- FLOKI and Rice Robotics Launch AI Companion Robot, Offering Token Rewards

- STEPN and Argentina Football Association Announce Latest NFT Drop

- BYDFi Partners with Ledger for Limited Edition Hardware Wallet Debut at TOKEN2049 Dubai

- Team Behind Popular Telegram Wallet Grindery Unveils Wallet Infra for AI Agents

- Common Launches First Privacy Web App with Sub-second Proving Times on Arbitrum and Aleph Zero EVM

- Falcon Finance Unveils Transparency Page

Covering the future of finance, including macroeconomic trends, bitcoin, ethereum, crypto, decentralized finance, blockchain, regulation, and more.

Categories

- News, Bitcoin, Ethereum, Trading, Altcoins, Financeflux, Futuremash, Blockchain, Regulators, Scams, HodlX, Press Releases

ABOUT US | EDITORIAL POLICY | PRIVACY POLICY | TERMS AND CONDITIONS | CONTACT | ADVERTISE

JOIN US ON TELEGRAM

JOIN US ON X

JOIN US ON FACEBOOK

COPYRIGHT © 2017-2025 THE DAILY HODL

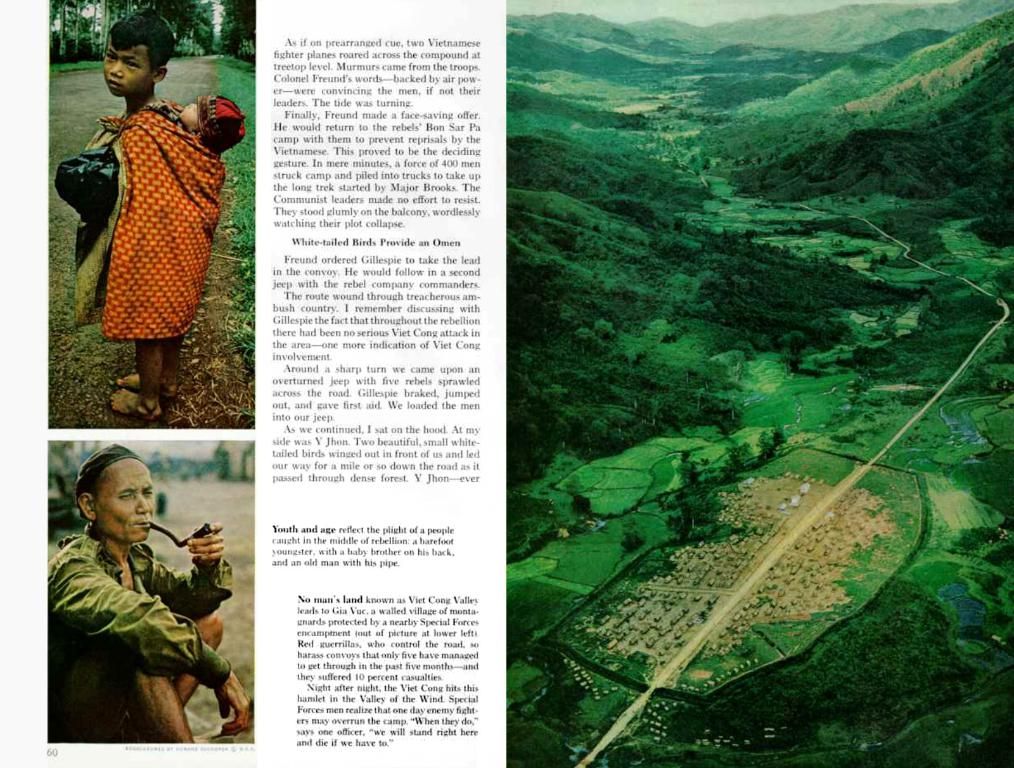

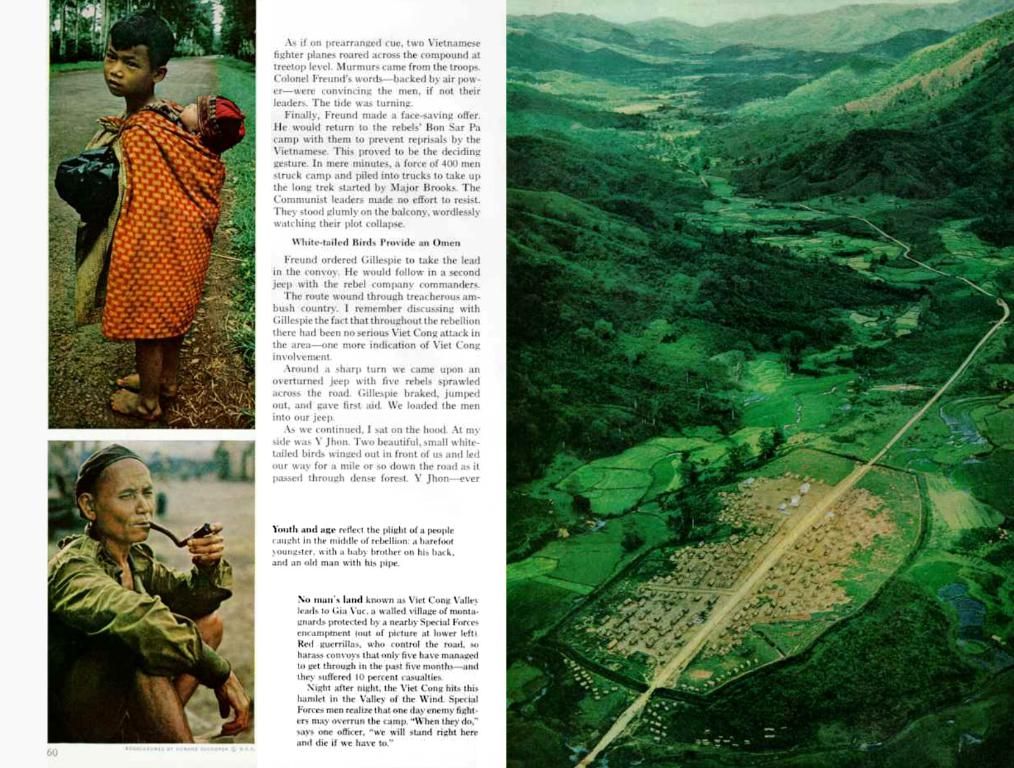

Cover Image: Midjourney

- The ongoing bullish sentiments predicted by Michaeël van de Poppe for altcoins are rooted in the increasing global liquidity, as financial conditions ease, providing a favorable environment for risk-on assets like Bitcoin and altcoins.

- In the next 12-18 months, investors who have benefited from gold's strong rally might transition their capital into cryptocurrencies following a potential gold market correction, creating a suitable atmosphere for altcoins to capitalize on the ensuing risk-on momentum.

- Van de Poppe asserts that the offshore Chinese Yuan and US dollar ratio (CNH/USD) is correlated with the ETH/BTC pair, suggesting that the recent "tariff madness" could signal a CNH/USD bottom, which in turn indicates an impending Ethereum and altcoins bull run.

- As we delve into the world of finance and explore macroeconomic trends, cryptocurrencies, blockchain, and decentralized finance, we find ourselves amidst a rapidly evolving landscape, with industry announcements such as the Bitcoin Seoul 2025 conference and collaborations like the one between BYDFi and Ledger adding to the growing ecosystem.