CEO of National Express parent company departs amid £609 million deficit experienced by transport organization

Firing on All Cylinders:

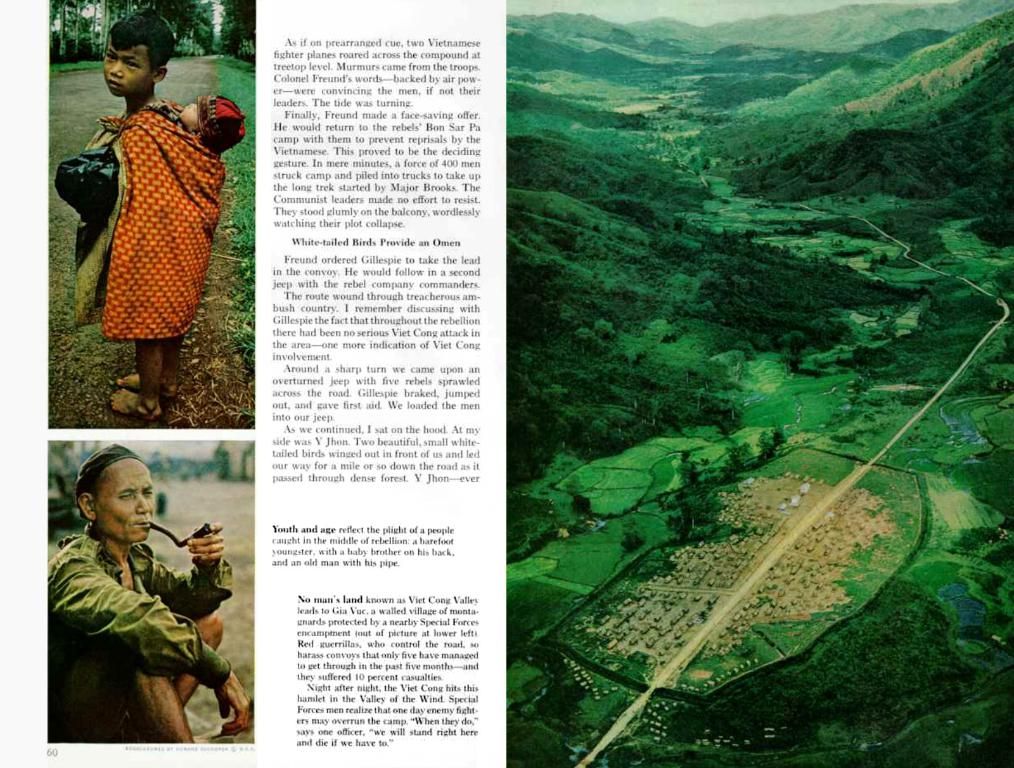

Ignacio Garat, the pompous CEO of Mobico, is packing his bags as he steps down amidst a massive haul of losses last year. On Wednesday, this National Express owner will leave the sinking ship.

Shareholders had the wrath of a hurricane brewing at the end of last week when they found out about the sale of Mobico's North America school bus division for a price that didn't match some valuations, causing a dip in shares.

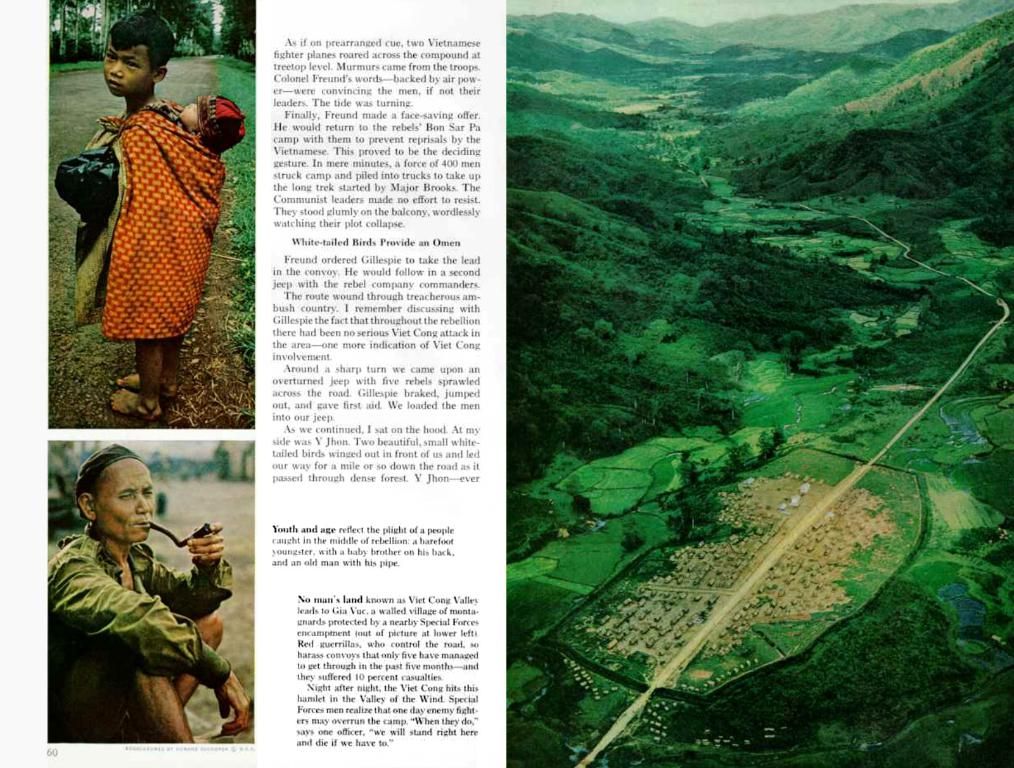

In a communication to shareholders on Tuesday, Mobico announced Garat's departure after five years, following a pre-tax loss of a whopping £609.3 million in 2024 compared to £120.1 million the previous year. The company pointed out difficulties in both its UK and German operations but did mention improvement in domestic rail and bus operations.

Helen Weir, Mobico's chair, declared it was the right time for a change in leadership, particularly after agreeing to the sale of its US bus unit. The $608 million deal with infrastructure investor I Squared Capital, which is expected to net proceeds of approximately $365 million to $385 million when it goes through in the third quarter, is intended to help pay off Mobico's debt.

Shares have plummeted about 70% since Mobico changed its corporate name from National Express to Mobico almost a year ago.

RELATED ARTICLES

- Previous

- 1

- Next

- Mobico's Troubled Steering: US Bus Business Sold For Pocket Change National Express Struggles: Cutthroat US Deal

Share This Article

The almost £457 million deal fell far short of Jefferies' estimates, suggesting the US school bus unit could be worth over a billion quid.

Financial expert Peel Hunt slammed the deal as 'rubbish for shareholders,' arguing that if investors don't kick out Mobico's board, the deal will see value being obliterated.

Mobico's Shares were down 4.5 per cent to 32.08p by midafternoon.

The Birmingham-based company's share price has plummeted by about 70% since its transformation from National Express to Mobico back in 2023.

Outgoing boss Garat said, "The past couple of years have been a pain in the arse, as we've had to deal with and adapt to numerous market storms. However, I'm bloody proud of the work our 51,500 employees do every day to help assist our customers and the communities they serve. It's been a blast to work alongside the team."

Garat will stay on until a replacement is found, paving the way for a search led by executive chair Phil White. White mentioned Mobico would hire someone who could steer the company towards its next phase.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Learn More Learn More### Hargreaves Lansdown

Hargreaves Lansdown

Learn More Learn More### interactive investor

interactive investor

Learn More Learn More### InvestEngine

InvestEngine

Learn More Learn More### Trading 212

Trading 212

Learn More Learn MoreAffiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

- After the sale of Mobico's North America school bus division in 2023 for a lower value than anticipated by some financial evaluations, there was a decrease in Mobico's share prices.

- The upcoming departure of Ignacio Garat, the former CEO of Mobico, comes after dismissing headwinds faced by the business, particularly in its UK and German operations, but with improvements noted in domestic rail and bus operations.

- As Mobico faces significant debt, it is planning to utilise the proceeds from a $608 million deal with infrastructure investor I Squared Capital to help alleviate the burden, following the sale of its US bus unit in the third quarter of the year.

- Despite the challenges faced by Mobico in terms of finance, industry experts have expressed criticism over the valuations of certain business decisions, such as the sale of its US bus unit, claiming it could erase value for shareholders.