Car-sharing venture with options from Volkswagen, BMW, or Mercedes-Benz promises lucrative investment prospects for 2025.

The German Auto Industry's Struggles, and a Promising 2025?

Riding out the storm: A glance at the future for Volkswagen, BMW, and Mercedes-Benz

The year 2024 has put the German automotive industry through its paces. Struggling with profit warnings, stiff competition from China, and burgeoning costs, the stocks of Volkswagen, Mercedes-Benz, and BMW have experienced tumult in recent times. But with the new year upon us, are there signs of calmer waters ahead for these heavyweights? How about investing possibilities for the savvy investor?

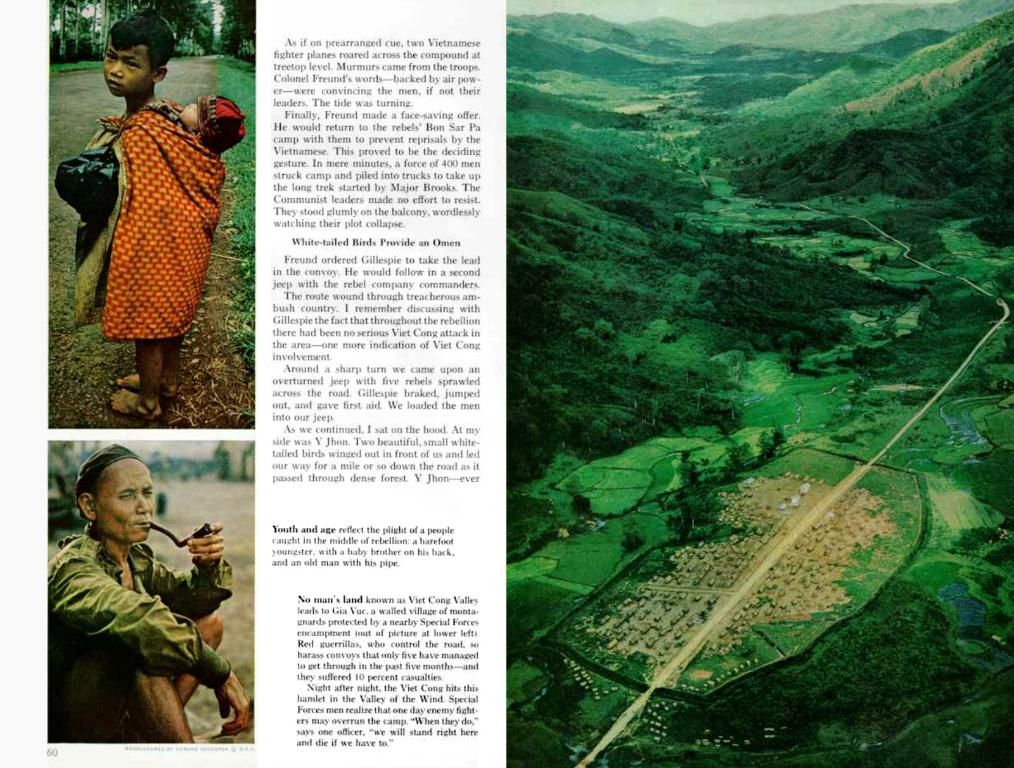

A Tight Race: BMW vs. Mercedes-Benz

The analysts have cast their votes, and it seems we're in for a close contest. Mercedes-Benz, on average, promises a whopping 22% upside, but BMW trails close behind with a potential return of more than 10%. An interesting trend has emerged, with sentiment favoring BMW as of late. For example, Swiss investment bank UBS recently switched its preferred auto maker pick to BMW, downgrading Mercedes-Benz and Porsche. BMW's success is attributed to its rising cash return on investment, stable margins, and innovative techniques to stay competitive—all of which have earned praise from UBS analyst Patrick Hummel[1].

BMW AG (WKN: 519003)

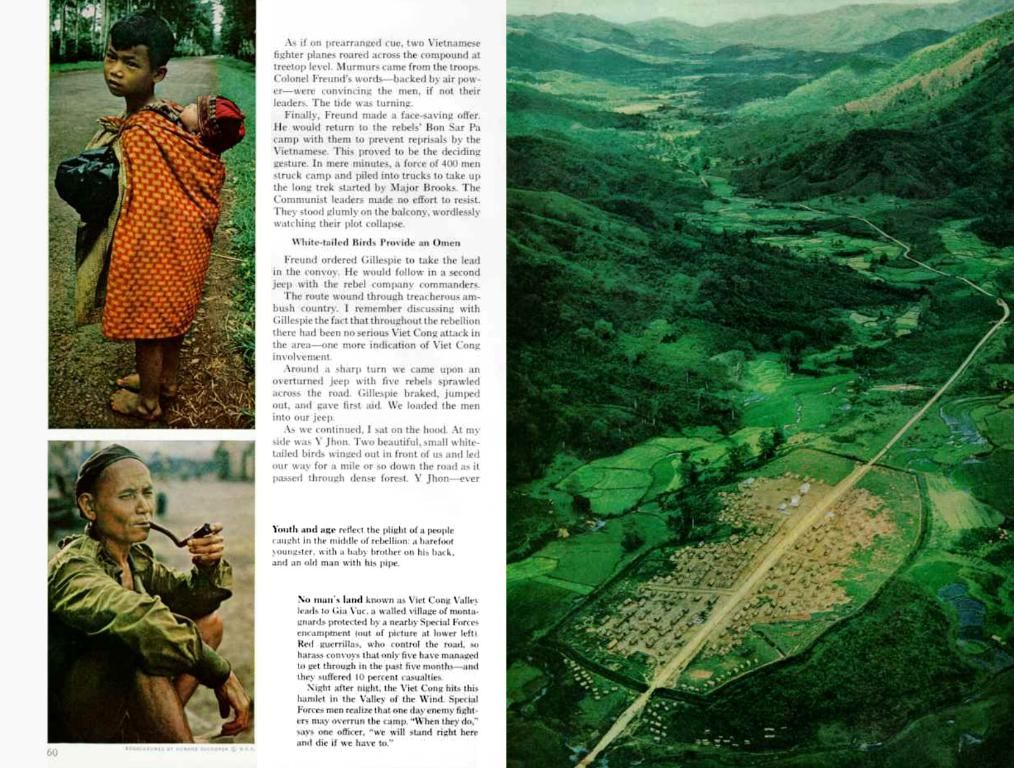

Volkswagen: A Mixed Bag

Volkswagen may serve as a bellwether for the German automotive industry's hardships. Cutting costs has led to internal discord between management in Wolfsburg and employee representatives over reductions strategies. The possibility of plant closures and layoffs cannot be ruled out, contributing to the stock's ongoing struggles. However, this dark cloud carries a silver lining, with the potential for significant growth on the horizon[1].

On average, Volkswagen's price target is set at 114 euros, representing a potential upside of over 33%. Some analysts are even more optimistic, with targets reaching as high as 180 euros, suggesting a potential near-doubling of the stock's value in the mid-term. For now, BMW takes the lead[1].

Contains material from dpa-AFX

Further Reading:

- Between the Years, It's Going to Explode: Now's the Time to Buy Stocks of FMC, Deutsche Wohnen, and LPKF

- New Dividend Record! This is What Investors Can Expect in 2025

Disclosure: CEO and majority shareholder of Boerse-Medien AG, Mr. Bernd Förtsch, holds direct and indirect positions in the financial instruments mentioned in this publication that could benefit from the potential price development resulting from this publication: Volkswagen Vz.

Disclosure: Managing editor-in-chief, Mr. Frank Pöpsel, holds direct and indirect positions in the financial instruments mentioned in this publication that could benefit from the potential price development resulting from this publication: Volkswagen Vz.

Enrichment Data:

- The German automotive industry's struggles in 2024 have largely stemmed from profit warnings, competition from China, and high costs borne by Volkswagen, Mercedes-Benz, and BMW.

- While analysts believe that 2025 may not offer significant improvements, there are stocks that promise growth, such as BMW.

- BMW's growth potential stems from its implementation of advanced manufacturing technologies, like AI and robotics, and its involvement in tariff negotiations with the U.S., which have the potential to boost the company's shares if successful.

- BMW's stock is considered a real-time barometer for the automotive sector, reflecting broader industry trends.

- Mercedes-Benz has enjoyed a 22% average upside potential, according to analysts, due to its technological advancements and involvement in tariff negotiations with the U.S.

- Recent stock price increases for Mercedes-Benz can be attributed to tariff talks, which suggests the potential for further growth if concessions are secured.

- Volkswagen's focus on electric vehicles (EVs) has positioned it well for growth in the long-term, with a focus on sustainability.

- Olkswagen's stock price targets are set at an average of 114 euros and a maximum of 180 euros, representing potential increases of over 33% and almost 100%, respectively.

- Investors should exercise caution when considering their investment strategies due to geopolitical tensions and ongoing tariff disputes. These factors could have significant impacts on the shares of Volkswagen, Mercedes-Benz, and BMW.

- The German automotive sector is experiencing a surge in demand, partly due to front-loading exports to avoid U.S. tariffs, which suggests resilience in the face of economic challenges. However, this trend may be restrained by lingering tensions and tariff disputes.

- With analysts predicting a possible return of over 10% for BMW, there might be investing opportunities for savvy investors looking at the German automotive sector in 2025.

- The potential growth of Volkswagen's stock, with price targets reaching as high as 180 euros, could be an attractive proposition for investors seeking mid-term gains in the auto industry.