Riding the Wave of Pessimism: Manufacturing Sentiment in a Turbulent Economy

Business confidence within the manufacturing sector plunges in April

Are times tough in the manufacturing sector? You betcha! April'23 has seen a dramatic surge in manufacturing gloom, with producers hitting the brakes on their spending plans, all thanks to the whirlwind of changing tariff schemes and the uncertainty surrounding global trade policies.

A slew of surveys this week have shown a rollercoaster ride in business confidence, from a rosy outlook in January to a downward spiral in April. It's as if someone dropped a brick on the manufacturing industry's parade!

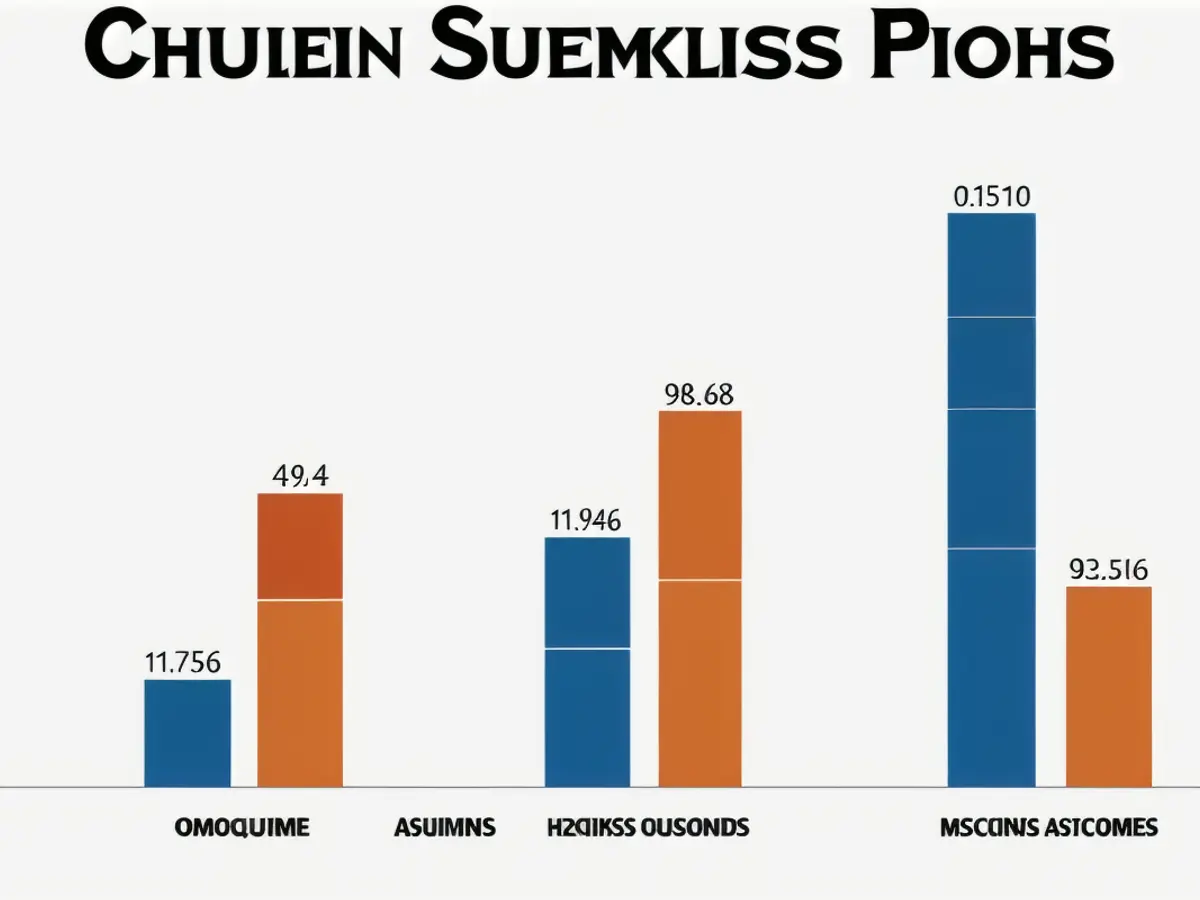

Take, for example, the Federal Reserve Bank of Philadelphia's monthly survey, the "Manufacturing Business Outlook Survey." Back in January, around 39% of businesses were hell-bent on increasing capital expenditures this year to give their operations a boost—a figure not unlike the high points reached in 2017 and during the COVID recovery in 2021. But by April, that figure tumble down to a puny 2%. To put this into perspective, that metric had dipped only to 9.7% during the worst of the COVID declines and during 2023's inflation surge.

This gloom doesn't end in New York, as the Fed's "Empire State Manufacturing Survey" mirrors the downward trend, with the percentage of businesses planning to bump up their capital spending dropping from 9.2% in March to 1.6% in April.

"False hope and pessimism are feeding a vicious cycle," the Empire State authors wrote in their report. "The index for future general business conditions fell twenty points to -7.4; the index has fallen a cumulative forty-four points over the past three months." Yikes! That's some serious pessimism there!

The most unfortunate part? The blame game is pointing at President Donald Trump’s massive tariff announcement, with massive duties on incoming European, South American, and Asian goods. Although, 145% tariffs on some Chinese goods still remain, Trump later hit the pause button on most of the new import taxes for 90 days. We'll have to wait a month for the May surveys to see if this reprieve will have a positive impact.

On the brighter side, some early indicators from January and February show some glimmers of growth in manufacturing capital spending. The Association for Manufacturing Technology's monthly report revealed an 8.8% increase in capital equipment spending by U.S. manufacturers. Orders from electrical equipment producers were particularly strong, as the growth of AI and data centers has resulted in a nationwide demand for electrical grid improvements.

But even this good news can't brighten the overall pessimistic outlook for the manufacturing sector, shrouded as it is by the uncertainties in global trade policies and the impact of changing tariff plans, which show no signs of abating anytime soon.

Boosting the Electric Grid: Investments and Innovations

- Hitachi Energy Turns Up the Voltage: Spurred by increased demand for electrical grid improvements, Hitachi Energy has decided to invest $70M to expand its high-voltage manufacturing facilities in Pennsylvania. [Plant Services]

- Google's Grid Revolution: Google's AI is revolutionizing the U.S. power landscape, with heavy investments in data centers driving demand for electrical equipment. [Data Center Frontier]

- DTE Electric Steps Up: DTE Electric's innovative plan to expedite distributed energy resources and enhance grid reliability has been approved in Michigan. [T&D World]

- America Needs More Juice: Production Pulse highlights the pressing need for increased electricity generation to drive economic growth in the US.

- Schneider Electric Lays Out the Power Plan: Schneider Electric plans to invest over $700M in its U.S. operations by 2027, supporting energy and AI sectors, and furthering job growth. [T&D World]

- The fluctuating business confidence in manufacturing, as shown by the surge in manufacturing gloom, may contribute to a decrease in investment in new technology, such as the planned $70M expansion of high-voltage manufacturing facilities by Hitachi Energy in Pennsylvania.

- Despite the pessimistic outlook in the manufacturing sector, investments in data centers are driving demand for electrical equipment, with Google's AI being a significant factor in this trend.

- In contrast to the overall pessimism in the manufacturing industry, DTE Electric's innovative plan to accelerate the adoption of distributed energy resources and improve grid reliability has been approved, indicating a sense of optimism and confidence within this industry segment.

- The uncertainties surrounding global trade policies and the impact of changing tariff plans may have a negative effect on the finance industry's outlook for the manufacturing sector, potentially making it challenging for manufacturers to secure funding for capital expenditures.

- The ongoing inflation, coupled with the uncertainty surrounding global trade policies, may erode consumer confidence, which could have far-reaching effects on various industries, including finance and manufacturing.