Banks boost non-interest revenue and trim expenses due to tightened NIM regulations

Living on the Edge: How Vietnamese Banks Navigate NIM Reduction

Caught in a bind between government demands and faltering profits, banks in Vietnam are reinventing their strategies to stay afloat.

Without lifeboats in sight, our local banks find themselves speeding through treacherous waters of dwindling profit margins. The net interest margin (NIM) is taking an alarming plunge, pushing our banking fraternity to its wits' end. The culprit? Government pressure to cut deposit rates and roll out low-interest loan schemes to accelerate economic growth.

Tran Thuy Ngoc, Deputy General Director at Deloitte, isn't shying away from the gravity of the situation. "Banks must seek fresh revenue streams and escalate non-interest income," she warns, "as they brace for reduced profits and forced rate cuts following the government's mandate of shared risks and benefits."

In a bid to meet the government's ambitious 8% growth target by 2025, over 20 banks across the nation have palmed the hot potato of reducing deposit interest rates, while simultaneously unveiling low-interest loans to keep economic momentum rolling. This move could severely impact bank profit margins, as it widens the gap between deposit and lending rates, especially since the credit-centric operations of banks remain unaltered.

Ngoč suggests embracing a more resilient cost transformation, utilizing proven strategies from international banks. This entails scrutinizing soaring core and operational costs, comprehending the underlying causes, and strategizing more efficient utilization of resources, thereby ensuring sustainable cost reductions.

She also advocates flinging open the doors to digital transformation and AI, expecting them to slash costs and elevate productivity. Embracing automation, machine learning, and large language models can unlock additional efficiencies and cost savings for banks.

But that's not all. Ngoč urges banks to integrate risk management and compliance considerations into their transformation initiatives, advocating a sustainable cost reduction approach. Steady discipline in execution is essential to achieve cost savings objectives, as constant scrutiny of output against business targets and strict accountability are necessary components of this strategy.

Looking ahead, Ngoč forecasts the portion of non-interest income in total bank income to remain stable at around 22% in 2025. While this figure may shift as banks revamp their strategies in each business segment, an upward trend in non-interest income is expected.

According to Deloitte's latest banking and capital market outlook, the economic uncertainties brewing in the United States are driving banks to diversify their investment portfolios and accentuate non-interest incomes while maintaining iron-clad cost management.

As banks traverse the tempestuous waters of the modern banking landscape, they must focus on maintaining CASA (Current Account and Savings Account) growth, implementing risk management strategies, and tailoring customer-centric services for sustainable growth and profitability. The future is ripe with opportunities for those willing to steer the banking ship skilfully through the challenging tides.

Insights:

As Vietnamese banks navigate the choppy waters of the modern banking industry, they are taking on a variety of strategies to maintain their profitability in the face of declining NIM:

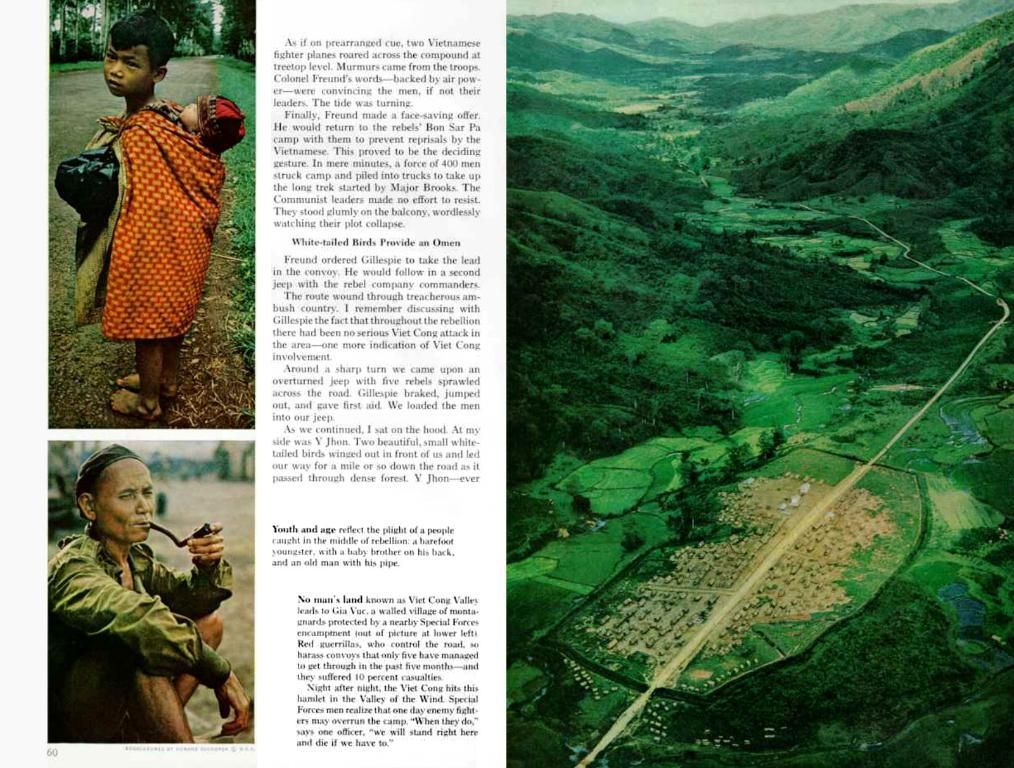

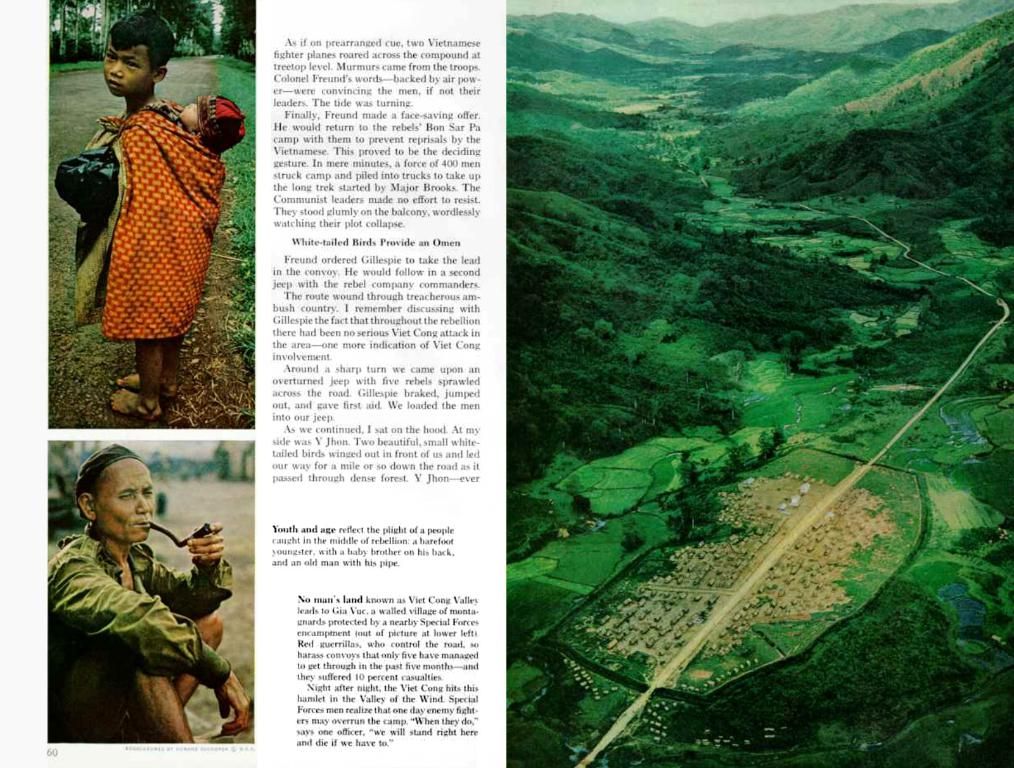

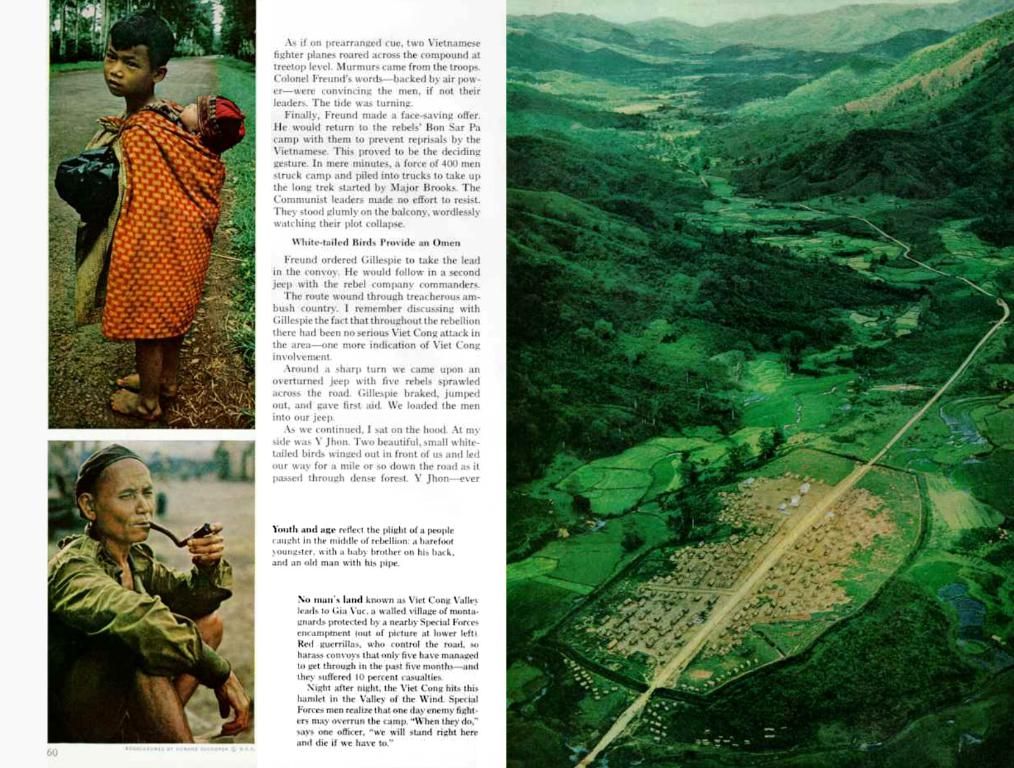

It is indispensable for banks to diversify their revenue sources and improve non-interest income as they have to cut rates and reduce profits. Photo thoibaotaichinh.vn

- Diversification of Revenue Streams: Banks are striving to generate income from various sources, not just credit, by enhancing service fees, investing in insurance products and financial services.

- Low-Interest Credit Packages: Banks are rolling out low-interest loans to boost economic growth, while strategically managing the impact on profit margins.

- Effective Cost Transparency: Banks are scrutinizing their core and operational costs to achieve long-term reductions and make the most of their resources effectively.

- Digital Transformation: Adopting digital technologies, automation, and AI can lead to operational efficiency improvements, cost savings, and a more customer-centric approach.

- Risk Management: Implementing comprehensive risk management strategies, like model risk management systems, collateralization, and customer-centric services, can ensure sustainable growth and financial risk management.

Embracing these strategies allows Vietnamese banks to brace themselves against the challenges of NIM reduction and thrive in a competitive banking atmosphere.

- In response to the government's mandate, local banks are looking to diversify their revenue streams, focusing on non-interest income sources like service fees and insurance products.

- As a means of promoting economic growth, banks are deploying low-interest loan packages, while working to mitigate the effect on their profits.

- To ensure long-term cost reductions, banks are enhancing cost transparency through assessing core and operational expenditure and implementing resource management strategies.

- Banks are acknowledging the potential of technology, particularly digital transformation, AI, and automation, to yield operational efficiencies, cost savings, and improved customer-centric services.

- To stay competitive and navigate NIM reduction, implementing robust risk management strategies, such as model risk management systems, collateralization, and customer-centric services, will be crucial for Vietnamese banks.